Confidential Tax Information Authorization 2020-2026

What is the Confidential Tax Information Authorization

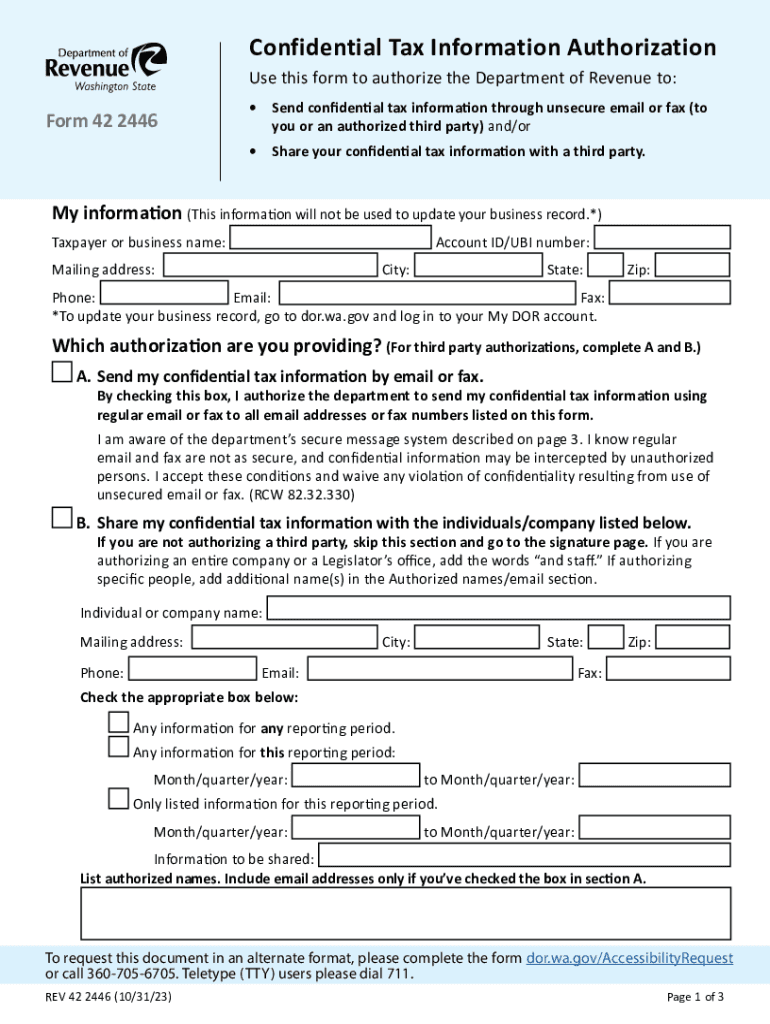

The Confidential Tax Information Authorization is a crucial document that allows individuals or businesses to authorize a third party to access their confidential tax information. This form is essential for ensuring that sensitive tax details can be shared securely with designated representatives, such as tax professionals or financial advisors. By completing this authorization, taxpayers can facilitate smoother communication and processing of their tax matters.

How to use the Confidential Tax Information Authorization

Using the Confidential Tax Information Authorization involves several straightforward steps. First, the taxpayer must obtain the form, which can typically be found on the relevant state or federal tax authority's website. Next, the taxpayer fills out the required fields, including their personal information and the details of the authorized representative. Once completed, the form should be submitted to the appropriate tax authority. It is important to ensure that all information is accurate to avoid any delays in processing.

Steps to complete the Confidential Tax Information Authorization

Completing the Confidential Tax Information Authorization requires attention to detail. Follow these steps:

- Obtain the form from the appropriate tax authority.

- Fill in your personal information, including your name, address, and tax identification number.

- Provide the details of the authorized representative, including their name and contact information.

- Sign and date the form to validate your authorization.

- Submit the completed form to the tax authority, either online or via mail.

Key elements of the Confidential Tax Information Authorization

The Confidential Tax Information Authorization includes several key elements that are vital for its validity. These elements typically consist of:

- The taxpayer's full name and identification details.

- The name and contact information of the authorized representative.

- A clear statement of the specific tax information that can be disclosed.

- The taxpayer's signature and the date of authorization.

Legal use of the Confidential Tax Information Authorization

The legal use of the Confidential Tax Information Authorization is governed by state and federal laws regarding tax privacy and confidentiality. This form must be used in compliance with these regulations to ensure that the taxpayer's information is protected. Unauthorized disclosure of tax information can lead to legal repercussions for both the taxpayer and the authorized representative.

Form Submission Methods

The Confidential Tax Information Authorization can be submitted through various methods, depending on the specific requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's secure portal.

- Mailing the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete confidential tax information authorization

Prepare Confidential Tax Information Authorization effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a flawless eco-friendly alternative to conventional printed and signed files, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents quickly without any hold-ups. Manage Confidential Tax Information Authorization on any device using airSlate SignNow's Android or iOS applications and enhance any documentation process today.

How to modify and electronically sign Confidential Tax Information Authorization effortlessly

- Obtain Confidential Tax Information Authorization and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, through email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Confidential Tax Information Authorization and ensure outstanding communication at any phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct confidential tax information authorization

Create this form in 5 minutes!

How to create an eSignature for the confidential tax information authorization

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is authorization dor wa in airSlate SignNow?

Authorization dor wa is a crucial feature in airSlate SignNow that allows users to manage document permissions and approvals efficiently. This functionality ensures that only authorized individuals can access and sign documents, enhancing security and compliance in your workflows.

-

How does airSlate SignNow facilitate the authorization dor wa process?

airSlate SignNow streamlines the authorization dor wa process by providing customizable workflows that allow you to set specific rules for document access. Users can easily configure settings to define who can sign and approve documents, ensuring a smooth and controlled signing experience.

-

Is there a cost associated with using authorization dor wa in airSlate SignNow?

The authorization dor wa feature is included in airSlate SignNow's pricing plans, which cater to businesses of all sizes. We offer flexible pricing options that ensure you receive the best value for your investment while empowering your document workflows with robust authorization features.

-

What are the benefits of using authorization dor wa with airSlate SignNow?

Using authorization dor wa with airSlate SignNow provides several benefits, including enhanced document security, improved compliance, and faster turnaround times. By establishing clear authorization roles, businesses can ensure that documents are handled appropriately and signed promptly.

-

Can I integrate authorization dor wa with other tools and software?

Yes, airSlate SignNow allows for easy integration of authorization dor wa with various tools and software. This seamless integration ensures that your existing systems work harmoniously with our e-signature solution, enhancing your overall document management process.

-

What types of documents can I manage using authorization dor wa in airSlate SignNow?

You can manage a wide range of documents using authorization dor wa in airSlate SignNow, from contracts and agreements to forms and applications. The platform is designed to handle any document that requires signatures and approvals, allowing your business to operate efficiently.

-

How secure is the authorization dor wa feature in airSlate SignNow?

The authorization dor wa feature in airSlate SignNow is built with security as a top priority. It employs encryption and strict compliance measures to protect your documents and signature data, ensuring that your business processes remain safe from unauthorized access.

Get more for Confidential Tax Information Authorization

- 1055cw statement of cash wages form

- Rightfax edd form

- Customer service representative fastrip jaco oil company form

- Background research application and release lakeshore form

- Tip gratuity income affidavit form

- Pennsylvania state work study application form

- Application for employment preemployment questionnaire an equal opportunity employer personal information date name last first

- Notice of intent to terminate for material breach of rental agreement form

Find out other Confidential Tax Information Authorization

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed