Personal Information Update Form Credit Report

What is the Personal Information Update Form Credit Report

The Personal Information Update Form for credit reports is a document used to request changes or corrections to personal information on credit reports maintained by credit bureaus. This form is essential for individuals who have experienced changes in their name, address, or other identifying details. Accurate personal information is crucial for maintaining a good credit score and ensuring that credit reports reflect the most current data. By submitting this form, consumers can help prevent identity theft and ensure that their credit history is accurate.

Steps to Complete the Personal Information Update Form Credit Report

Completing the Personal Information Update Form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your full name, current address, previous address, and any other identifying details. Next, clearly indicate the specific changes you wish to make on the form. It is important to provide supporting documentation, such as a government-issued ID or utility bill, to verify your identity and the accuracy of the requested changes. Finally, review the completed form for any errors before submitting it to the appropriate credit bureau.

How to Use the Personal Information Update Form Credit Report

Using the Personal Information Update Form effectively involves understanding how to submit it correctly. After filling out the form, you can submit it either online or via mail, depending on the credit bureau's guidelines. If submitting online, ensure you follow the specific instructions provided on the bureau's website. For mail submissions, use a secure method, such as certified mail, to confirm delivery. Keep a copy of the completed form and any supporting documents for your records, as this can be helpful for future reference or disputes.

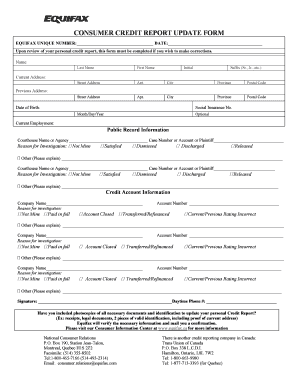

Key Elements of the Personal Information Update Form Credit Report

The Personal Information Update Form typically includes several key elements that must be completed accurately. These elements include:

- Full Name: Your current legal name as it appears on official documents.

- Current Address: Your current residential address, including city, state, and ZIP code.

- Previous Address: Any previous addresses where you have lived, if applicable.

- Identification: Information about your identification, such as a driver's license number or Social Security number.

- Reason for Update: A brief explanation of why you are requesting the change.

Legal Use of the Personal Information Update Form Credit Report

The legal use of the Personal Information Update Form is governed by regulations that protect consumer rights. Under the Fair Credit Reporting Act (FCRA), consumers have the right to dispute inaccuracies in their credit reports. Submitting this form is a formal way to exercise that right and ensure that credit bureaus maintain accurate records. It is important to follow the legal guidelines when completing and submitting the form to ensure that your request is processed correctly and in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

There are multiple methods for submitting the Personal Information Update Form, each with its own advantages. Online submission is often the fastest method, allowing for immediate processing. Most credit bureaus offer secure online portals for this purpose. Mail submissions are also common, and it is advisable to use certified mail for tracking purposes. In-person submissions may be available at local credit bureau offices, providing an opportunity to discuss any concerns directly with a representative. Always check the specific submission guidelines for the credit bureau you are dealing with to ensure compliance.

Quick guide on how to complete personal information update form credit report

Effortlessly Prepare Personal Information Update Form Credit Report on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any delays. Manage Personal Information Update Form Credit Report on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Edit and eSign Personal Information Update Form Credit Report with Ease

- Obtain Personal Information Update Form Credit Report and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to secure your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or mislaid documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Personal Information Update Form Credit Report to guarantee excellent communication throughout your form completion journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal information update form credit report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a personal information update letter credit bureau template?

A personal information update letter credit bureau template is a pre-formatted document designed to help individuals request updates or corrections to their personal information on credit reports. This template simplifies the process, ensuring that your communication with credit bureaus is clear and effective.

-

How can I use the personal information update letter credit bureau template?

You can use the personal information update letter credit bureau template by filling in your specific details and sending it to the relevant credit bureau. This ensures that any errors in your personal information are promptly addressed, ultimately improving your credit report accuracy.

-

Is there a cost associated with the personal information update letter credit bureau template?

airSlate SignNow offers competitive pricing for users who need access to the personal information update letter credit bureau template. The service provides a cost-effective solution that combines document preparation and eSignature capabilities for streamlined document management.

-

What benefits does the personal information update letter credit bureau template offer?

The personal information update letter credit bureau template offers several benefits, including simplicity, clarity, and compliance with credit reporting standards. By using this template, you ensure that your requests are professionally formatted, which can expedite the correction process with credit bureaus.

-

Can I integrate the personal information update letter credit bureau template with other tools?

Yes, airSlate SignNow allows for integrations with various tools, enhancing the functionality of the personal information update letter credit bureau template. This means you can easily merge data from other applications and streamline your workflow across multiple platforms.

-

What features does the personal information update letter credit bureau template include?

The personal information update letter credit bureau template includes customizable fields, easy document sharing options, and eSignature functionality. These features make it easier for users to efficiently update their personal details and ensure timely responses from credit bureaus.

-

How quickly can I expect a response after sending my personal information update letter credit bureau template?

Response times can vary, but typically credit bureaus respond within 30 days of receiving your personal information update letter credit bureau template. Using our optimized template can help ensure that your submission is processed quickly and accurately.

Get more for Personal Information Update Form Credit Report

- Sample assistive technology evaluation report swaaac form

- Restitution payment form

- Renewal application for license for nursing home the tennessee health state tn form

- Form e24

- Foot and ankle clinic queensway carleton hospital form

- Application for undergraduate admission saginaw valley state svsu form

- Georgia department of juvenile justice i policy djj form

- The homer fund matching grant pre approval packet form

Find out other Personal Information Update Form Credit Report

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter