Client Funds Savings Sub Account Application Agreement Form

What is the Client Funds Savings Sub Account Application Agreement

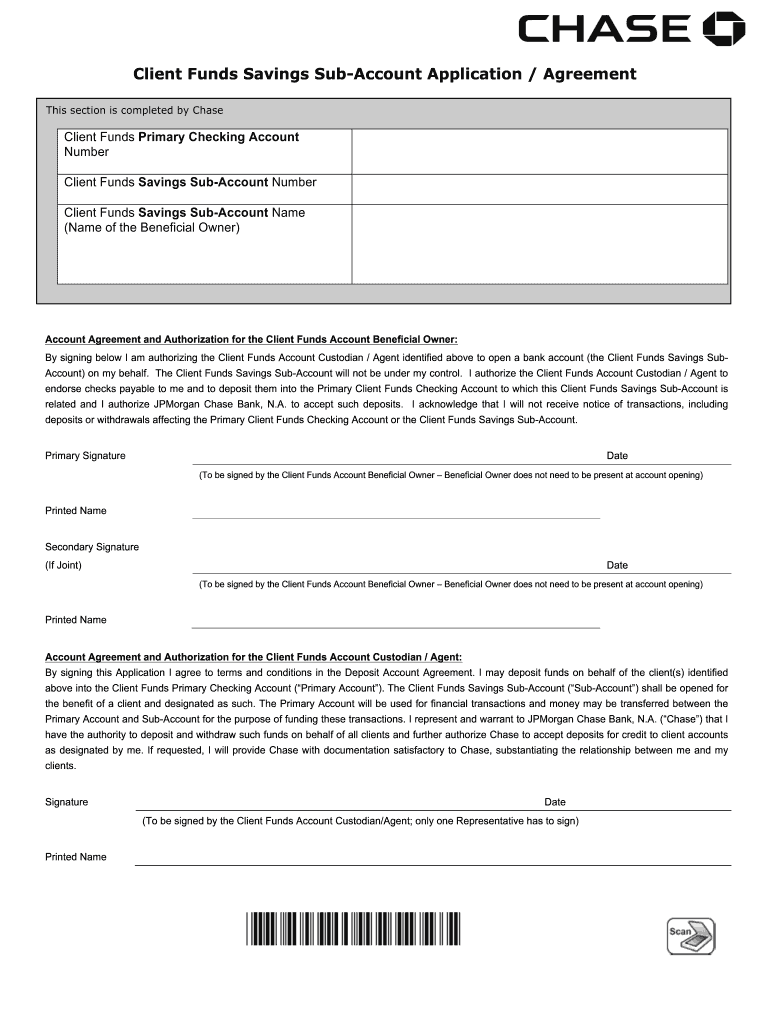

The Client Funds Savings Sub Account Application Agreement is a crucial document for businesses that manage client funds. This agreement outlines the terms under which client funds will be held in a savings sub-account, ensuring compliance with relevant regulations. It serves to protect both the client and the institution by clearly defining the responsibilities and rights of each party involved.

This agreement is particularly important in industries where client funds are common, such as real estate, legal services, and financial advisory. By establishing clear guidelines, this document helps to avoid misunderstandings and potential legal disputes.

Steps to complete the Client Funds Savings Sub Account Application Agreement

Completing the Client Funds Savings Sub Account Application Agreement involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including the business's legal name, address, and tax identification number. Next, provide details about the client funds to be managed, such as the expected amount and purpose of the funds.

Once the information is collected, carefully fill out the application form. Ensure that all sections are completed, as incomplete forms may lead to delays in processing. After filling out the form, review it for accuracy and clarity. Finally, sign the agreement electronically or in person, depending on the requirements of the institution handling the application.

Legal use of the Client Funds Savings Sub Account Application Agreement

The legal use of the Client Funds Savings Sub Account Application Agreement is governed by various regulations, including the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws provide a framework for the validity of electronic signatures and documents, ensuring that agreements executed digitally are legally binding.

It is essential for businesses to adhere to these legal standards when using the agreement. This includes maintaining proper documentation and ensuring that all parties involved understand the terms of the agreement. Compliance with these regulations not only protects the business but also builds trust with clients.

Key elements of the Client Funds Savings Sub Account Application Agreement

The Client Funds Savings Sub Account Application Agreement includes several key elements that are vital for its effectiveness. These elements typically encompass the identification of the parties involved, the purpose of the account, and the terms of fund management. Additionally, the agreement should outline the rights and responsibilities of both the client and the institution, including provisions for withdrawal and access to funds.

Another important aspect is the disclosure of any fees associated with the account, as well as the process for resolving disputes. Clear definitions of terms and conditions help ensure that all parties have a mutual understanding of the agreement, which is crucial for maintaining a positive business relationship.

How to obtain the Client Funds Savings Sub Account Application Agreement

Obtaining the Client Funds Savings Sub Account Application Agreement can be done through various channels. Many financial institutions provide the agreement directly on their websites, allowing businesses to download and print the form. Alternatively, businesses can request a copy from their financial advisor or institution representative.

It is advisable to ensure that the version being used is the most current, as regulations and requirements may change over time. If necessary, consult with legal counsel to confirm that the agreement meets all applicable legal standards before submission.

Quick guide on how to complete client funds savings sub account application agreement

Effortlessly Prepare Client Funds Savings Sub Account Application Agreement on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without any delays. Manage Client Funds Savings Sub Account Application Agreement on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Edit and Electronically Sign Client Funds Savings Sub Account Application Agreement with Ease

- Obtain Client Funds Savings Sub Account Application Agreement and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which only takes a few seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form—via email, SMS, or an invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searches, or errors that necessitate new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Client Funds Savings Sub Account Application Agreement and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the client funds savings sub account application agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the 'sorry bank' process?

airSlate SignNow is an innovative solution that allows businesses to send and eSign documents seamlessly. When dealing with financial transactions or bank-related processes, using airSlate SignNow can streamline the 'sorry bank' process by providing easy access to electronic signatures and document management.

-

What pricing options does airSlate SignNow offer?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs. Our pricing is competitive and ensures that your business can manage the 'sorry bank' paperwork without breaking the bank, making it a cost-effective choice for all users.

-

What key features does airSlate SignNow provide for document management?

airSlate SignNow includes a range of features that enhance document management, such as customizable templates, advanced eSigning capabilities, and collaboration tools. These features help businesses streamline their 'sorry bank' operations and improve efficiency in handling transactions.

-

How can airSlate SignNow benefit my business?

By utilizing airSlate SignNow, your business can enhance productivity, reduce turnaround time for documents, and improve customer satisfaction. These benefits are particularly relevant when navigating the 'sorry bank' procedures, ensuring that all documentation is handled swiftly and accurately.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various software platforms, including CRM and productivity tools. This integration can streamline your 'sorry bank' processes, ensuring that all your documents are easily accessible and managed across different applications.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely. airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry standards. This ensures that sensitive information related to 'sorry bank' matters is protected during transmission and storage.

-

Can I use airSlate SignNow on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile use, allowing users to send and eSign documents on-the-go. This convenience is particularly useful for businesses dealing with 'sorry bank' tasks, as it enables quick and efficient transactions anytime, anywhere.

Get more for Client Funds Savings Sub Account Application Agreement

- 9199 form

- Sample management review form elsmar

- Verizon wireless government phone form

- John amp mary fleming scholarship bperryb public schools perry k12 ok form

- Facial intake form salon 302

- Revolving credit agreement template form

- Revolving credit facility agreement template form

- Direct deposit sign up form turkmenistan

Find out other Client Funds Savings Sub Account Application Agreement

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy