Merchant License Form Pulaski County Collector

What is the Merchant License Form Pulaski County Collector

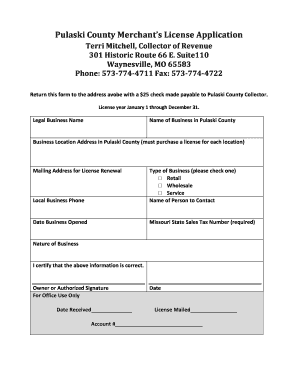

The Merchant License Form Pulaski County Collector is a vital document required for businesses operating within Pulaski County. This form serves as an official application for obtaining a merchant license, which is necessary for legal compliance when conducting commercial activities. The form collects essential information about the business, including its name, address, ownership structure, and the nature of the business activities. Completing this form accurately is crucial for ensuring that the business operates within the legal framework established by local regulations.

How to use the Merchant License Form Pulaski County Collector

Using the Merchant License Form Pulaski County Collector involves several straightforward steps. First, download the form from the official Pulaski County Collector's website or obtain a physical copy from their office. Next, fill out the required fields, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions. Once verified, submit the form either electronically or in person, depending on the submission options provided by the county. Keeping a copy for your records is also advisable, as it may be needed for future reference.

Steps to complete the Merchant License Form Pulaski County Collector

Completing the Merchant License Form Pulaski County Collector involves a series of specific steps:

- Gather necessary information about your business, including its legal name, address, and type of business entity.

- Access the Merchant License Form from the Pulaski County Collector's website or office.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or missing information.

- Submit the completed form via the designated method, whether online or in person.

- Retain a copy of the submitted form for your records.

Legal use of the Merchant License Form Pulaski County Collector

The legal use of the Merchant License Form Pulaski County Collector is essential for businesses to operate lawfully within Pulaski County. This form not only grants permission to conduct business but also ensures compliance with local regulations. Properly completing and submitting the form establishes a legal record of the business's existence and its adherence to county laws. Failure to obtain a merchant license can result in penalties, including fines or restrictions on business operations.

Key elements of the Merchant License Form Pulaski County Collector

Key elements of the Merchant License Form Pulaski County Collector include:

- Business Information: Name, address, and contact details of the business.

- Ownership Details: Information about the business owner(s), including names and addresses.

- Nature of Business: Description of the type of business activities conducted.

- Signature: Required signature of the business owner or authorized representative.

- Date: The date on which the form is completed and submitted.

Who Issues the Form

The Merchant License Form Pulaski County Collector is issued by the Pulaski County Collector's office. This office is responsible for managing the licensing process and ensuring that all businesses comply with local laws. The Collector's office provides guidance on how to fill out the form and the necessary steps to obtain a merchant license. It is advisable for applicants to contact the office directly for any specific questions or clarifications regarding the form and the licensing process.

Quick guide on how to complete merchant license form pulaski county collector

Complete Merchant License Form Pulaski County Collector effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Handle Merchant License Form Pulaski County Collector on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to modify and electronically sign Merchant License Form Pulaski County Collector with ease

- Locate Merchant License Form Pulaski County Collector and click Get Form to begin.

- Make use of the features we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Alter and electronically sign Merchant License Form Pulaski County Collector to guarantee outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the merchant license form pulaski county collector

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Merchant License Form Pulaski County Collector?

The Merchant License Form Pulaski County Collector is a document required for businesses operating in Pulaski County to obtain the necessary licenses. This form ensures compliance with local regulations and helps streamline the licensing process. Completing this form accurately is essential for lawful business operation in the region.

-

How can airSlate SignNow help with the Merchant License Form Pulaski County Collector?

With airSlate SignNow, you can easily prepare, send, and eSign the Merchant License Form Pulaski County Collector. Our platform simplifies the document workflow, allowing you to complete the licensing process quickly and efficiently. You can manage all your documents online, reducing the hassle of paper forms.

-

What are the costs associated with using airSlate SignNow for the Merchant License Form Pulaski County Collector?

airSlate SignNow offers various pricing plans to suit different business needs, starting with a free trial. The cost for using our services to process the Merchant License Form Pulaski County Collector will depend on the selected subscription plan. Investing in SignNow saves you time and enhances productivity, making it a worthwhile expense for your business.

-

Can I integrate airSlate SignNow with other applications for managing the Merchant License Form Pulaski County Collector?

Yes, airSlate SignNow can be integrated with numerous applications and tools to streamline your overall document management process. This includes CRM systems, cloud storage, and productivity software. By integrating with your existing tools, you can efficiently handle the Merchant License Form Pulaski County Collector and improve your workflow.

-

What features does airSlate SignNow offer for completing the Merchant License Form Pulaski County Collector?

airSlate SignNow provides a comprehensive set of features for handling the Merchant License Form Pulaski County Collector, including eSigning, document templates, and secure storage. Our user-friendly interface ensures that you can easily edit and manage your documents. Additionally, the platform allows you to track the status of your forms, keeping you updated on your application's progress.

-

Is airSlate SignNow secure for handling the Merchant License Form Pulaski County Collector?

Yes, airSlate SignNow prioritizes the security of your documents, including the Merchant License Form Pulaski County Collector. We use advanced encryption protocols to protect your data both in transit and at rest. You can trust that your sensitive information is stored securely within our platform.

-

What is the typical processing time for the Merchant License Form Pulaski County Collector using airSlate SignNow?

The processing time for the Merchant License Form Pulaski County Collector can be signNowly reduced when using airSlate SignNow. Typically, documents can be sent for eSignature and completed within a few hours. This efficiency helps you expedite your business licensing process and get started faster.

Get more for Merchant License Form Pulaski County Collector

- Teachers college leveled booklist order form fc lovett

- Raf ihcda in gov form

- Work readiness assessment questionnaire for youth form

- Auraria campus immunization compliance form ucdenver

- Live in aide request form

- Skrill merchant form

- Grand rapids income tax form

- 4567 michigan business tax annual return form

Find out other Merchant License Form Pulaski County Collector

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template