Form 1120ME 2023-2026

What is the Form 1120ME

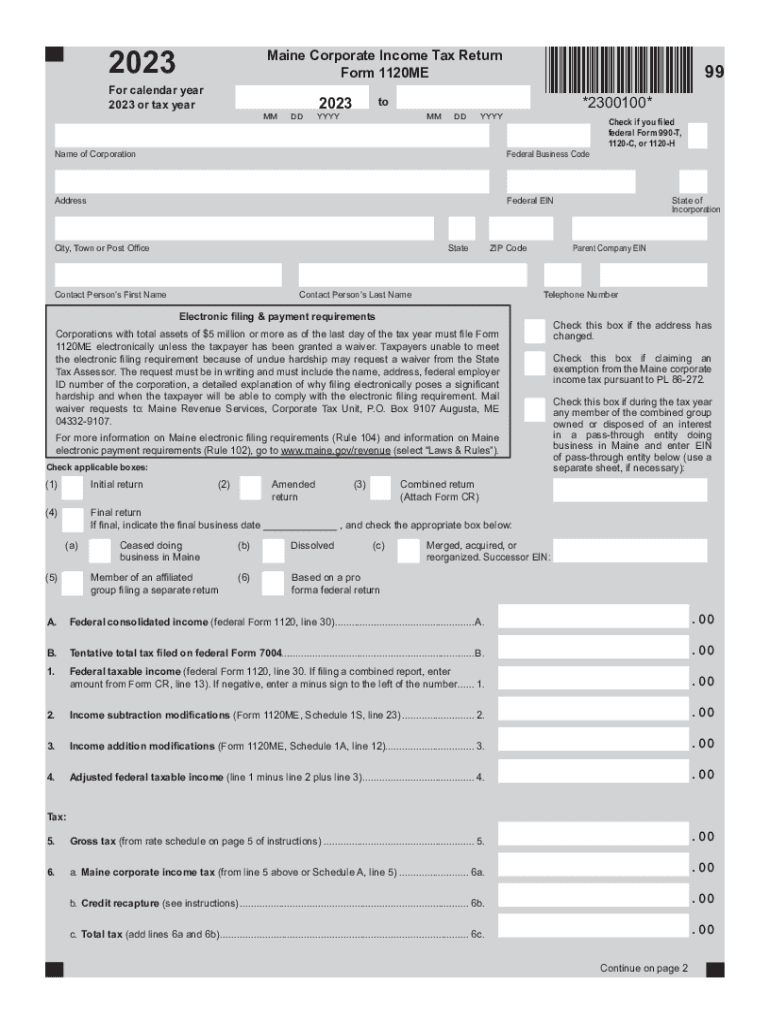

The Form 1120ME is a tax document specifically designed for corporations operating in the state of Maine. It is used to report income, gains, losses, deductions, and credits, and to calculate the corporate income tax owed to the state. This form is essential for businesses to ensure compliance with Maine tax laws and to accurately report their financial activities for the tax year.

How to obtain the Form 1120ME

The Form 1120ME can be obtained directly from the Maine Revenue Services website. It is available for download in PDF format, allowing businesses to access the most current version of the form. Additionally, businesses can request a physical copy by contacting Maine Revenue Services if they prefer to fill out the form by hand.

Steps to complete the Form 1120ME

Completing the Form 1120ME involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the identification section, providing details such as the corporation's name, address, and federal employer identification number (EIN).

- Report total income, including sales revenue and other income sources.

- Detail allowable deductions, such as operating expenses and depreciation.

- Calculate the taxable income and the corresponding tax liability based on Maine's corporate tax rates.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Form 1120ME. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. Extensions may be available, but they must be requested in advance.

Required Documents

To accurately complete the Form 1120ME, certain documents are required. These include:

- Financial statements, including balance sheets and income statements.

- Records of all income received during the tax year.

- Documentation for all deductions claimed, such as receipts and invoices.

- Any prior year tax returns that may be relevant for comparison.

Form Submission Methods

The Form 1120ME can be submitted in several ways. Corporations have the option to file online through Maine Revenue Services' e-filing system, which is a quick and efficient method. Alternatively, businesses can mail the completed form to the appropriate address provided by the state or deliver it in person to a local tax office. It is important to choose a method that ensures timely receipt by the state.

Quick guide on how to complete form 1120me

Effortlessly prepare Form 1120ME on any device

Managing documents online has become increasingly popular among both organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 1120ME on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Form 1120ME with ease

- Find Form 1120ME and click on Get Form to commence.

- Make use of the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using the tools offered by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 1120ME and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120me

Create this form in 5 minutes!

How to create an eSignature for the form 1120me

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Maine Form 1120ME and why do I need it?

Maine Form 1120ME is the tax form that corporations in Maine use to report their income, deductions, and calculate their tax liability. Understanding the Maine Form 1120ME instructions is crucial for ensuring compliance with state tax laws and avoiding penalties. Businesses must accurately complete this form to maintain good standing with state tax authorities.

-

Where can I find detailed Maine Form 1120ME instructions?

Detailed Maine Form 1120ME instructions are available on the Maine Revenue Services website and can often be accessed through tax preparation software. Additionally, reputable financial services platforms like airSlate SignNow can assist in providing guidance on filling out the Maine Form 1120ME, ensuring you're following the latest updates and requirements.

-

Does airSlate SignNow support the filing of Maine Form 1120ME electronically?

Yes, airSlate SignNow empowers businesses to easily eSign and send documents, including Maine Form 1120ME, electronically. This digital solution not only streamlines the filing process but also enhances security and efficiency, making it easier to meet tax deadlines.

-

What features does airSlate SignNow offer for handling tax documents like Maine Form 1120ME?

airSlate SignNow offers features like secure electronic signing, document templates, and seamless integration with various accounting software. These tools help users efficiently manage tax documents, including the Maine Form 1120ME, while ensuring compliance and accuracy in their submissions.

-

Is there a cost associated with using airSlate SignNow for Maine Form 1120ME processing?

Yes, airSlate SignNow operates on a subscription model with various pricing plans. The cost may vary depending on the features you choose, but the value it provides in ease of use and compliance support for Maine Form 1120ME instructions often outweighs the expense.

-

What are the benefits of using airSlate SignNow for submitting Maine Form 1120ME?

Using airSlate SignNow to submit Maine Form 1120ME provides several benefits, such as increased efficiency, reduced paperwork, and improved accuracy. The platform allows for real-time collaboration, making it easier for teams to ensure that all necessary information is correctly entered, reducing the risk of errors.

-

Can I integrate airSlate SignNow with other tools I use for taxes?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax preparation software, allowing you to streamline your workflow. By integrating these tools, you can simplify the process of completing and filing Maine Form 1120ME instructions without having to switch between multiple platforms.

Get more for Form 1120ME

- Master deferred compensation plan doc templatepdffiller form

- Justia determination by court that a person may act as form

- Petition for leave to convey or encumber property form

- Free 20 petition for leave to encroach on corpus georgia form

- Handbook for guardians and conservators of adults in georgia form

- In the probate court of county state of georgia in re estate form

- Justia petition to probate will in solemn form georgia

- Justia default certificate georgia probate court form

Find out other Form 1120ME

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free