Taxation and Revenue Department SUSTAINABLE BUILDING 2016-2026

Understanding the Taxation And Revenue Department Sustainable Building

The Taxation And Revenue Department Sustainable Building refers to a regulatory framework established to promote environmentally friendly construction practices while ensuring compliance with local tax laws. This initiative encourages the development of buildings that minimize environmental impact through sustainable materials and energy-efficient designs. It integrates tax incentives for builders and property owners who adhere to specific sustainability criteria, ultimately contributing to a greener economy.

How to Utilize the Taxation And Revenue Department Sustainable Building Framework

To effectively use the Taxation And Revenue Department Sustainable Building framework, individuals and businesses should first familiarize themselves with the eligibility criteria and specific requirements outlined by their state’s taxation authority. This involves understanding the types of projects that qualify for sustainability incentives. Engaging with local government resources can provide guidance on the application process for obtaining necessary permits and tax benefits.

Steps to Complete the Taxation And Revenue Department Sustainable Building Application

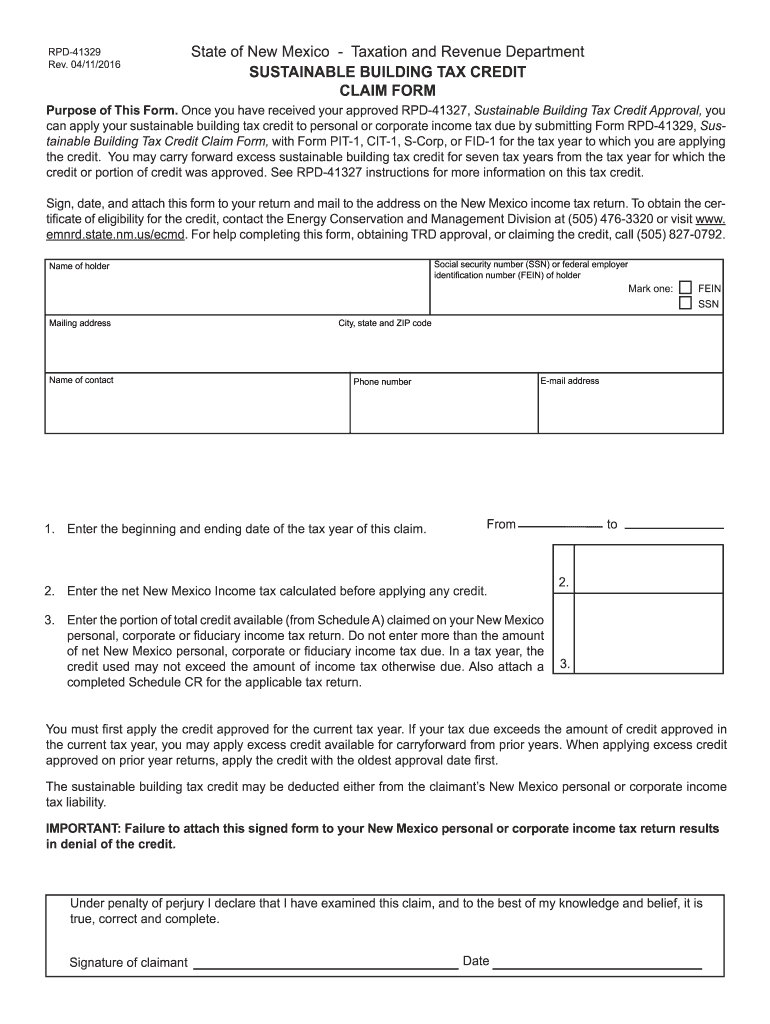

Completing the application for the Taxation And Revenue Department Sustainable Building involves several key steps:

- Gather necessary documentation, including project plans and sustainability certifications.

- Complete the application form provided by the Taxation And Revenue Department.

- Submit the application along with any required fees to the appropriate state office.

- Await confirmation and any follow-up requests from the department.

- Implement the approved sustainable practices in your building project.

Legal Considerations for the Taxation And Revenue Department Sustainable Building

Legal use of the Taxation And Revenue Department Sustainable Building framework requires adherence to both state and federal regulations regarding construction and environmental standards. It is essential to ensure that all building practices comply with zoning laws, building codes, and sustainability guidelines. Non-compliance may result in penalties or loss of tax incentives.

Key Elements of the Taxation And Revenue Department Sustainable Building

Key elements of the Taxation And Revenue Department Sustainable Building include:

- Definition of sustainable building practices.

- Eligibility criteria for tax incentives.

- Documentation requirements for application submission.

- Compliance guidelines for ongoing project evaluation.

- Reporting obligations for tax benefits received.

State-Specific Rules for the Taxation And Revenue Department Sustainable Building

Each state may have unique rules governing the Taxation And Revenue Department Sustainable Building. These rules can vary significantly, including differences in tax incentives, application processes, and compliance requirements. It is crucial for applicants to consult their state’s taxation department or website for specific guidelines and updates related to sustainable building initiatives.

Quick guide on how to complete taxation and revenue department sustainable building

Effortlessly Prepare Taxation And Revenue Department SUSTAINABLE BUILDING on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary forms and safely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Taxation And Revenue Department SUSTAINABLE BUILDING on any device using the airSlate SignNow apps for Android or iOS and enhance any document-focused workflow today.

How to Modify and eSign Taxation And Revenue Department SUSTAINABLE BUILDING with Ease

- Find Taxation And Revenue Department SUSTAINABLE BUILDING and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive details with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending the form—via email, SMS, invite link, or download it to your computer.

Forget about lost or misfiled documents, cumbersome form navigation, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign Taxation And Revenue Department SUSTAINABLE BUILDING to ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxation and revenue department sustainable building

Create this form in 5 minutes!

How to create an eSignature for the taxation and revenue department sustainable building

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the Taxation And Revenue Department SUSTAINABLE BUILDING in document management?

The Taxation And Revenue Department SUSTAINABLE BUILDING focuses on ensuring compliance and efficiency in managing documents related to sustainable building practices. By utilizing airSlate SignNow, businesses can streamline their document workflows, ensuring that all necessary forms are signed and submitted promptly.

-

How can airSlate SignNow help with compliance in the Taxation And Revenue Department SUSTAINABLE BUILDING?

airSlate SignNow provides tools that help businesses maintain compliance with regulations set by the Taxation And Revenue Department SUSTAINABLE BUILDING. With features like audit trails and secure eSignatures, companies can ensure that their documents meet all legal requirements.

-

What are the pricing options for using airSlate SignNow for the Taxation And Revenue Department SUSTAINABLE BUILDING?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses engaging with the Taxation And Revenue Department SUSTAINABLE BUILDING. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing essential features for document management.

-

What features does airSlate SignNow offer for the Taxation And Revenue Department SUSTAINABLE BUILDING?

Key features of airSlate SignNow include customizable templates, automated workflows, and secure eSigning capabilities. These features are designed to enhance the efficiency of document handling for the Taxation And Revenue Department SUSTAINABLE BUILDING, making it easier to manage and track important documents.

-

How does airSlate SignNow improve collaboration for the Taxation And Revenue Department SUSTAINABLE BUILDING?

With airSlate SignNow, teams can collaborate in real-time on documents related to the Taxation And Revenue Department SUSTAINABLE BUILDING. The platform allows multiple users to review, comment, and sign documents, ensuring that everyone is on the same page and reducing delays in the approval process.

-

Can airSlate SignNow integrate with other tools used by the Taxation And Revenue Department SUSTAINABLE BUILDING?

Yes, airSlate SignNow offers integrations with various tools and software commonly used in the Taxation And Revenue Department SUSTAINABLE BUILDING. This ensures seamless data transfer and enhances overall productivity by connecting your existing systems with our document management solution.

-

What benefits does airSlate SignNow provide for businesses working with the Taxation And Revenue Department SUSTAINABLE BUILDING?

Businesses can benefit from increased efficiency, reduced paperwork, and improved compliance when using airSlate SignNow for the Taxation And Revenue Department SUSTAINABLE BUILDING. The platform simplifies the signing process, allowing for faster turnaround times and better resource management.

Get more for Taxation And Revenue Department SUSTAINABLE BUILDING

Find out other Taxation And Revenue Department SUSTAINABLE BUILDING

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form