Tax Form File

What is the Tax Form File

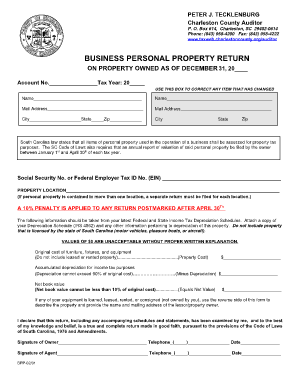

The Charleston County business personal property return is a specific tax form that business owners must complete to report their personal property assets to the local tax authority. This form is essential for ensuring that businesses are accurately assessed for property taxes based on the value of their equipment, furniture, and other tangible assets. Completing this form is a legal requirement for maintaining compliance with local tax regulations.

Steps to complete the Tax Form File

Completing the Charleston County business personal property return involves several key steps:

- Gather necessary information about your business assets, including equipment, furniture, and any other personal property.

- Access the form through the Charleston County tax office or an authorized platform.

- Fill in the required fields, ensuring that all information is accurate and up to date.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online or via mail.

Legal use of the Tax Form File

The Charleston County business personal property return is legally binding when completed and submitted correctly. To ensure its legal standing, it must be signed by an authorized representative of the business. Additionally, compliance with local regulations and deadlines is crucial, as failure to submit the form can result in penalties or fines.

Filing Deadlines / Important Dates

Business owners in Charleston County should be aware of specific deadlines for submitting the personal property return. Typically, the deadline falls on a designated date each year, often aligned with the tax calendar. It is important to check for any updates or changes to these dates to avoid late submissions, which may incur penalties.

Required Documents

When completing the Charleston County business personal property return, certain documents may be required to support the information provided. These documents can include:

- Previous year’s tax return for comparison.

- Receipts or invoices for purchased equipment and assets.

- Depreciation schedules for any assets claimed.

Form Submission Methods (Online / Mail / In-Person)

Business owners have several options for submitting the Charleston County business personal property return. The form can typically be submitted online through the county's tax office website, mailed to the appropriate address, or delivered in person. Each method may have different processing times, so it is advisable to choose the method that best suits your needs and timeline.

Quick guide on how to complete tax form file

Complete Tax Form File effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, amend, and eSign your documents promptly without delays. Manage Tax Form File on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Tax Form File with ease

- Obtain Tax Form File and click on Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your adjustments.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign Tax Form File to ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax form file

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Charleston County business personal property return?

A Charleston County business personal property return is a document that businesses must file annually to report personal property owned for business purposes. This process ensures accurate valuation and taxation of business assets in Charleston County.

-

How can airSlate SignNow help with the Charleston County business personal property return?

airSlate SignNow streamlines the process of completing and submitting your Charleston County business personal property return. With our eSignature solution, you can quickly sign and send documents, reducing paperwork and saving time.

-

Is there a cost associated with using airSlate SignNow for my Charleston County business personal property return?

Yes, airSlate SignNow offers flexible pricing plans to cater to various business needs. Our cost-effective solutions allow you to efficiently manage your Charleston County business personal property return without breaking the bank.

-

What features does airSlate SignNow provide for managing Charleston County business personal property returns?

AirSlate SignNow includes features such as document templates, customizable workflows, and secure eSignature capabilities to simplify your Charleston County business personal property return process. These tools help reduce errors and increase efficiency in document management.

-

How secure is the information I provide when filing the Charleston County business personal property return with airSlate SignNow?

Security is a top priority for airSlate SignNow. We use industry-standard encryption protocols to ensure that all information provided during the Charleston County business personal property return process is kept confidential and secure.

-

Can I integrate airSlate SignNow with other software for my Charleston County business personal property return?

Yes! AirSlate SignNow offers seamless integrations with other platforms to enhance your workflow. Whether you use accounting software or project management tools, we can help streamline your Charleston County business personal property return process.

-

What are the benefits of using airSlate SignNow for my Charleston County business personal property return?

Using airSlate SignNow for your Charleston County business personal property return offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our user-friendly platform allows you to focus on growing your business instead of getting bogged down by paperwork.

Get more for Tax Form File

- Florida notice of assignment of contract for deed form

- Sitrep form 41362814

- Sponsorship form royal british legion scotland

- New client consultation form

- Georgetown county auditor form

- Dog licensevaccination certificate dog or cat sedgwick county sedgwickcounty form

- Commercial purchase and sale agreement cine fl com form

- Partnership income tax hawaii department of taxation form

Find out other Tax Form File

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure