C1201 Form

What is the C1201 Form

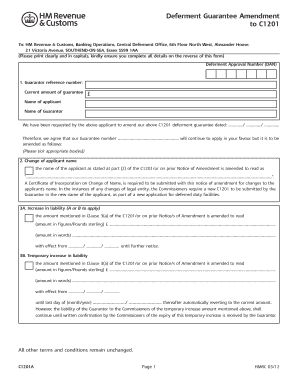

The C1201 form, also known as the C1201 guarantee form, is a document used primarily for deferment requests in the context of tax and financial obligations. It is issued by the HM Revenue and Customs (HMRC) in the United Kingdom, but its relevance extends to U.S. businesses and individuals dealing with international transactions or financial arrangements. This form is essential for individuals or entities seeking to defer their tax payments or obligations under specific circumstances.

How to use the C1201 Form

Using the C1201 form involves several key steps. First, ensure that you have the correct version of the form, which can be obtained from the relevant authority's website or office. Next, carefully read the instructions accompanying the form to understand the requirements for completion. Fill out the form accurately, providing all necessary information regarding your financial situation and the reason for your deferment request. After completing the form, submit it through the designated channels, which may include online submission, mailing it to a specific address, or delivering it in person.

Steps to complete the C1201 Form

Completing the C1201 form requires attention to detail. Begin by gathering all necessary documentation that supports your request for deferment. This may include financial statements, proof of income, or other relevant records. Then, follow these steps:

- Fill in your personal or business information, including name, address, and tax identification number.

- Clearly state the reason for your deferment request.

- Provide any supporting documentation as required.

- Review the form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the C1201 Form

The C1201 form holds legal significance when completed and submitted correctly. It serves as a formal request for deferment, and its acceptance by the relevant authority can provide legal protection against penalties for late payment. To ensure its legal validity, it is crucial to comply with all applicable regulations and guidelines set forth by the HMRC or other governing bodies.

Key elements of the C1201 Form

Understanding the key elements of the C1201 form is essential for proper completion. Important components include:

- Personal Information: This includes the name, address, and tax identification number of the individual or business.

- Reason for Deferment: A clear explanation of why the deferment is being requested.

- Supporting Documentation: Any additional documents that substantiate the request.

- Signature: The form must be signed and dated by the individual or authorized representative.

Form Submission Methods

The C1201 form can be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online Submission: Many authorities offer a digital platform for submitting forms electronically.

- Mail: The form can often be sent via postal service to a designated address.

- In-Person: Some individuals may prefer to submit the form directly at a local office.

Quick guide on how to complete c1201 form

Effortlessly Prepare C1201 Form on Any Device

Digital document management has gained traction among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents rapidly without any hold-ups. Manage C1201 Form across various platforms using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign C1201 Form with minimal effort

- Obtain C1201 Form and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review all the details and click on the Done button to secure your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Adjust and eSign C1201 Form to guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the c1201 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a c1201 form and why is it important?

The c1201 form is a crucial document used in various business processes to facilitate electronic signatures and record-keeping. Understanding this form is essential for ensuring compliance and streamlining workflow, making it easier for businesses to manage important transactions effectively.

-

How can airSlate SignNow help with the c1201 form?

airSlate SignNow allows users to easily create, send, and eSign c1201 forms within their platform. This integration simplifies the process, ensuring that your documents are not only securely signed but also compliant with legal standards, which is vital for business operations.

-

What are the pricing options for using airSlate SignNow for c1201 forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs for managing c1201 forms. You can choose a plan that suits your budget and requirements, including options for annual subscriptions that provide additional savings and features for frequent users.

-

Are there any features specifically for managing c1201 forms in airSlate SignNow?

Yes, airSlate SignNow includes specific features to simplify handling c1201 forms, such as custom templates, automated reminders, and tracking capabilities. These tools enhance overall efficiency, ensuring you never miss important deadlines or signatures.

-

Can I integrate other applications with airSlate SignNow for handling c1201 forms?

Absolutely! airSlate SignNow supports various integrations with popular business applications such as CRM and document management systems. This interoperability allows you to streamline your workflow when dealing with c1201 forms and other essential documents.

-

What are the benefits of using airSlate SignNow for c1201 forms?

Using airSlate SignNow for c1201 forms provides numerous benefits including enhanced security, reduced turnaround times, and cost-effectiveness. The platform's user-friendly interface also makes it accessible for all team members, improving collaboration on document signing.

-

Is airSlate SignNow compliant with regulations for c1201 forms?

Yes, airSlate SignNow complies with relevant legal standards and regulations for electronic signatures, ensuring that c1201 forms are legally binding. This compliance gives businesses peace of mind when transitioning to digital signature processes.

Get more for C1201 Form

Find out other C1201 Form

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney