Partnership Income Tax Hawaii Department of Taxation 2023-2026

Understanding the K-1 Tax Document

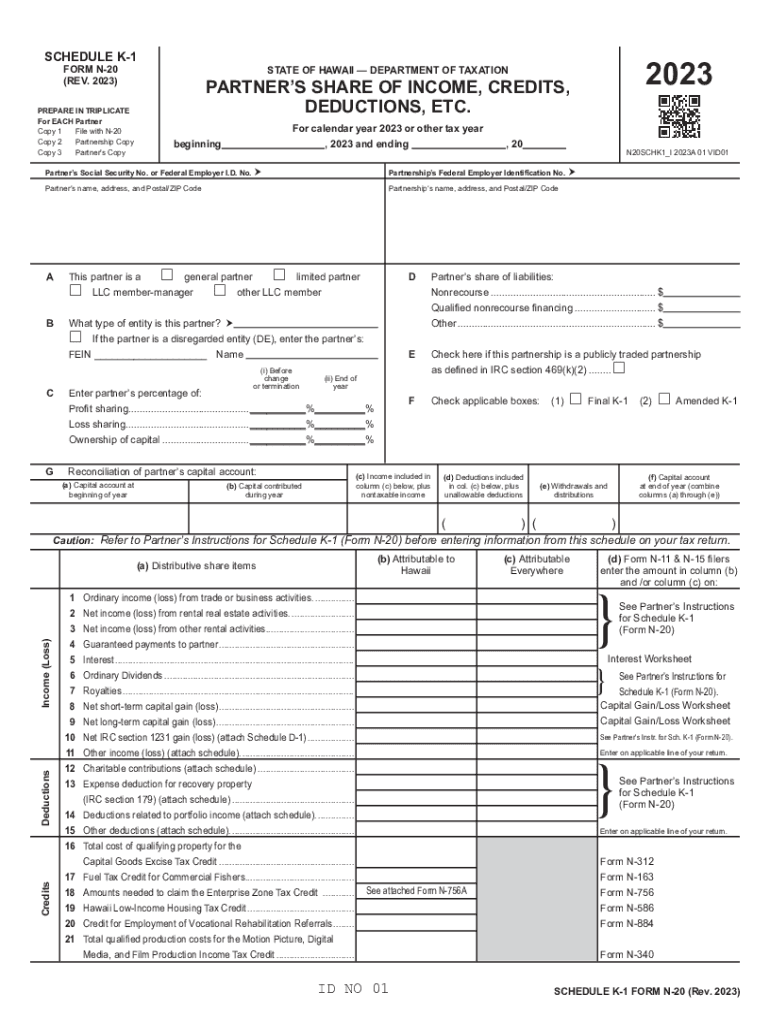

The 2024 K-1 form, also known as Schedule K-1, is a crucial tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form provides detailed information about each partner's share of the entity's income, which is essential for individual tax filings. Understanding what is included in the K-1 form helps taxpayers accurately report their earnings and comply with tax regulations.

Key Elements of the 2024 K-1 Form

The K-1 form includes several important sections that detail a partner's share of income, losses, and other tax-related items. Key elements typically found on the form include:

- Part I: Information about the partnership or entity, including its name, address, and tax identification number.

- Part II: Information about the partner, such as name, address, and identifying number.

- Part III: Details of the partner's share of income, deductions, credits, and other items. This section is vital for determining the partner's tax liability.

Steps to Complete the 2024 K-1 Form

Filling out the K-1 form requires careful attention to detail. Here are the steps to complete the 2024 K-1 form:

- Gather necessary information about the partnership and the partner, including tax identification numbers.

- Fill out Part I with the partnership's details accurately.

- Complete Part II with the partner's personal information.

- In Part III, report the partner's share of income, deductions, and credits as provided by the partnership.

- Review the completed form for accuracy before submission.

Filing Deadlines for the K-1 Form

Understanding the filing deadlines for the K-1 form is essential to avoid penalties. The K-1 form must be issued to partners by the partnership by March 15, 2025, for the 2024 tax year. Partners should ensure they receive their K-1 in time to incorporate the information into their individual tax returns, which are typically due by April 15, 2025.

IRS Guidelines for Reporting K-1 Income

The IRS provides specific guidelines on how to report K-1 income on individual tax returns. Partners must include the income reported on their K-1 forms on their personal tax returns, typically on Schedule E. It is important to follow IRS instructions carefully to ensure compliance and avoid potential audits or penalties.

Common Scenarios Involving K-1 Forms

Various taxpayer scenarios may affect how K-1 income is reported. For example:

- Self-employed individuals may need to report K-1 income as part of their overall business income.

- Retired individuals receiving income from a partnership must include K-1 income when calculating their taxable income.

- Students who are partners in a business may also receive K-1 forms, which they must report on their tax returns.

Digital vs. Paper Version of the K-1 Form

Taxpayers can choose between digital and paper versions of the K-1 form. Digital forms can be filled out and submitted electronically, providing convenience and efficiency. However, some may prefer paper forms for record-keeping purposes. Regardless of the format, ensuring accuracy in reporting is paramount for compliance with tax regulations.

Quick guide on how to complete partnership income tax hawaii department of taxation

Effortlessly Prepare Partnership Income Tax Hawaii Department Of Taxation on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow offers all the resources necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage Partnership Income Tax Hawaii Department Of Taxation on any device with airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

Steps to Modify and Electronically Sign Partnership Income Tax Hawaii Department Of Taxation with Ease

- Obtain Partnership Income Tax Hawaii Department Of Taxation and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for these purposes by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or download to your computer.

No more worrying about lost or misplaced files, frustrating form navigation, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Partnership Income Tax Hawaii Department Of Taxation and guarantee excellent communication throughout every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct partnership income tax hawaii department of taxation

Create this form in 5 minutes!

How to create an eSignature for the partnership income tax hawaii department of taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2024 K1 form, and why is it important?

The 2024 K1 form is a tax document used to report income, deductions, and credits from partnerships, S corporations, and estates. It is crucial for accurately reporting income on your tax return, ensuring compliance with IRS regulations, and providing necessary details to investors. Utilizing airSlate SignNow simplifies the eSigning process of your 2024 K1 form, making it efficient and secure.

-

How can I easily send and eSign my 2024 K1 form with airSlate SignNow?

With airSlate SignNow, you can easily upload your 2024 K1 form, add required signers, and send it out for eSignature. Our intuitive interface allows users to guide their clients through the signing process seamlessly. You can also track the status in real time to ensure timely completion.

-

What features does airSlate SignNow offer for managing the 2024 K1 form?

airSlate SignNow provides features designed specifically for managing your 2024 K1 form, including templates, automated workflows, and custom signing fields. These tools enhance accuracy and streamline your document management process. Additionally, cloud storage ensures your forms are always accessible albeit remote.

-

Is airSlate SignNow cost-effective for handling the 2024 K1 form?

Yes, airSlate SignNow offers competitive pricing that makes it a cost-effective solution for individuals and businesses dealing with the 2024 K1 form. With subscription plans catered to different needs, you can select the one that provides maximum value for your eSigning requirements. Consider our free trial to explore features before committing.

-

Can I integrate airSlate SignNow with other tools for my 2024 K1 form?

Absolutely! airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Salesforce, and Zapier, allowing you to manage your 2024 K1 form effectively across different platforms. These integrations help automate workflows and keep your document management streamlined.

-

What are the security measures for eSigning my 2024 K1 form on airSlate SignNow?

Security is a top priority for airSlate SignNow. When eSigning your 2024 K1 form, you benefit from bank-level encryption, multi-factor authentication, and audit trails that document every action taken on your documents. This ensures that your sensitive tax information is secured throughout the signing process.

-

How does airSlate SignNow enhance the signing experience for my 2024 K1 form?

airSlate SignNow enhances the signing experience by providing a user-friendly interface, customizable signing flows, and mobile accessibility. Users can sign the 2024 K1 form from any device, making it convenient and efficient. Our platform also minimizes signing delays, ensuring you stay on top of your filing deadlines.

Get more for Partnership Income Tax Hawaii Department Of Taxation

Find out other Partnership Income Tax Hawaii Department Of Taxation

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA