Irs Form 4797 Instructions 2015

What is the IRS Form 4797 Instructions

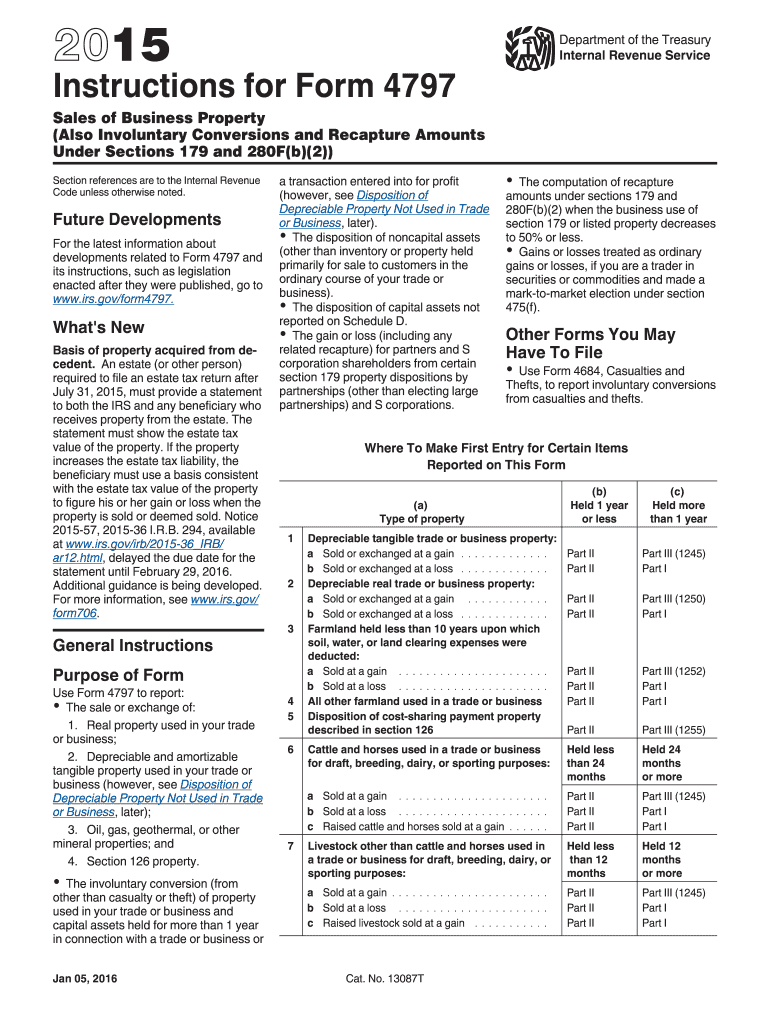

The IRS Form 4797 Instructions provide detailed guidance on how to report the sale of business property. This form is essential for taxpayers who have sold or exchanged property used in a trade or business, as well as for those who have disposed of certain depreciable property. Understanding these instructions is crucial for accurate reporting and compliance with IRS regulations.

Steps to Complete the IRS Form 4797 Instructions

Completing the IRS Form 4797 requires several key steps:

- Gather necessary information: Collect details about the property sold, including purchase price, selling price, and any depreciation taken.

- Determine the type of transaction: Identify whether the transaction involves a sale, exchange, or involuntary conversion.

- Fill out the form: Enter the required information in the appropriate sections of the form, ensuring accuracy.

- Review the form: Check for any errors or omissions before submission to avoid potential penalties.

- Submit the form: File the completed form with your tax return by the designated deadline.

Legal Use of the IRS Form 4797 Instructions

The IRS Form 4797 Instructions are legally binding and must be followed to ensure compliance with tax laws. Proper use of these instructions helps taxpayers accurately report their transactions and avoid issues with the IRS. Failure to comply with the guidelines may result in penalties or audits, making it essential to understand and apply the instructions correctly.

