Motor Finance Proposal Form

What is the Motor Finance Proposal Form

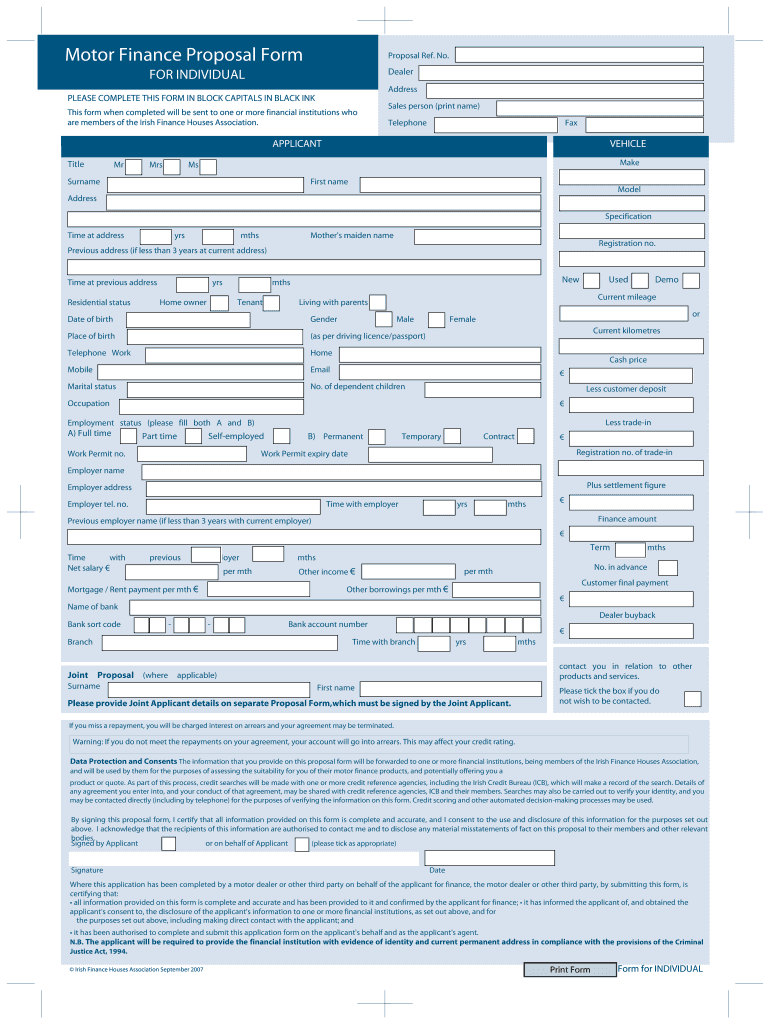

The motor finance proposal form is a vital document used in the automotive finance industry. It serves as a formal request for financing to purchase a vehicle. This form collects essential information about the applicant, including personal details, financial status, and the specifics of the vehicle being financed. By filling out this form, potential buyers can initiate the financing process with lenders or dealerships, allowing them to explore available options for purchasing a car.

How to use the Motor Finance Proposal Form

Using the motor finance proposal form involves several straightforward steps. First, gather all necessary personal and financial information, such as your income, employment details, and credit history. Next, accurately complete the form, ensuring all sections are filled out to avoid delays. After filling out the form, review it for accuracy and completeness. Once confirmed, submit the form to the relevant financial institution or dealership for processing. This initiation allows lenders to evaluate your application and determine financing options.

Steps to complete the Motor Finance Proposal Form

Completing the motor finance proposal form requires careful attention to detail. Follow these steps for a successful submission:

- Collect necessary documentation, including proof of income and identification.

- Fill in personal information, such as name, address, and contact details.

- Provide financial information, including monthly expenses and debts.

- Specify the vehicle details, including make, model, and purchase price.

- Review the form for any errors or missing information.

- Submit the completed form to the lender or dealership.

Key elements of the Motor Finance Proposal Form

The motor finance proposal form consists of several key elements that are crucial for processing a financing request. These include:

- Personal Information: Name, address, and contact details of the applicant.

- Financial Information: Income, employment status, and monthly expenses.

- Vehicle Information: Details about the vehicle, including make, model, and price.

- Loan Terms: Desired loan amount, term length, and payment preferences.

Legal use of the Motor Finance Proposal Form

The motor finance proposal form is legally binding when completed and signed correctly. It is essential to ensure that all information provided is accurate and truthful, as discrepancies can lead to legal issues or denial of financing. The form must comply with applicable laws and regulations, including those related to consumer protection and financing disclosures. By using a reliable electronic signature solution, applicants can ensure that their submissions are secure and legally recognized.

Form Submission Methods

The motor finance proposal form can be submitted through various methods, depending on the lender or dealership's preferences. Common submission methods include:

- Online Submission: Many lenders offer online portals for submitting forms electronically.

- Mail: Applicants can print the completed form and send it via postal service.

- In-Person: Submitting the form directly at a dealership or lender's office is also an option.

Quick guide on how to complete motor finance proposal form

Complete Motor Finance Proposal Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly and without delays. Manage Motor Finance Proposal Form on any device using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to modify and eSign Motor Finance Proposal Form seamlessly

- Obtain Motor Finance Proposal Form and click Get Form to begin.

- Utilize the provided tools to complete your form.

- Select relevant portions of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Motor Finance Proposal Form while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the motor finance proposal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a motor finance proposal form?

A motor finance proposal form is a document used by businesses to outline finance options for a vehicle purchase. This form details essential information such as customer data, vehicle costs, and payment plans. Utilizing airSlate SignNow to manage this form makes the process faster and more efficient.

-

How can airSlate SignNow enhance the motor finance proposal form process?

airSlate SignNow streamlines the motor finance proposal form process by allowing users to create, send, and eSign documents easily. Our platform provides templates specifically for finance documents, which helps reduce errors and accelerates approvals. You can manage all your proposal forms in one secure digital space.

-

What features does airSlate SignNow offer for motor finance proposal forms?

AirSlate SignNow offers a variety of features to enhance motor finance proposal forms, including customizable templates, real-time tracking, and integration with popular business tools. Our electronic signature feature ensures documents are signed quickly and legally. These features collectively improve workflow efficiency.

-

Is there a cost associated with using airSlate SignNow for motor finance proposal forms?

Yes, airSlate SignNow operates under a subscription model that provides different pricing tiers to suit various business needs. Each plan includes access to features for managing motor finance proposal forms, ensuring that you have the tools required at an affordable price. The cost remains competitive relative to the functionality offered.

-

Can I integrate airSlate SignNow with other software for managing motor finance proposal forms?

Absolutely! airSlate SignNow integrates seamlessly with numerous third-party applications, allowing you to manage motor finance proposal forms alongside your existing systems. Popular integrations include CRM tools, accounting software, and payment processors. These integrations enhance your business workflows by keeping everything centralized.

-

What are the benefits of using airSlate SignNow for motor finance proposal forms?

Using airSlate SignNow for motor finance proposal forms offers numerous benefits, such as reduced processing time and enhanced accuracy. The ability to eSign documents securely speeds up transactions, improving customer satisfaction. Additionally, our platform's user-friendly interface ensures that both staff and customers find it easy to navigate.

-

Is airSlate SignNow secure for handling motor finance proposal forms?

Yes, airSlate SignNow prioritizes security for documents, including motor finance proposal forms. We utilize encryption, secure data storage, and compliance with industry standards to protect sensitive information. This ensures that your data remains confidential and safe throughout the signing process.

Get more for Motor Finance Proposal Form

Find out other Motor Finance Proposal Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors