457b Beneficiary Form Delaware State Treasury Treasury Delaware

What is the 457b Beneficiary Form Delaware State Treasury

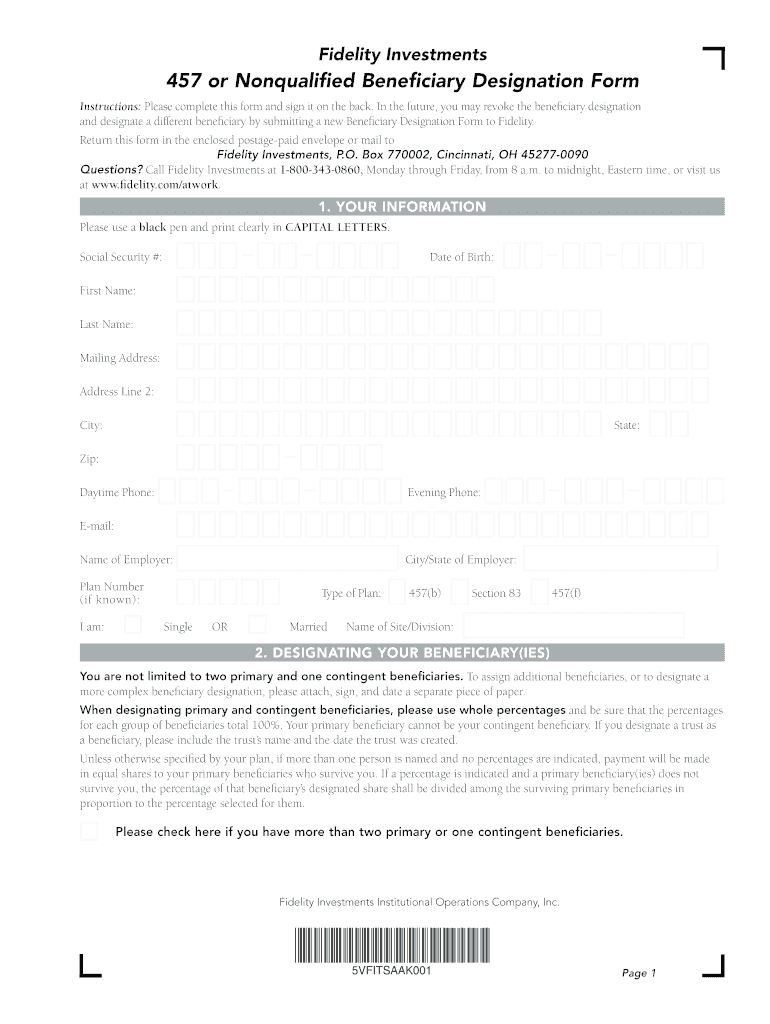

The 457b Beneficiary Form is a crucial document used by employees participating in the Delaware State Treasury's deferred compensation plan. This form allows individuals to designate beneficiaries who will receive benefits in the event of their death. It is essential for ensuring that the intended recipients receive the funds, which may include retirement savings and other accrued benefits. Understanding this form is vital for anyone involved in the Delaware state retirement system, as it directly impacts financial security for loved ones.

How to use the 457b Beneficiary Form Delaware State Treasury

Utilizing the 457b Beneficiary Form involves several straightforward steps. First, individuals must obtain the form from the Delaware State Treasury website or through their human resources department. After acquiring the form, it should be filled out with accurate information, including the names and relationships of the chosen beneficiaries. Once completed, the form must be submitted according to the instructions provided, ensuring that it reaches the appropriate office for processing. Keeping a copy for personal records is also recommended for future reference.

Steps to complete the 457b Beneficiary Form Delaware State Treasury

Completing the 457b Beneficiary Form requires careful attention to detail. Here are the steps to follow:

- Obtain the form from the Delaware State Treasury.

- Fill in your personal information accurately, including your name, address, and employee identification number.

- Designate your beneficiaries by providing their names, relationships to you, and any relevant contact information.

- Review the form for accuracy and completeness.

- Sign and date the form to validate your choices.

- Submit the form via the designated method, whether online, by mail, or in person.

Legal use of the 457b Beneficiary Form Delaware State Treasury

The legal use of the 457b Beneficiary Form is governed by state and federal regulations. For the form to be considered valid, it must be completed accurately and submitted in accordance with the Delaware State Treasury's guidelines. This ensures that the designations made are legally binding and recognized by the treasury. It is important to keep the form updated, especially after significant life events such as marriage, divorce, or the birth of a child, to ensure that the beneficiaries reflect current intentions.

Key elements of the 457b Beneficiary Form Delaware State Treasury

Several key elements are essential for the 457b Beneficiary Form to be effective:

- Personal Information: Accurate details about the employee, including name and identification number.

- Beneficiary Designation: Clear identification of beneficiaries, including their full names and relationships.

- Signature: The employee's signature is required to validate the form.

- Date: The date of signing must be included to establish when the form was executed.

State-specific rules for the 457b Beneficiary Form Delaware State Treasury

Delaware has specific rules governing the use of the 457b Beneficiary Form. These rules dictate how the form should be filled out, submitted, and updated. For instance, Delaware law requires that beneficiaries be clearly identified to avoid disputes. Additionally, the state mandates that the form must be kept on file with the Delaware State Treasury to ensure that it is honored upon the account holder's passing. Familiarity with these rules is essential for compliance and to ensure that beneficiaries receive their intended benefits.

Quick guide on how to complete 457b beneficiary form delaware state treasury treasury delaware

Accomplish 457b Beneficiary Form Delaware State Treasury Treasury Delaware effortlessly on any gadget

Web-based document management has gained traction among enterprises and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the required form and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle 457b Beneficiary Form Delaware State Treasury Treasury Delaware on any device with airSlate SignNow Android or iOS applications and streamline any document-related workflow today.

The easiest method to modify and electronically sign 457b Beneficiary Form Delaware State Treasury Treasury Delaware without hassle

- Find 457b Beneficiary Form Delaware State Treasury Treasury Delaware and click Get Form to begin.

- Employ the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 457b Beneficiary Form Delaware State Treasury Treasury Delaware and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

Create this form in 5 minutes!

How to create an eSignature for the 457b beneficiary form delaware state treasury treasury delaware

How to make an eSignature for your 457b Beneficiary Form Delaware State Treasury Treasury Delaware in the online mode

How to generate an eSignature for your 457b Beneficiary Form Delaware State Treasury Treasury Delaware in Chrome

How to make an eSignature for signing the 457b Beneficiary Form Delaware State Treasury Treasury Delaware in Gmail

How to generate an electronic signature for the 457b Beneficiary Form Delaware State Treasury Treasury Delaware from your smart phone

How to make an eSignature for the 457b Beneficiary Form Delaware State Treasury Treasury Delaware on iOS devices

How to make an electronic signature for the 457b Beneficiary Form Delaware State Treasury Treasury Delaware on Android

People also ask

-

What is the 457b Beneficiary Form Delaware State Treasury Treasury Delaware?

The 457b Beneficiary Form Delaware State Treasury Treasury Delaware is a crucial document that designates beneficiaries for your deferred compensation plan. It ensures that your benefits are distributed according to your wishes upon your passing. Completing this form accurately is essential for the smooth transfer of funds.

-

How can I complete the 457b Beneficiary Form Delaware State Treasury Treasury Delaware electronically?

You can complete the 457b Beneficiary Form Delaware State Treasury Treasury Delaware electronically using airSlate SignNow's user-friendly platform. Our eSigning solution simplifies the process, allowing you to fill out and submit the form quickly and securely from any device. This feature eliminates the need for paper forms and enhances efficiency.

-

Is there a cost associated with using airSlate SignNow for the 457b Beneficiary Form Delaware State Treasury Treasury Delaware?

Yes, while airSlate SignNow offers a cost-effective solution for eSigning documents, there may be subscription fees depending on your chosen plan. However, the investment in our platform can save you time and resources when handling the 457b Beneficiary Form Delaware State Treasury Treasury Delaware, making it a worthwhile expense.

-

What benefits does airSlate SignNow provide for managing the 457b Beneficiary Form Delaware State Treasury Treasury Delaware?

airSlate SignNow offers numerous benefits for managing the 457b Beneficiary Form Delaware State Treasury Treasury Delaware, including secure cloud storage, easy access to documents, and the ability to track eSignatures in real-time. Our platform enhances the overall experience by ensuring that your documents are processed swiftly and securely.

-

Can I integrate airSlate SignNow with other applications for the 457b Beneficiary Form Delaware State Treasury Treasury Delaware?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to streamline your workflow. This means you can manage the 457b Beneficiary Form Delaware State Treasury Treasury Delaware alongside your other critical business applications, enhancing productivity and efficiency.

-

What is the process for submitting the 457b Beneficiary Form Delaware State Treasury Treasury Delaware once it's completed?

Once you have completed the 457b Beneficiary Form Delaware State Treasury Treasury Delaware using airSlate SignNow, you can submit it directly through our platform. Our system ensures that your form is securely transmitted to the Delaware State Treasury, reducing the hassle of manual submissions and ensuring it signNowes the right destination.

-

How secure is my information when using airSlate SignNow for the 457b Beneficiary Form Delaware State Treasury Treasury Delaware?

Security is a top priority at airSlate SignNow. When you use our platform for the 457b Beneficiary Form Delaware State Treasury Treasury Delaware, your information is protected with advanced encryption and secure cloud storage. We prioritize your data privacy, ensuring that your sensitive information remains confidential and secure.

Get more for 457b Beneficiary Form Delaware State Treasury Treasury Delaware

- County of san diego state of california sdcounty ca form

- Affidavit of death of trustee california 2011 form

- Worker verification form 2008 2019

- How to fill out local tax form lancaster

- Deq 600 permit form

- Asn 4 form

- Biosolids annual report form

- Point source application department of environmental quality deq state or form

Find out other 457b Beneficiary Form Delaware State Treasury Treasury Delaware

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement