Sers W4 P Form

What is the Sers W4 P Form

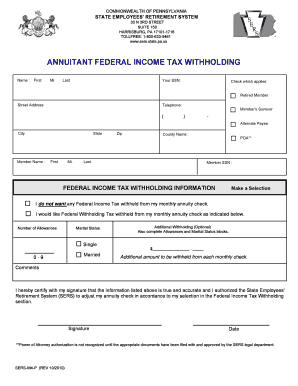

The Sers W4 P form, also known as the annuitant federal income tax withholding Sers W4 P, is a document used by annuitants to inform their payers about their federal income tax withholding preferences. This form is crucial for individuals receiving retirement benefits or annuities, as it helps determine the amount of federal tax that should be withheld from their payments. Proper completion ensures compliance with tax regulations and helps avoid underpayment or overpayment of taxes.

How to Use the Sers W4 P Form

Using the Sers W4 P form involves several steps to ensure accurate completion and submission. First, download the form from the appropriate source or obtain it directly from your payer. Next, fill out the required sections, including your personal information, tax filing status, and any additional withholding preferences. After completing the form, review it for accuracy and submit it to your payer. It is advisable to keep a copy for your records.

Steps to Complete the Sers W4 P Form

Completing the Sers W4 P form requires careful attention to detail. Begin by entering your name, address, and Social Security number in the designated fields. Next, indicate your filing status by checking the appropriate box. If you wish to withhold additional amounts, specify the desired amount in the relevant section. Finally, sign and date the form to validate it. Ensure that all information is correct to prevent any issues with tax withholding.

Legal Use of the Sers W4 P Form

The Sers W4 P form is legally binding when filled out correctly and submitted to the appropriate payer. It complies with federal regulations regarding income tax withholding for annuitants. To ensure its legal validity, the form must be signed and dated by the individual submitting it. Additionally, using a reliable electronic signature platform can enhance its legal standing, as these platforms often provide a digital certificate that confirms the authenticity of the signature.

Key Elements of the Sers W4 P Form

Key elements of the Sers W4 P form include personal identification information, tax filing status, and any additional withholding preferences. The form typically requires your name, address, and Social Security number, which are essential for accurate tax reporting. The filing status section allows you to select whether you are single, married, or head of household, impacting your withholding calculations. Lastly, specifying any additional withholding amounts ensures that you meet your tax obligations effectively.

Form Submission Methods

The Sers W4 P form can be submitted through various methods, depending on your payer's requirements. Common submission methods include online submission via a secure portal, mailing a physical copy of the form, or delivering it in person to the payer's office. It is important to verify the preferred submission method with your payer to ensure timely processing of your withholding preferences.

Quick guide on how to complete sers w4 p form

Effortlessly Prepare Sers W4 P Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Sers W4 P Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

Easily Modify and Electronically Sign Sers W4 P Form

- Locate Sers W4 P Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all information and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Sers W4 P Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sers w4 p form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the sers w4 p form?

The sers w4 p form is used for reporting employee withholding allowances for federal income tax. It's essential for both businesses and employees to ensure correct tax withholding. airSlate SignNow simplifies the submission process, allowing users to complete and eSign the sers w4 p with ease, ensuring compliance.

-

How does airSlate SignNow facilitate the completion of the sers w4 p?

airSlate SignNow offers an intuitive platform where users can fill out and electronically sign the sers w4 p form quickly. The user-friendly interface ensures that individuals can navigate through the document with little effort. This streamlines the process and minimizes the chance of errors in tax withholding.

-

Are there any costs associated with using the sers w4 p form on airSlate SignNow?

Yes, while airSlate SignNow offers a free trial, there are pricing plans available that provide extensive features beyond the basic sers w4 p capabilities. These plans are designed to be cost-effective, catering to businesses of all sizes. Investing in our solution allows for unlimited eSigning and document management features.

-

What features does airSlate SignNow provide for the sers w4 p form?

airSlate SignNow includes features such as reusable templates, secure cloud storage, and real-time tracking for the sers w4 p form. With these tools, users can manage multiple documents efficiently and ensure that their forms are signed promptly. This enhances overall productivity and compliance within organizations.

-

Can multiple users collaborate on the sers w4 p form within airSlate SignNow?

Absolutely! airSlate SignNow supports collaboration, allowing multiple users to work together on the sers w4 p form. This feature is particularly beneficial for HR departments who need input from various stakeholders. You can send the document for review or approvals, ensuring a smoother workflow.

-

Is the sers w4 p form secure when using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. The platform complies with industry standards for data protection, ensuring that your sers w4 p form is encrypted during transmission and storage. Users can trust that their sensitive information is well-protected while eSigning.

-

What integrations does airSlate SignNow offer for managing the sers w4 p form?

airSlate SignNow integrates seamlessly with various applications like Google Workspace, Salesforce, and Dropbox. These integrations simplify the workflow by allowing users to access the sers w4 p form directly from their preferred platforms. This capability enhances efficiency and reduces time spent switching between applications.

Get more for Sers W4 P Form

- Plasmapheresis order set form

- Phlebotomy training program application interpath laboratory form

- Police fto checklist form

- Noc form education department

- Po box 71402 salt lake city form

- Therapeutic separation agreement template form

- Therapy confidentiality agreement template form

- Therapy financial agreement template form

Find out other Sers W4 P Form

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free