Morgan Stanley W9 Form

What is the Morgan Stanley W-9?

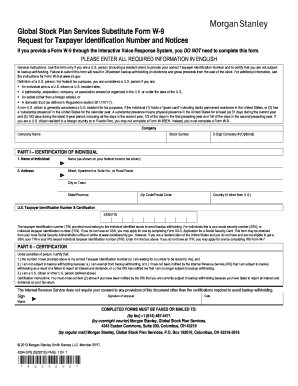

The Morgan Stanley W-9 form is a tax document used by individuals and businesses to provide their taxpayer identification information to Morgan Stanley. This form is essential for reporting income to the Internal Revenue Service (IRS) and is typically required when a financial institution needs to report payments made to a taxpayer. The W-9 form includes important details such as the name, business name (if applicable), address, and taxpayer identification number (TIN) of the individual or entity. Completing this form accurately ensures compliance with IRS regulations and helps avoid potential penalties.

How to Obtain the Morgan Stanley W-9

To obtain the Morgan Stanley W-9 form, individuals can visit the official Morgan Stanley website or contact their financial advisor directly. The form is also available through various financial platforms and can often be requested via email or through secure online portals. It is important to ensure that the form is the most current version to comply with IRS requirements. Users should verify that they are using the correct form for their specific tax situation.

Steps to Complete the Morgan Stanley W-9

Completing the Morgan Stanley W-9 form involves several straightforward steps:

- Provide your name as it appears on your tax return.

- If applicable, include your business name.

- Fill in your address, ensuring it matches IRS records.

- Enter your taxpayer identification number (TIN), which can be your Social Security number or Employer Identification Number.

- Sign and date the form to certify that the information provided is accurate.

After completing the form, it can be submitted directly to Morgan Stanley, either online or by mailing it to the designated address.

Legal Use of the Morgan Stanley W-9

The Morgan Stanley W-9 form serves a critical legal function by ensuring that financial institutions have accurate taxpayer information for reporting purposes. The form must be filled out truthfully and submitted in compliance with IRS regulations. Failure to provide accurate information can lead to penalties, including backup withholding on payments made to the taxpayer. It is essential to maintain records of the submitted form for future reference and to ensure compliance with tax obligations.

Key Elements of the Morgan Stanley W-9

Several key elements are crucial when filling out the Morgan Stanley W-9 form:

- Name: The legal name of the individual or business entity.

- Business Name: If applicable, the name under which the business operates.

- Address: The current mailing address where the taxpayer can be reached.

- Taxpayer Identification Number (TIN): Either a Social Security number or an Employer Identification Number.

- Signature: The taxpayer's signature certifying the accuracy of the information provided.

- Date: The date when the form is signed.

Ensuring that all these elements are correctly filled out is vital for the form's validity.

IRS Guidelines for the Morgan Stanley W-9

The IRS provides specific guidelines for completing the W-9 form, emphasizing the importance of accuracy in taxpayer identification. Taxpayers must ensure that the information provided matches IRS records to avoid discrepancies. The IRS also outlines the circumstances under which the W-9 form should be submitted, including when requested by a financial institution or when a taxpayer is earning income that must be reported. Familiarity with these guidelines helps taxpayers fulfill their obligations and maintain compliance with federal tax laws.

Quick guide on how to complete morgan stanley w9

Complete Morgan Stanley W9 with ease on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents efficiently and without delays. Handle Morgan Stanley W9 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to edit and electronically sign Morgan Stanley W9 seamlessly

- Obtain Morgan Stanley W9 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow has specifically designed for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Morgan Stanley W9 to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the morgan stanley w9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the morgan stanley w9 form and why is it important?

The morgan stanley w9 form is a tax document that provides your taxpayer identification number to Morgan Stanley. It is crucial for accurate tax reporting and helps ensure you are taxed correctly on any income received from Morgan Stanley. Completing this form is a necessary step for any freelancer or contractor working with the firm.

-

How can airSlate SignNow assist with signing the morgan stanley w9?

airSlate SignNow simplifies the signing process for the morgan stanley w9 by allowing users to electronically sign documents from any device. Our platform provides a secure and user-friendly interface, making it easy to manage and sign your tax forms without the hassle of printing or scanning. With airSlate SignNow, you can complete your morgan stanley w9 quickly and efficiently.

-

What are the costs associated with using airSlate SignNow for the morgan stanley w9?

airSlate SignNow offers competitive pricing plans that cater to varying needs and budgets. Depending on your usage, you can choose a plan that provides you with unlimited access to eSigning features, including support for the morgan stanley w9 and other documents. We offer a cost-effective solution that adjusts to your business's size and requirements.

-

Are there any features that make airSlate SignNow ideal for managing the morgan stanley w9?

Yes, airSlate SignNow includes several features that enhance the management of the morgan stanley w9. These features include templates for quick access, team collaboration tools, and real-time tracking of document status. Additionally, our security measures ensure your sensitive information remains safe throughout the signing process.

-

Can I integrate airSlate SignNow with other tools when handling the morgan stanley w9?

Absolutely! airSlate SignNow seamlessly integrates with various applications to streamline your workflow, making it easier to manage the morgan stanley w9. Whether you're using CRM software, cloud storage solutions, or email platforms, our integration capabilities allow you to keep everything organized and efficient.

-

What are the benefits of using airSlate SignNow for the morgan stanley w9 compared to traditional methods?

Using airSlate SignNow for the morgan stanley w9 offers several advantages over traditional signing methods. It eliminates the need for paper, reducing waste and saving time spent on printing and mailing documents. Additionally, it provides a faster and more secure way to execute essential tax forms, ensuring you're always compliant with filing deadlines.

-

Is airSlate SignNow secure for handling sensitive documents like the morgan stanley w9?

Yes, airSlate SignNow prioritizes security and ensures that your documents, including the morgan stanley w9, are protected. We employ advanced encryption and security protocols to safeguard your data against unauthorized access. You can trust that your sensitive information remains confidential while using our platform.

Get more for Morgan Stanley W9

- Cornhole tournament registration form lake improvement

- Peg feed chart form

- Computer paper for class 4 form

- Application for employment barberitos form

- Seller information sheet 389855079

- Request for extension and journal entry lucas county form

- Va form 21 4142 779589899

- Financial advisory agreement template form

Find out other Morgan Stanley W9

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer