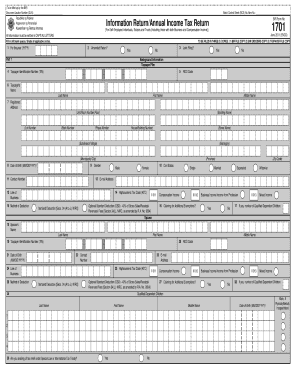

Income Tax Return Sample Form

What is the Income Tax Return Sample Form

The Income Tax Return Sample Form, specifically the bir form , serves as a template for individuals to report their annual income and calculate their tax obligations. This form is essential for self-employed individuals and those with multiple income sources, ensuring compliance with federal tax regulations. The 2011 bir 1701 form includes sections for personal information, income details, deductions, and tax credits, making it a comprehensive tool for accurate tax filing.

Steps to Complete the Income Tax Return Sample Form

Completing the Income Tax Return Sample Form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and other income statements.

- Fill in personal information, such as your name, Social Security number, and address.

- Report all sources of income in the designated sections of the form.

- Include any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Sign and date the form to validate your submission.

Legal Use of the Income Tax Return Sample Form

The bir form is legally recognized for tax filing purposes in the United States. To ensure its validity, it must be completed accurately and submitted by the designated deadlines. Utilizing electronic signature solutions, like signNow, can enhance the legal standing of your submission by providing a secure and verified method of signing the document. Compliance with relevant tax laws is crucial to avoid penalties and ensure that your tax return is accepted by the IRS.

How to Obtain the Income Tax Return Sample Form

The Income Tax Return Sample Form can be obtained through various channels. It is available for download from the official IRS website or can be requested from tax preparation offices. Additionally, many tax software programs include the form as part of their filing packages, allowing for easier completion and submission. Ensure that you are using the correct version of the form for the tax year you are filing.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax Return Sample Form are critical to avoid penalties. Typically, the deadline for submitting your tax return is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes in deadlines each tax year to ensure timely filing.

Required Documents

To complete the bir form accurately, several documents are required:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income sources, such as rental or investment income

- Documentation for deductions, including receipts and statements

- Social Security number and other personal identification information

Form Submission Methods (Online / Mail / In-Person)

The Income Tax Return Sample Form can be submitted through various methods, including:

- Online submission via tax software that supports e-filing

- Mailing a physical copy of the completed form to the appropriate IRS address

- In-person submission at designated IRS offices or authorized tax preparers

Quick guide on how to complete income tax return sample form

Effortlessly prepare Income Tax Return Sample Form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a sustainable alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Income Tax Return Sample Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Income Tax Return Sample Form with ease

- Obtain Income Tax Return Sample Form and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Income Tax Return Sample Form to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax return sample form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is BIR Form 1701 2011 and why is it important?

BIR Form 1701 2011 is an income tax return used by self-employed individuals and professionals in the Philippines. It's crucial for tax compliance as it details your income, deductions, and tax liabilities. By accurately completing this form, you can ensure that you meet your tax obligations and avoid penalties.

-

How can airSlate SignNow help with BIR Form 1701 2011?

airSlate SignNow streamlines the process of sending and eSigning your BIR Form 1701 2011. With its user-friendly interface, it makes it easy to fill out and share your tax forms securely, ensuring that all your data is protected and accessible when needed.

-

Is airSlate SignNow a cost-effective solution for managing BIR Form 1701 2011?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses. It offers various pricing plans that cater to different needs, ensuring that you get the best value while efficiently managing your BIR Form 1701 2011 and other documents.

-

What features does airSlate SignNow offer to assist with tax forms like BIR Form 1701 2011?

airSlate SignNow provides features such as customizable templates, secure eSigning, and tracking capabilities, which are beneficial for managing BIR Form 1701 2011. These features simplify the entire process, from creation to filing, allowing users to focus more on their business instead of paperwork.

-

Can I integrate airSlate SignNow with other accounting software for BIR Form 1701 2011?

Yes, airSlate SignNow offers integrations with various accounting and financial software. This allows you to seamlessly integrate your data for BIR Form 1701 2011, making tax preparation more efficient and reducing the risk of errors associated with manual data entry.

-

Is my information secure when using airSlate SignNow for BIR Form 1701 2011?

Absolutely! Security is a top priority at airSlate SignNow. The platform uses advanced encryption methods and secure servers to protect your sensitive information related to BIR Form 1701 2011, ensuring your data remains confidential.

-

What support does airSlate SignNow provide for completing BIR Form 1701 2011?

airSlate SignNow offers comprehensive customer support, including guides and resources that help you understand how to complete BIR Form 1701 2011. Whether you need technical assistance or general inquiries, our support team is ready to help you navigate the process efficiently.

Get more for Income Tax Return Sample Form

- Registerbyinternetcombassetlaw form

- Vba va form

- Openbaarvervoerverklaring form

- Substitution elimination flowchart form

- Student course evaluation form california osfmtraining fire ca

- Cosmetic surgery superbill y n tricare tricare form

- Pir report police form

- Application for vacation pay meba benefit plans form

Find out other Income Tax Return Sample Form

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement