Get CA Schedule K 1 565 US Legal Forms 2022

Understanding California Schedule K-1 (568)

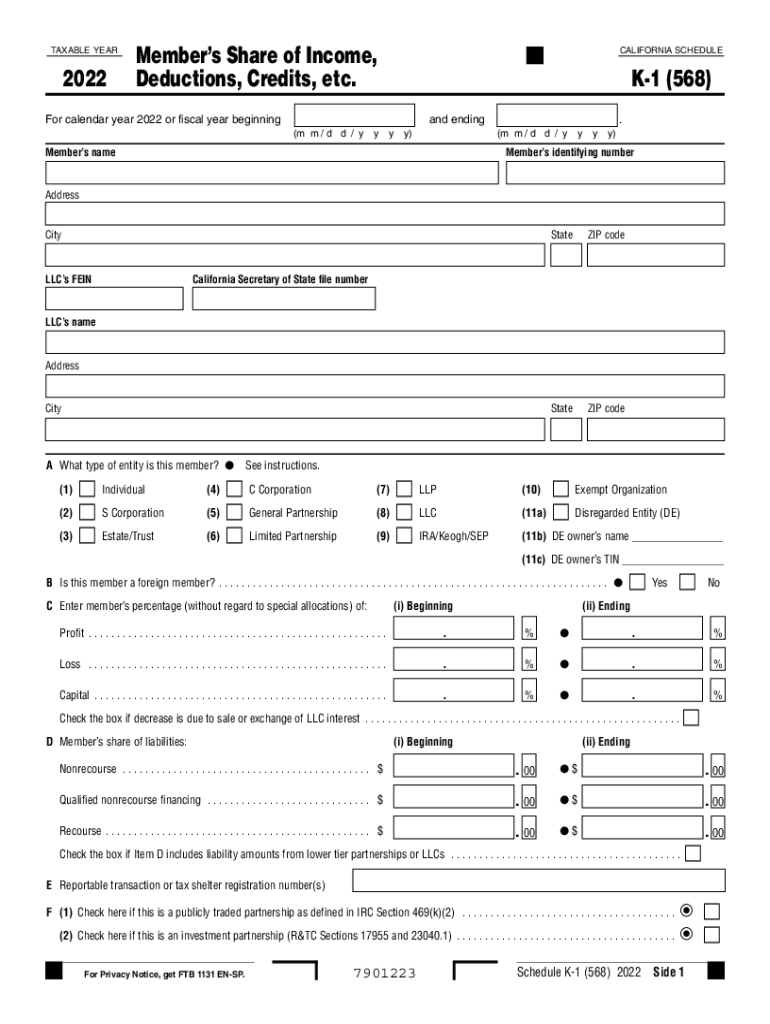

The California Schedule K-1 (568) is a tax document used by partnerships and limited liability companies (LLCs) operating in California. This form reports each partner's or member's share of the partnership's income, deductions, credits, and other tax-related items. It is essential for individuals to accurately report their income on their personal tax returns, as the information provided on the K-1 directly affects their tax liability.

Key Elements of California Schedule K-1 (568)

California Schedule K-1 (568) includes several critical components:

- Partner or Member Information: This section captures the names, addresses, and identification numbers of the partners or members.

- Income and Deductions: It details the partner's share of the partnership's income, losses, and deductions, which must be reported on their individual tax returns.

- Credits: The form outlines any California 568 credits that partners or members can claim, which can help reduce their overall tax burden.

- Other Information: This may include details about the partnership's activities, such as business type and location.

Steps to Complete California Schedule K-1 (568)

Completing the California Schedule K-1 (568) involves several steps:

- Gather Information: Collect all necessary information about the partnership, including income, expenses, and partner details.

- Fill Out the Form: Accurately enter the required information in the designated sections of the form.

- Review for Accuracy: Double-check all entries to ensure accuracy, as errors can lead to complications during tax filing.

- Distribute Copies: Provide each partner or member with a copy of their K-1 for their records and tax filing purposes.

Filing Deadlines for California Schedule K-1 (568)

It is crucial to adhere to the filing deadlines associated with California Schedule K-1 (568). Typically, partnerships must file their tax returns by the 15th day of the third month after the end of their tax year. For most partnerships operating on a calendar year, this means the deadline is March 15. Partners should receive their K-1 forms in time to include the information on their individual tax returns, which are generally due on April 15.

Required Documents for California Schedule K-1 (568)

To complete the California Schedule K-1 (568), the following documents are typically required:

- Partnership Agreement: This document outlines the terms of the partnership and the distribution of income and expenses.

- Financial Statements: These include profit and loss statements, balance sheets, and other relevant financial records.

- Prior Year Tax Returns: Reviewing previous returns can help ensure consistency and accuracy in reporting.

Digital Submission Methods for California Schedule K-1 (568)

Submitting the California Schedule K-1 (568) can be done through various digital methods. Partnerships can e-file their tax returns, including the K-1, using approved tax software. This method is often faster and more efficient than traditional paper filing. Additionally, partners may receive their K-1 forms electronically, allowing for quicker access to the necessary information for their individual tax filings.

Quick guide on how to complete get ca schedule k 1 565 us legal forms

Complete Get CA Schedule K 1 565 US Legal Forms effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Get CA Schedule K 1 565 US Legal Forms on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Get CA Schedule K 1 565 US Legal Forms effortlessly

- Find Get CA Schedule K 1 565 US Legal Forms and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Get CA Schedule K 1 565 US Legal Forms and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get ca schedule k 1 565 us legal forms

Create this form in 5 minutes!

How to create an eSignature for the get ca schedule k 1 565 us legal forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Schedule K-1 568?

The California Schedule K-1 568 is a tax document used by LLCs in California to report income, deductions, and credits to the state. It is essential for ensuring that your LLC complies with California tax regulations. If you're using airSlate SignNow for your tax documents, preparing and signing your California Schedule K-1 568 can be done easily and efficiently.

-

How does airSlate SignNow simplify the process of filling out the California Schedule K-1 568?

AirSlate SignNow provides a user-friendly interface that allows for easy completion of the California Schedule K-1 568. You can fill out required fields, save progress, and even collaborate with tax professionals or other members. This streamlines the paperwork process, allowing you to focus on what really matters—your business.

-

Is there a cost associated with using airSlate SignNow for the California Schedule K-1 568?

Yes, there is a cost associated with airSlate SignNow, but it remains a cost-effective solution for managing your documents including the California Schedule K-1 568. With various pricing plans available, you can choose one that fits your business requirements. The investment can lead to signNow time savings and enhanced compliance.

-

Can I eSign the California Schedule K-1 568 using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to legally eSign your California Schedule K-1 568 securely. Our platform ensures compliance with eSignature laws, making it a reliable choice for submitting your tax documents without the hassle of printing or mailing.

-

Does airSlate SignNow offer templates for the California Schedule K-1 568?

Yes, airSlate SignNow provides customizable templates for the California Schedule K-1 568. This feature helps you get started quickly by reducing the amount of manual entry needed. Templates can be tailored to meet your specific requirements, ensuring all necessary information is captured correctly.

-

What other documents can I manage with airSlate SignNow alongside the California Schedule K-1 568?

In addition to the California Schedule K-1 568, airSlate SignNow lets you manage a variety of documents including contracts, agreements, and other tax forms. This all-in-one platform enables you to keep your documents organized and accessible. It's a comprehensive solution for all your eSigning needs.

-

How secure is the information I provide for the California Schedule K-1 568 on airSlate SignNow?

Security is a top priority at airSlate SignNow. When using the platform for the California Schedule K-1 568, your data is protected by advanced encryption and compliant with industry standards. You can confidently handle sensitive information knowing it's safeguarded against unauthorized access.

Get more for Get CA Schedule K 1 565 US Legal Forms

- Ft gratiot twp electrical permit form

- Dealer manual chapter 5 august 2003doc michigans dealer manual chapter 5 revised august michigan form

- Annual tier ii facility filing fee worksheet dhsem wv form

- The vaughn miller dance scholarship application form

- Tx zoning verification letter form

- Alarm application docx form

- Www cityofdwg netpermits inspections and zoningpermits inspections and zoningcity of dalworthington gardens form

- Www puc texas govwatersearchutilitywater utility detail public utility commission of texas form

Find out other Get CA Schedule K 1 565 US Legal Forms

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement