Rfd 09 Word Format

What is the Rfd 09 Word Format

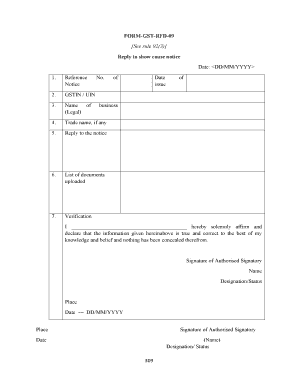

The Rfd 09 Word format is a specific template used for submitting a reply to a show cause notice under the Goods and Services Tax (GST) regime in the United States. This form is essential for individuals or businesses that need to respond to inquiries from tax authorities regarding compliance with GST regulations. The Rfd 09 format ensures that all necessary information is presented clearly and concisely, making it easier for the authorities to process the response.

Steps to Complete the Rfd 09 Word Format

Completing the Rfd 09 form involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant documents that support your case. Next, open the Rfd 09 Word format template and fill in your details, including your name, address, and GST identification number. Clearly state the reasons for your response to the show cause notice, providing any necessary evidence or documentation. Review the completed form for errors and ensure that all required fields are filled out. Finally, save the document in a secure format for submission.

Legal Use of the Rfd 09 Word Format

The Rfd 09 Word format is legally recognized when filled out correctly and submitted in accordance with GST regulations. To ensure its legal validity, it is important to adhere to the specific guidelines outlined by tax authorities. This includes providing accurate information, signing the document where required, and submitting it within the stipulated time frame. Using a reliable eSignature solution can further enhance the legal standing of your submission, as it provides a digital certificate that verifies the authenticity of your signature.

Required Documents for Rfd 09 Submission

When preparing to submit the Rfd 09 form, certain documents are typically required. These may include:

- Copy of the show cause notice received from the tax authorities

- Supporting documents that substantiate your claims or arguments

- Proof of GST registration, such as a GST certificate

- Any previous correspondence related to the matter

Having these documents ready will facilitate a smoother submission process and strengthen your response.

Form Submission Methods for Rfd 09

The Rfd 09 form can be submitted through various methods, depending on the preferences of the individual or business. Common submission methods include:

- Online submission via the official GST portal, which allows for quick processing

- Mailing a physical copy of the completed form to the relevant tax authority

- In-person submission at designated tax offices, which can provide immediate confirmation of receipt

Choosing the appropriate method will depend on factors such as urgency and convenience.

Examples of Using the Rfd 09 Word Format

Utilizing the Rfd 09 Word format can vary based on individual circumstances. For instance, a business may use this form to respond to a notice regarding discrepancies in tax filings. An individual taxpayer might use it to clarify misunderstandings related to their GST obligations. Each example highlights the importance of providing clear, concise information and supporting documentation to address the concerns raised by tax authorities effectively.

Quick guide on how to complete rfd 09 word format

Effortlessly prepare Rfd 09 Word Format on any device

Online document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Rfd 09 Word Format on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Rfd 09 Word Format effortlessly

- Obtain Rfd 09 Word Format and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to finalize your changes.

- Choose how to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you prefer. Edit and eSign Rfd 09 Word Format and guarantee excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rfd 09 word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rfd 09 feature in airSlate SignNow?

The rfd 09 feature in airSlate SignNow allows users to easily create and manage document workflows with electronic signatures. It simplifies the process of sending, signing, and tracking documents, making it ideal for businesses looking to enhance their efficiency.

-

How does pricing work for rfd 09 on airSlate SignNow?

Pricing for the rfd 09 feature on airSlate SignNow is competitive and structured to meet different business needs. Organizations can choose from various plans based on their volume of documents and required features, ensuring a flexible and cost-effective solution.

-

What benefits do I gain from using rfd 09?

By utilizing rfd 09 through airSlate SignNow, you gain several benefits, including faster document turnaround times and improved compliance. The intuitive interface enables even non-technical users to efficiently manage their eSigning needs.

-

Can I integrate rfd 09 with my existing tools?

Yes, airSlate SignNow offers seamless integrations with various third-party applications. This means you can effortlessly incorporate the rfd 09 feature into your current workflow, enhancing productivity and collaboration within your team.

-

Is rfd 09 secure for sensitive documents?

Absolutely, the rfd 09 feature prioritizes security and compliance, ensuring that your sensitive documents are protected. AirSlate SignNow uses advanced encryption and follows industry standards, giving you peace of mind while handling confidential information.

-

How can rfd 09 help streamline my business processes?

Implementing the rfd 09 feature helps streamline your business processes by automating document handling and reducing manual tasks. This leads to signNow time savings and allows you to focus on more strategic initiatives for your organization.

-

What types of documents can I sign using rfd 09?

With the rfd 09 feature in airSlate SignNow, you can sign a wide array of document types, including contracts, agreements, forms, and more. This versatility makes it suitable for various industries and use cases.

Get more for Rfd 09 Word Format

- 1513 0094 1231 for ttb use only department of the treasury alcohol and tobacco tax and trade bureau examined by tax federal form

- Ao 187 form

- Li 226 arizona department of real estate azre form

- Mahoning county prc application form

- Ma form ca 6a

- The new car assessment program suggested approaches for form

- Certificate of residence schenectady county 521146745 form

- M 40 2 requerimento de carto profissional psp form

Find out other Rfd 09 Word Format

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document