Nj W3 Form 1999

What is the Nj W3 Form

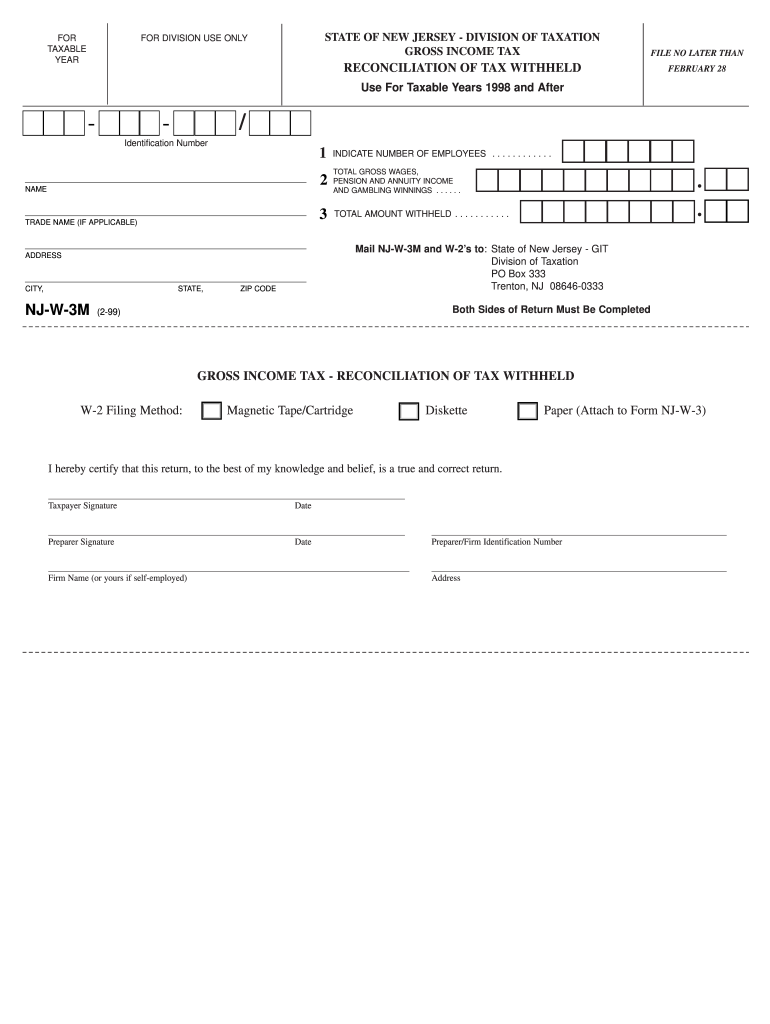

The Nj W3 Form is a summary of the income and withholding information for New Jersey employers. It is used to report the total wages paid and the taxes withheld for employees during the tax year. This form is essential for employers to ensure compliance with state tax regulations and to provide accurate information to the New Jersey Division of Taxation. The Nj W3 Form consolidates data from individual W-2 forms submitted by employers, making it a crucial document for both payroll processing and tax reporting.

Steps to complete the Nj W3 Form

Completing the Nj W3 Form involves several key steps to ensure accuracy and compliance. Here’s a brief overview:

- Gather all W-2 forms for employees, ensuring that all information is accurate and complete.

- Enter the total number of W-2 forms submitted in the designated field on the Nj W3 Form.

- Calculate the total wages paid to employees and the total state income tax withheld.

- Ensure that the employer's information, including name, address, and Employer Identification Number (EIN), is correctly filled out.

- Review the completed form for any errors before submission.

Legal use of the Nj W3 Form

The Nj W3 Form is legally binding when completed accurately and submitted on time. It must comply with New Jersey state laws regarding payroll and tax reporting. Employers are required to file this form annually, and failure to do so can result in penalties. The form serves as a verification tool for the state, ensuring that employers report their tax obligations correctly. Proper use of the Nj W3 Form helps maintain transparency and accountability in financial reporting.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when submitting the Nj W3 Form. Typically, the form is due by the end of January following the close of the tax year. It is essential for employers to mark their calendars and ensure timely submission to avoid late fees or penalties. Keeping track of these important dates is crucial for maintaining compliance with New Jersey tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Nj W3 Form can be submitted through various methods to accommodate different employer preferences. Employers can file the form online through the New Jersey Division of Taxation's website, which offers a streamlined process for electronic submission. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times, so employers should choose the one that best fits their needs.

Key elements of the Nj W3 Form

Understanding the key elements of the Nj W3 Form is vital for accurate completion. Important sections include:

- Employer Information: This includes the employer's name, address, and EIN.

- Total Wages: The total amount of wages paid to employees during the tax year.

- Tax Withheld: The total amount of state income tax withheld from employee wages.

- Number of W-2 Forms: The total number of W-2 forms submitted by the employer.

Quick guide on how to complete nj w3 form

Complete Nj W3 Form easily on any device

Digital document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Nj W3 Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign Nj W3 Form effortlessly

- Locate Nj W3 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight key sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to submit your form, by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Nj W3 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj w3 form

Create this form in 5 minutes!

How to create an eSignature for the nj w3 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NJ W3 online filing?

NJ W3 online filing is a digital process that allows businesses in New Jersey to submit their annual Summary of W-2 Forms to the state electronically. This method simplifies filing, reduces paperwork, and ensures timely submissions, essential for compliance with state regulations.

-

How can airSlate SignNow help with NJ W3 online filing?

airSlate SignNow streamlines the NJ W3 online filing process by providing an easy-to-use platform for document management and e-signatures. Our solution ensures that all necessary forms, including the NJ W3, are completed accurately and submitted on time, avoiding penalties and delays.

-

What are the costs associated with NJ W3 online filing using airSlate SignNow?

The pricing for NJ W3 online filing with airSlate SignNow is competitive and cost-effective, offering flexible plans that scale based on your business needs. We provide various subscription options, allowing you to choose a plan that fits your budget while accessing powerful features for document management.

-

Is my information secure when filing NJ W3 online?

Yes, airSlate SignNow takes data security seriously. Our platform ensures that all NJ W3 online filing data is encrypted and securely stored, adhering to industry standards to protect your sensitive information throughout the filing process.

-

Are there any features specific to NJ W3 online filing in airSlate SignNow?

airSlate SignNow offers features tailored for NJ W3 online filing, including easy form templates, automated reminders, and secure e-signature capabilities. These tools enhance the efficiency of your filing process, allowing for quick adjustments and prompt submissions.

-

Can I integrate airSlate SignNow with my current payroll system for NJ W3 online filing?

Absolutely! airSlate SignNow supports various integrations with popular payroll systems, making NJ W3 online filing seamless. By connecting your existing payroll software, you can automatically generate the necessary documents and minimize manual data entry.

-

How long does it take to complete NJ W3 online filing with airSlate SignNow?

Completing NJ W3 online filing with airSlate SignNow is quick and efficient. Most users can finalize their filings in a matter of minutes, thanks to our intuitive interface and pre-filled templates that speed up the process signNowly.

Get more for Nj W3 Form

Find out other Nj W3 Form

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself