Nj W 3m 2007-2026

What is the Nj W 3m

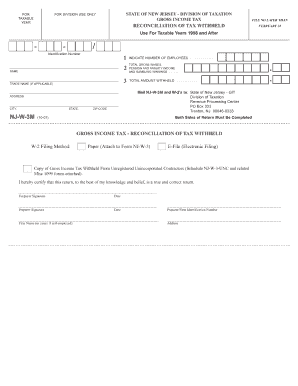

The Nj W 3m form is a state-specific document used in New Jersey for reporting income tax information. It is primarily utilized by employers to report the amount of wages paid to employees and the taxes withheld from those wages. This form is essential for ensuring compliance with state tax regulations and for accurate reporting to the New Jersey Division of Taxation.

How to use the Nj W 3m

To effectively use the Nj W 3m form, employers should first gather all necessary payroll information, including total wages paid and withholding amounts for each employee. Once this data is compiled, it can be entered into the form. After completing the form, employers must submit it to the New Jersey Division of Taxation, ensuring that all information is accurate to avoid penalties.

Steps to complete the Nj W 3m

Completing the Nj W 3m form involves several key steps:

- Collect employee wage data for the reporting period.

- Calculate the total amount of state taxes withheld.

- Fill out the form with the required information, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail to the appropriate tax authority.

Legal use of the Nj W 3m

The legal use of the Nj W 3m form is governed by New Jersey tax laws. Employers are required to accurately report wages and withholdings to comply with state regulations. Failure to submit this form correctly can result in penalties, including fines and interest on unpaid taxes. It is crucial for employers to understand their obligations regarding this form to maintain compliance.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Nj W 3m form. Typically, the form is due by the end of January for the previous calendar year. It is important to stay updated on any changes to these deadlines, as late submissions can lead to penalties. Employers should also be aware of any quarterly reporting requirements that may apply.

Who Issues the Form

The Nj W 3m form is issued by the New Jersey Division of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among employers and taxpayers. Employers can obtain the form directly from the Division of Taxation's website or through authorized channels to ensure they are using the most current version.

Quick guide on how to complete nj w 3m 100000638

Effortlessly Prepare Nj W 3m on Any Device

Digital document management has gained signNow traction among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without any delays. Handle Nj W 3m on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Alter and eSign Nj W 3m Without Stress

- Find Nj W 3m and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Nj W 3m and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj w 3m 100000638

Create this form in 5 minutes!

How to create an eSignature for the nj w 3m 100000638

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is nj w3m and how does it relate to airSlate SignNow?

The nj w3m is a form used in New Jersey for reporting employee wages and taxes. airSlate SignNow makes it easy to fill, sign, and send the nj w3m electronically, ensuring compliance and efficiency in your document management process.

-

How much does using nj w3m with airSlate SignNow cost?

airSlate SignNow offers various pricing plans that can accommodate businesses of all sizes, from startups to large enterprises. The cost for using nj w3m with airSlate SignNow varies based on features, but it remains a cost-effective solution for eSigning and managing documents.

-

What features does airSlate SignNow offer for nj w3m users?

airSlate SignNow provides specialized features for nj w3m, including customizable templates, automated reminders, and secure document storage. These features help streamline the signing process and enhance overall productivity.

-

Can I integrate nj w3m processing with other applications through airSlate SignNow?

Yes, airSlate SignNow offers numerous integrations with popular applications like Google Drive, Salesforce, and Zapier. This makes it easy to connect nj w3m processing with your existing workflows and improve your overall document management.

-

What benefits does airSlate SignNow provide for nj w3m document signing?

By using airSlate SignNow for nj w3m document signing, businesses enjoy faster turnaround times, reduced paper usage, and enhanced security. The platform ensures that your nj w3m documents are signed and stored securely in the cloud.

-

Is airSlate SignNow easy to use for filling out nj w3m forms?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for anyone to fill out nj w3m forms. The intuitive interface allows users to complete their documents quickly without any steep learning curve.

-

How does airSlate SignNow ensure the security of nj w3m documents?

airSlate SignNow employs advanced security measures such as encryption, secure access controls, and audit trails for all nj w3m documents. This ensures that your sensitive information remains protected throughout the signing process.

Get more for Nj W 3m

- September 15 rope access work plan amp job hazard analysis utexas form

- Resident information form 41915948

- Standing instruction form 251967612

- Apaches ultimate download festival survival peter c matthews apachetech co form

- Sce customer project information sheet

- Mc 351 order approving compromise of claim or actionor disposition of proceeds of judgmentfor minor or person with a disability form

- Jobseeker support student hardship application form sljssh

- Jobseeker support student hardship application form sljssh jobseeker support student hardship is a weekly payment to help with

Find out other Nj W 3m

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online