How to Obtain the IRS Form 4797 Instructions

The IRS Form 4797 Instructions can be obtained directly from the IRS website or through tax preparation software. Additionally, physical copies may be available at local IRS offices or through tax professionals. It is important to ensure that you are using the most current version of the instructions to comply with any recent changes in tax law.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 4797 are typically aligned with the annual tax return deadlines. Generally, taxpayers must file their forms by April 15 of the following year. However, if you are granted an extension for your tax return, the deadline for submitting Form 4797 may also be extended. It is vital to stay informed about any changes to these dates to avoid late filing penalties.

Examples of Using the IRS Form 4797 Instructions

Examples of scenarios where the IRS Form 4797 Instructions apply include:

- Sale of a commercial property, such as an office building or retail space.

- Exchange of business equipment, like machinery or vehicles.

- Involuntary conversions, such as property loss due to theft or natural disaster.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 4797 can be submitted through various methods:

- Online: Many taxpayers choose to file electronically using tax preparation software, which simplifies the process.

- Mail: Completed forms can be printed and mailed to the appropriate IRS address based on the taxpayer's location.

- In-Person: Taxpayers may also visit local IRS offices to submit their forms directly, though this option may require an appointment.

Quick guide on how to complete irs form 4797 instructions 2015

Complete Irs Form 4797 Instructions effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Irs Form 4797 Instructions on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to update and eSign Irs Form 4797 Instructions with ease

- Locate Irs Form 4797 Instructions and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Form 4797 Instructions and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 4797 instructions 2015

Create this form in 5 minutes!

How to create an eSignature for the irs form 4797 instructions 2015

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What are the Irs Form 4797 Instructions?

The Irs Form 4797 Instructions provide guidance on how to report sales of business property. Understanding these instructions is crucial for taxpayers to ensure accurate reporting and compliance with IRS regulations. For a complete overview, you can review the official instructions directly from the IRS.

-

How can airSlate SignNow assist with completing the Irs Form 4797?

AirSlate SignNow offers a streamlined platform to create, send, and eSign documents, including tax forms like the Irs Form 4797. This solution simplifies the process by providing easy access to templates and ensuring all necessary signatures are collected securely and efficiently.

-

Is there a cost to use airSlate SignNow for filing Irs Form 4797?

AirSlate SignNow offers various pricing plans to cater to different business needs. While there are subscription fees, using SignNow can ultimately save you money by simplifying the filing process for forms such as the Irs Form 4797 and reducing the likelihood of errors that could lead to penalties.

-

What features does airSlate SignNow provide for managing Irs Form 4797?

AirSlate SignNow includes features like customizable templates, eSignature capabilities, and document tracking, all of which are beneficial for handling Irs Form 4797. These tools ensure that users can manage their documents efficiently and meet submission deadlines effectively.

-

Does airSlate SignNow support integration with accounting software for filing Irs Form 4797?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, streamlining the process of filing forms like the Irs Form 4797. This integration allows users to import data directly, reducing manual entry and enhancing overall accuracy.

-

Can I access Irs Form 4797 Instructions through airSlate SignNow?

While airSlate SignNow primarily focuses on document management and eSigning, you can upload and manage your Irs Form 4797 Instructions within the platform. This keeps all pertinent information at your fingertips for easy reference while completing your tax forms.

-

What are the benefits of using airSlate SignNow for Irs Form 4797?

Using airSlate SignNow for your Irs Form 4797 submissions provides numerous benefits, including time savings, secure storage, and quick access to documents. The platform ensures compliance by allowing users to manage their tax forms with the necessary signatures efficiently.

Get more for Irs Form 4797 Instructions

- Employment or job termination package hawaii form

- Newly widowed individuals package hawaii form

- Employment interview package hawaii form

- Employment employee personnel file package hawaii form

- Hawaii assignment form

- Assignment of lease package hawaii form

- Lease purchase agreements package hawaii form

- Satisfaction cancellation or release of mortgage package hawaii form

Find out other Irs Form 4797 Instructions

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast