Income Execution Form 5241

What is the Income Execution Form 5241

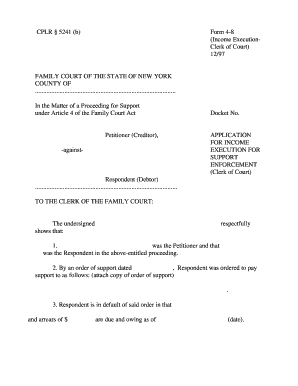

The Income Execution Form 5241 is a legal document used in New York to facilitate the collection of debts through income garnishment. This form allows creditors to obtain a portion of a debtor's wages directly from their employer. It is essential for creditors seeking to enforce judgments against individuals who have failed to meet their financial obligations. The form outlines the necessary information, including the debtor's details, the amount owed, and the creditor's information, ensuring compliance with state laws governing income execution.

How to use the Income Execution Form 5241

Using the Income Execution Form 5241 involves several steps to ensure proper completion and submission. First, the creditor must fill out the form accurately, providing all required information. After completing the form, it must be served to the debtor's employer along with a notice of the execution. The employer is then responsible for withholding the specified amount from the debtor's wages and remitting it to the creditor. It is crucial for creditors to follow the legal procedures outlined in New York law to avoid potential disputes or penalties.

Steps to complete the Income Execution Form 5241

Completing the Income Execution Form 5241 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the debtor, including their name, address, and Social Security number.

- Provide the details of the judgment, including the case number and the amount owed.

- Fill in the creditor's information, ensuring accurate contact details.

- Sign and date the form to certify its accuracy.

- Make copies of the completed form for your records before serving it to the employer.

Legal use of the Income Execution Form 5241

The Income Execution Form 5241 must be used in accordance with New York state laws to ensure its effectiveness and legality. Creditors are required to adhere to the provisions of the New York Civil Practice Law and Rules (CPLR) when executing this form. This includes providing proper notice to the debtor and ensuring that the amount garnished does not exceed the legal limits set by state law. Misuse of the form can result in legal repercussions for the creditor, including potential fines or dismissal of the garnishment order.

Key elements of the Income Execution Form 5241

Several key elements must be included in the Income Execution Form 5241 to ensure its validity:

- The debtor's full name and address.

- The creditor's name and contact information.

- The amount of the judgment and the specific amount to be garnished.

- The case number associated with the debt.

- A clear statement of the legal basis for the income execution.

Form Submission Methods

The Income Execution Form 5241 can be submitted through various methods, depending on the preferences of the creditor and the employer's policies. Common submission methods include:

- In-person delivery to the employer's payroll department.

- Mailing the completed form to the employer's address.

- Using electronic submission methods, if the employer allows.

Quick guide on how to complete income execution form 5241

Complete Income Execution Form 5241 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without complications. Manage Income Execution Form 5241 on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to update and eSign Income Execution Form 5241 seamlessly

- Find Income Execution Form 5241 and click on Get Form to initiate the process.

- Utilize the features we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Income Execution Form 5241 to guarantee smooth communication at all points of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income execution form 5241

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the income execution form New York and how is it used?

The income execution form New York is a legal document used to collect a portion of a debtor's wages to satisfy a judgment. It allows creditors to legally garnish income and ensures that payments are made towards the owed amount. Understanding how to properly fill out and submit this form can be crucial for successful collection.

-

How can airSlate SignNow assist with income execution forms in New York?

airSlate SignNow streamlines the process of creating and signing income execution forms in New York. With easy-to-use templates and eSigning capabilities, you can quickly prepare the necessary documentation and ensure compliance with legal requirements. This saves time and helps you focus on your business.

-

What are the pricing options for using airSlate SignNow for income execution forms?

airSlate SignNow offers flexible pricing plans designed to fit various business needs for managing income execution forms New York. With affordable monthly subscriptions, you can access features like unlimited document sends and secure cloud storage. Check our pricing page for detailed options and find the best plan for your requirements.

-

Are there specific features in airSlate SignNow that enhance the use of income execution forms?

Yes, airSlate SignNow provides features that optimize the use of income execution forms in New York, such as automated reminders for signatures and the ability to track document status. Additionally, its user-friendly interface makes it easy to navigate and customize documents. These features ensure a smooth experience for both senders and signers.

-

Can I integrate airSlate SignNow with other software for managing income execution forms?

Absolutely! airSlate SignNow offers seamless integrations with popular software applications, allowing you to manage income execution forms New York efficiently. Whether you need to connect with your CRM or accounting software, our integration capabilities ensure that your workflow remains seamless and organized.

-

What are the benefits of using airSlate SignNow for income execution forms over traditional methods?

Using airSlate SignNow for income execution forms in New York provides numerous benefits, including faster processing times and reduced paperwork. The eSigning functionality eliminates the need for printing or scanning, making it more eco-friendly and convenient. Businesses can also access documents anytime, anywhere through our secure cloud platform.

-

Is airSlate SignNow compliant with the legal requirements for income execution forms in New York?

Yes, airSlate SignNow adheres to legal regulations regarding income execution forms in New York. Our platform is designed to ensure that all documents comply with state laws, providing you peace of mind when managing legal paperwork. You can trust that your income execution forms will meet all necessary compliance standards.

Get more for Income Execution Form 5241

- Fab forms download

- Registrar wacotx gov form

- Canvasser authorization f0436 form

- Anne arundel county public libray form

- Physical education lesson plan form

- Get ca schedule k 1 565 us legal forms

- Credit card authorization form certified check or money order payable to visahq

- Novant health medical park hospital form

Find out other Income Execution Form 5241

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later