Notice 1036 Rev December Early Release Copies of the Percentage Method Tables for Income Tax Withholding Irs 2015

What is the Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs

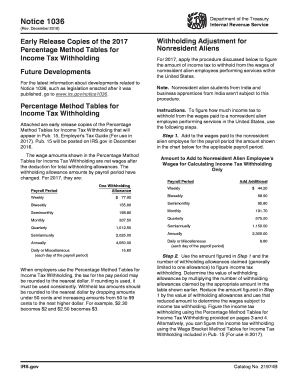

The Notice 1036 Rev December provides early release copies of the percentage method tables for income tax withholding as issued by the IRS. These tables are essential for employers to accurately calculate the amount of federal income tax to withhold from employees' wages. The notice outlines the specific percentages and income brackets that apply to various filing statuses, ensuring compliance with federal tax regulations. Understanding this notice is crucial for businesses to maintain proper payroll practices and avoid penalties associated with incorrect withholding.

How to use the Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs

To effectively use the Notice 1036 Rev December, employers should first identify the filing status of their employees. The percentage method tables provided in the notice will guide employers in determining the correct withholding amount based on the employee's income level. Employers must refer to the appropriate table corresponding to the employee's filing status—single, married, or head of household—before calculating the withholding amount. This ensures that the correct federal income tax is withheld from each paycheck, aligning with IRS guidelines.

Steps to complete the Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs

Completing the calculations based on the Notice 1036 Rev December involves several steps:

- Identify the employee's filing status.

- Refer to the appropriate percentage method table for that status.

- Determine the employee's gross pay for the pay period.

- Locate the corresponding withholding amount in the table based on the employee's income.

- Subtract the withholding amount from the gross pay to determine the net pay.

Following these steps ensures accurate tax withholding and compliance with IRS regulations.

Legal use of the Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs

The legal use of the Notice 1036 Rev December is grounded in its compliance with IRS regulations. Employers are required to utilize the tables to ensure accurate withholding amounts are calculated for federal income tax. Failure to adhere to these guidelines can result in penalties for both the employer and the employee. Additionally, using the notice in conjunction with electronic payroll systems can enhance accuracy and efficiency in tax withholding practices.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Notice 1036 Rev December. Employers must ensure they are using the most current version of the percentage method tables to avoid discrepancies in tax withholding. The IRS also emphasizes the importance of correctly categorizing employees based on their filing status and income level. Regular updates from the IRS may affect the tables, so staying informed about any changes is crucial for compliance.

Filing Deadlines / Important Dates

Employers should be aware of key filing deadlines related to the use of the Notice 1036 Rev December. Typically, employers must submit their payroll tax filings quarterly, with specific due dates for each quarter. Additionally, annual filings, such as Form 941, require accurate withholding calculations based on the tables provided in the notice. Staying on top of these deadlines helps prevent late fees and penalties.

Quick guide on how to complete notice 1036 rev december 2016 early release copies of the 2017 percentage method tables for income tax withholding irs

Complete Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your files quickly and without delays. Handle Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to alter and eSign Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs effortlessly

- Find Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Craft your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs while ensuring superior communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct notice 1036 rev december 2016 early release copies of the 2017 percentage method tables for income tax withholding irs

Create this form in 5 minutes!

How to create an eSignature for the notice 1036 rev december 2016 early release copies of the 2017 percentage method tables for income tax withholding irs

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the main purpose of Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs?

The Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs provides essential guidelines for calculating federal income tax withholding. It helps employers accurately determine the amount that should be withheld from employee wages, ensuring compliance with IRS regulations.

-

How can airSlate SignNow assist with the distribution of Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs?

airSlate SignNow allows businesses to efficiently send and eSign important documents like the Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs. Our platform simplifies the process of distributing these critical tables to your clients or employees, ensuring timely access and compliance.

-

Are there any costs associated with accessing the Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs through airSlate SignNow?

While accessing the Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs is free from the IRS, using airSlate SignNow for document management has associated pricing plans. Our services come at a competitive price that offers great value relative to the ease and efficiency we provide in managing such IRS documents.

-

What features of airSlate SignNow are beneficial for handling IRS documents like Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs?

airSlate SignNow offers robust features such as eSignature capabilities, document templates, and cloud storage that simplify how you manage IRS documents like the Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs. These features enhance collaboration and ensure that your documents are signed and stored securely.

-

How does airSlate SignNow ensure compliance when using Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs?

Our platform is designed with compliance in mind, featuring secure storage and legally binding eSignatures that comply with IRS standards. By using airSlate SignNow to manage your Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs, you can ensure that your document handling meets all regulatory requirements.

-

Can airSlate SignNow integrate with other software systems when handling IRS documents like Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs?

Yes, airSlate SignNow seamlessly integrates with numerous software systems, allowing you to streamline the workflow for documents like Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs. This integration capability enhances productivity and ensures a smooth data flow across your business operations.

-

What benefits does using airSlate SignNow provide for managing Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs?

Using airSlate SignNow for managing Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs greatly enhances efficiency and accuracy. Our platform allows for quick eSigning, easy tracking of document progress, and ensures that these critical IRS documents are handled without delays.

Get more for Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs

- Legal last will and testament form for domestic partner with adult children from prior marriage hawaii

- Legal last will and testament form for civil union partner with adult children from prior marriage hawaii

- Legal last will and testament form for divorced person not remarried with no children hawaii

- Legal last will and testament form for divorced person not remarried with minor children hawaii

- Legal last will and testament form for married person with adult children hawaii

- Legal last will and testament form for domestic partner with adult children hawaii

- Legal last will and testament form for a married person with no children hawaii

- Legal last will and testament form for a domestic partner with no children hawaii

Find out other Notice 1036 Rev December Early Release Copies Of The Percentage Method Tables For Income Tax Withholding Irs

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy