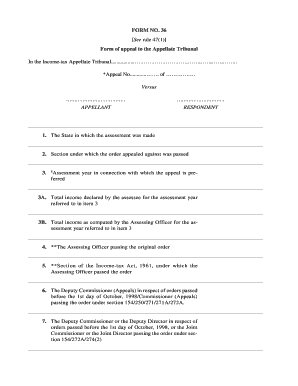

Form 36 Income Tax in Word Format

What is the Form 36 Income Tax In Word Format

The Form 36 Income Tax in Word format is a standardized document used for filing income tax appeals with the Income Tax Appellate Tribunal (ITAT) in the United States. This form allows taxpayers to formally contest decisions made by tax authorities. It is crucial for individuals and businesses seeking to challenge tax assessments or disputes. The Word format provides flexibility for users to fill out the form digitally, ensuring that it can be easily edited and customized according to specific needs.

How to use the Form 36 Income Tax In Word Format

Using the Form 36 in Word format involves several straightforward steps. First, download the form from a reliable source. Open the document in a word processing application, such as Microsoft Word. Fill in the required fields, including personal information, details of the tax assessment being contested, and any supporting documentation. Once completed, save the document to ensure all changes are preserved. It is advisable to review the form for accuracy before submission to avoid delays in processing.

Steps to complete the Form 36 Income Tax In Word Format

Completing the Form 36 in Word format requires attention to detail. Here are the key steps:

- Download the form from a trusted source.

- Open the form in a word processing application.

- Enter your personal details, including your name, address, and taxpayer identification number.

- Provide a clear description of the issue being appealed, including relevant dates and amounts.

- Attach any necessary supporting documents, such as previous correspondence or evidence.

- Review the completed form for errors and ensure all fields are filled out correctly.

- Save the document and prepare it for submission.

Legal use of the Form 36 Income Tax In Word Format

The Form 36 is legally recognized as a valid means of appealing tax decisions. To ensure its legality, it must be filled out accurately and submitted within the designated time frames set by the ITAT. The electronic submission of this form is permissible under eSignature laws, provided that all required signatures and certifications are included. Utilizing a reliable eSigning solution can enhance the legal standing of the submitted document.

Required Documents

When submitting the Form 36, certain documents are typically required to support your appeal. These may include:

- Previous tax returns related to the assessment.

- Correspondence with tax authorities.

- Evidence supporting your claims, such as receipts or financial statements.

- Any other documentation that substantiates your appeal.

Gathering these documents beforehand can streamline the process and improve the chances of a favorable outcome.

Form Submission Methods (Online / Mail / In-Person)

The Form 36 can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the ITAT. Common submission methods include:

- Online submission through the ITAT's official portal, which may require an account.

- Mailing a printed copy of the completed form to the appropriate ITAT office.

- In-person submission at designated ITAT offices, allowing for immediate confirmation of receipt.

Choosing the right submission method can help ensure that your appeal is processed in a timely manner.

Quick guide on how to complete form 36 income tax in word format

Complete Form 36 Income Tax In Word Format effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Form 36 Income Tax In Word Format on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form 36 Income Tax In Word Format with ease

- Find Form 36 Income Tax In Word Format and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your updates.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Form 36 Income Tax In Word Format and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 36 income tax in word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 36 word format?

The form 36 word format is a document template commonly used in legal proceedings. It allows users to present certain types of information in a standardized format, ensuring consistency and clarity. With airSlate SignNow, you can easily create, edit, and eSign documents in the form 36 word format.

-

How can I create a document in form 36 word format using airSlate SignNow?

Creating a document in the form 36 word format with airSlate SignNow is straightforward. Simply select the template for form 36, fill in the required information, and save your document. Our user-friendly interface makes it easy to customize your form according to your specific needs.

-

Is airSlate SignNow a cost-effective solution for using the form 36 word format?

Yes, airSlate SignNow offers a cost-effective solution for managing documents in the form 36 word format. We provide competitive pricing plans suitable for businesses of all sizes. This ensures you can efficiently produce and manage your legal documents without breaking the bank.

-

What features does airSlate SignNow offer for the form 36 word format?

AirSlate SignNow includes features such as eSignatures, template creation, and document tracking for the form 36 word format. Users can collaborate in real-time, ensuring that all parties have the most updated documents. These features streamline your workflow, making it easier to handle legal paperwork.

-

Can I integrate airSlate SignNow with other applications for handling form 36 word format?

Absolutely, airSlate SignNow can be integrated with various applications to enhance your document management process for the form 36 word format. This includes popular tools like Google Drive, Dropbox, and CRM systems. These integrations help you centralize your workflow and improve efficiency.

-

What benefits does using the form 36 word format offer in document management?

Using the form 36 word format enhances document consistency and professionalism in legal matters. It simplifies the process of preparing necessary submissions, reducing errors and ensuring compliance. With airSlate SignNow, the advantages of this format can be fully optimized through powerful eSigning capabilities.

-

Is training available for using the form 36 word format with airSlate SignNow?

Yes, airSlate SignNow offers training resources for users to become proficient in managing documents in the form 36 word format. Our support team provides tutorials, webinars, and guides to help you understand all features. You'll be able to utilize the platform effectively to produce and manage your legal documents.

Get more for Form 36 Income Tax In Word Format

- 7 form

- Noaa form 89 881

- Washburn marina boat slip rental agreement form

- Part 818 comprehensive treatment plan ta 7 oasas oasas ny form

- La dept of revenue mailing address for offer in compromise form

- Illinois closing 495571129 form

- Opensky remittance slip form

- Application liability waiver peoria farmers market form

Find out other Form 36 Income Tax In Word Format

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free