Dtf 950 Form

What is the DTF 950 Form

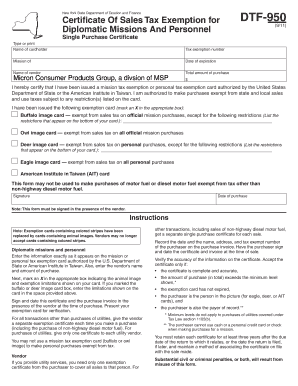

The DTF 950 form, also known as the New York State Sales Tax Exemption Certificate, is a crucial document for entities seeking tax-exempt purchases in New York. This form allows eligible organizations, such as non-profits, government agencies, and certain diplomatic missions, to make purchases without incurring sales tax. By completing the DTF 950 form, buyers can ensure compliance with state regulations while benefiting from tax exemptions on qualifying purchases.

How to Use the DTF 950 Form

To effectively use the DTF 950 form, individuals or organizations must first confirm their eligibility for tax exemption. Once eligibility is established, the form should be filled out accurately, providing all required information, including the purchaser's name, address, and the reason for the tax exemption. After completing the form, it should be presented to the seller at the time of purchase to validate the tax-exempt status. It is essential to retain a copy of the completed form for record-keeping purposes.

Steps to Complete the DTF 950 Form

Completing the DTF 950 form involves several straightforward steps:

- Obtain the DTF 950 form from a reliable source, such as the New York State Department of Taxation and Finance website.

- Fill in the required fields, including the name and address of the organization or individual claiming the exemption.

- Specify the type of exemption being claimed, ensuring it aligns with the eligibility criteria set by New York State.

- Sign and date the form to certify its accuracy and authenticity.

- Provide the completed form to the seller during the transaction.

Legal Use of the DTF 950 Form

The DTF 950 form is legally binding when used correctly. It must be completed in accordance with New York State laws governing tax exemptions. Misuse of the form, such as claiming exemptions without proper eligibility, can lead to penalties and legal repercussions. Therefore, it is vital for users to understand the legal implications of the form and ensure compliance with all applicable regulations.

Key Elements of the DTF 950 Form

Several key elements must be included in the DTF 950 form to ensure its validity:

- Purchaser Information: Name, address, and contact details of the entity claiming the exemption.

- Exemption Reason: A clear statement of the reason for claiming tax exemption, such as non-profit status or government affiliation.

- Signature: The form must be signed by an authorized representative of the organization.

- Date: The date of completion must be included to establish the timeline of the transaction.

Examples of Using the DTF 950 Form

Common scenarios for using the DTF 950 form include:

- A non-profit organization purchasing supplies for community services.

- A government agency acquiring equipment for public use.

- A diplomatic mission obtaining materials for official functions.

In each case, the DTF 950 form serves as proof of tax-exempt status, allowing these entities to operate without the burden of sales tax on qualifying purchases.

Quick guide on how to complete dtf 950 form

Complete Dtf 950 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It presents an excellent eco-friendly substitute for conventional printed and signed documentation, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents swiftly without delays. Handle Dtf 950 Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign Dtf 950 Form effortlessly

- Find Dtf 950 Form and click on Get Form to initiate.

- Use the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow makes available specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of missing or lost files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you prefer. Edit and eSign Dtf 950 Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 950 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do I get a US tax-exempt number?

You can find out how to apply for an EIN by visiting the IRS website at .irs.gov and searching for 'apply for an EIN'. You may apply for an EIN online or by fax or mail. International applicants may call 267-941-1099 (toll call). TIP: Don't apply for an EIN more than once.

-

How do I become exempt from US taxes?

Who Does Not Have to Pay Taxes? You generally don't have to pay taxes if your income is less than the standard deduction or the total of your itemized deductions, if you have a certain number of dependents, if you work abroad and are below the required thresholds, or if you're a qualifying non-profit organization.

-

What is a ca590 form?

Use Form 590, Withholding Exemption Certificate, to signNow an exemption from nonresident withholding. Form 590 does not apply to payments of backup withholding. For more information, go to ftb.ca.gov and search for backup withholding.

-

Who is exempt from US sales tax?

Government: As noted earlier, the Federal Government is exempt from paying sales tax. Surprisingly, state and local governments may not be exempt from sales tax depending on the state. Similarly, schools and universities have specific rules from state to state that outline whether they are exempt or not.

-

What is DTF 95?

To change any other business tax account information (as well as your address), file Form DTF-95, Business Tax Account Update and instructions. To report a completed change of entity, call the Business Tax Information Center. There is no paper option.

-

How do I get my exemption certificate?

If you're entitled to a certificate because of your medical condition, speak to your GP or doctor. They'll give you an application form. You'll get a certificate in the post within 10 working days of us receiving your application.

-

How do I get a US sales tax exemption certificate?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

-

What is a NYS DTF pit tax payment?

The acronym breaks down as follows: NYS (New York State), DTF (Department of Tax and Finance), and PIT (Personal Income Tax). NY DTF is responsible for managing and collecting tax revenues for state. affairs. As a resident of New York earning an income, you'll be subject to state taxes based on your income and payroll.

Get more for Dtf 950 Form

- Fms 2958 white check boxes v5 bureau of the fiscal service fms treas form

- Individuals doing business or providing services in the district oregon form

- Hiring your children kit deb wieseamp39s bookkeeping amp tax service form

- Subsemnatul form

- Confidential tax information authorization

- Transfer of intellectual property rights agreement template form

- Transfer of ownership agreement template form

- Transfer of rights agreement template form

Find out other Dtf 950 Form

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy