Delaware Claim for Revision Form

What is the Delaware Claim For Revision Form

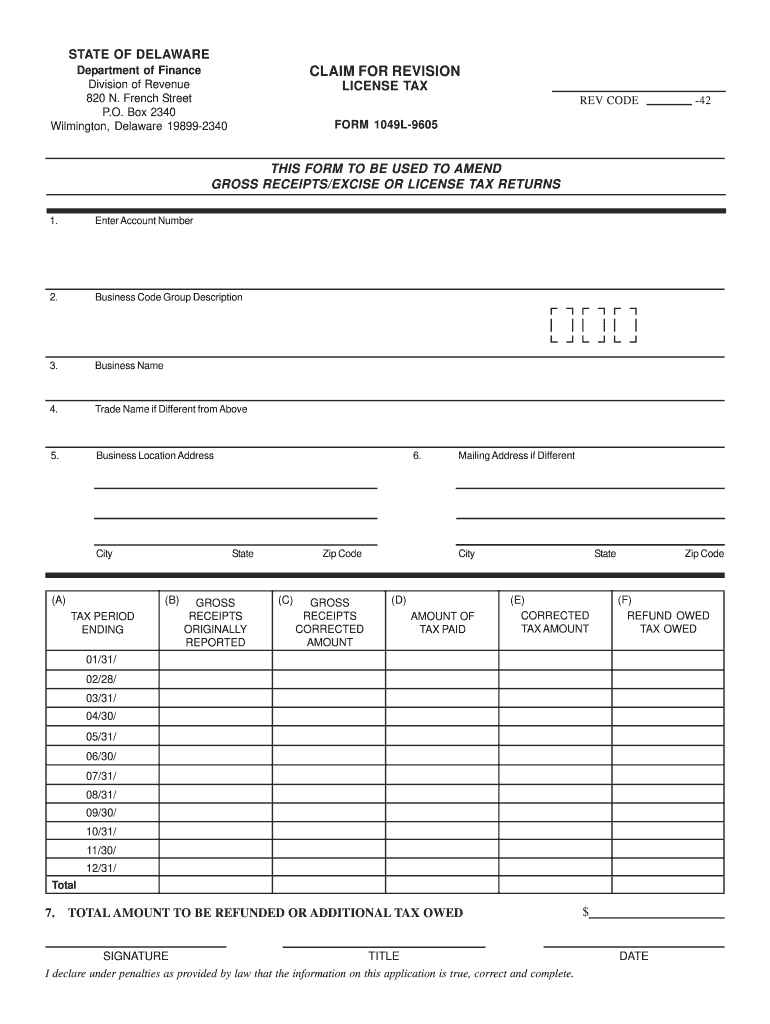

The Delaware Claim For Revision Form is a crucial document used by taxpayers in Delaware to request a revision of their tax assessments. This form is particularly relevant for individuals or businesses who believe that their gross receipts tax assessments are incorrect. By submitting this form, taxpayers can formally challenge the assessment and seek a fair evaluation of their tax obligations. Understanding the purpose and function of this form is essential for ensuring compliance with Delaware tax regulations.

How to use the Delaware Claim For Revision Form

To effectively use the Delaware Claim For Revision Form, taxpayers should first gather all relevant documentation that supports their claim for revision. This may include financial records, previous tax returns, and any correspondence with the Delaware Division of Revenue. Once the necessary information is compiled, the taxpayer should accurately fill out the form, ensuring that all sections are completed thoroughly. After completing the form, it should be submitted to the appropriate department within the Delaware Division of Revenue, either online or via mail, depending on the submission guidelines provided.

Steps to complete the Delaware Claim For Revision Form

Completing the Delaware Claim For Revision Form involves several key steps:

- Gather documentation: Collect all relevant financial records and previous tax assessments.

- Fill out the form: Provide accurate information in all required fields, ensuring clarity and completeness.

- Review the form: Double-check for any errors or omissions before submission.

- Submit the form: Send the completed form to the Delaware Division of Revenue through the designated method, either online or by mail.

Legal use of the Delaware Claim For Revision Form

The legal use of the Delaware Claim For Revision Form is governed by state tax laws. This form must be used in accordance with the regulations set forth by the Delaware Division of Revenue. Submitting the form correctly and within the specified deadlines ensures that taxpayers maintain their rights to contest tax assessments. Failure to adhere to these legal guidelines may result in the rejection of the claim or potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Delaware Claim For Revision Form are critical to ensure timely processing. Taxpayers must submit the form within a specific timeframe following the issuance of their tax assessment. Typically, this deadline is set forth by the Delaware Division of Revenue and can vary based on the type of tax being contested. It is advisable for taxpayers to check for any updates or changes to these deadlines to avoid missing the opportunity to file their claim.

Required Documents

When submitting the Delaware Claim For Revision Form, taxpayers are often required to include supporting documents. These may include:

- Previous tax returns

- Financial statements

- Correspondence with the Delaware Division of Revenue

- Any other documentation that substantiates the claim for revision

Providing comprehensive documentation can strengthen the claim and facilitate a smoother review process.

Quick guide on how to complete delaware claim for revision 1049l 9605 form

Effortlessly Prepare Delaware Claim For Revision Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the correct form and securely keep it online. airSlate SignNow provides you with all the necessary tools to quickly create, modify, and eSign your documents without any delays. Handle Delaware Claim For Revision Form on any platform using airSlate SignNow's Android or iOS applications, and streamline your document-related processes today.

The Easiest Way to Modify and eSign Delaware Claim For Revision Form Effortlessly

- Locate Delaware Claim For Revision Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of your documents or redact sensitive information with the specialized tools provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to apply your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mishandled documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your desired device. Edit and eSign Delaware Claim For Revision Form to ensure outstanding communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

What tax forms would I have to fill out for a single-owner LLC registered in Delaware (generating income in California)?

A2A - LLC are a tax fiction - they do not exist for tax purposes. There are default provisions thus assuming you've done nothing you are a sole proprietor.Sounds to me link you have a Delaware, California, and whatever your state of residence is in addition to federal.You've not provided enough information to answer it properly however.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

I’ve been staying out of India for 2 years. I have an NRI/NRO account in India and my form showed TDS deduction of Rs. 1 lakh. Which form should I fill out to claim that?

The nature of your income on which TDS has been deducted will decide the type of ITR to be furnished by you for claiming refund of excess TDS. ITR for FY 2017–18 only can be filed now with a penalty of Rs. 5000/- till 31.12.2018 and Rs. 10,000/- from 01.01.2019 to 31.03.2019. So if your TDS relates to any previous year, then just forget the refund.

-

Will the NEET 2018 give admission in paramedical courses and Ayush courses too? If yes, how do you fill out the form to claim a seat if scored well?

wait for notifications.

Create this form in 5 minutes!

How to create an eSignature for the delaware claim for revision 1049l 9605 form

How to make an electronic signature for the Delaware Claim For Revision 1049l 9605 Form in the online mode

How to create an electronic signature for the Delaware Claim For Revision 1049l 9605 Form in Chrome

How to make an eSignature for signing the Delaware Claim For Revision 1049l 9605 Form in Gmail

How to generate an electronic signature for the Delaware Claim For Revision 1049l 9605 Form from your smart phone

How to generate an eSignature for the Delaware Claim For Revision 1049l 9605 Form on iOS

How to make an eSignature for the Delaware Claim For Revision 1049l 9605 Form on Android

People also ask

-

What is the Delaware Claim For Revision Form and how do I use it?

The Delaware Claim For Revision Form is a document used to request a revision of a claim within the Delaware jurisdiction. To use it, simply download the form, fill in the required information regarding your claim, and submit it as per the provided instructions. Utilizing airSlate SignNow makes this process even easier, allowing you to eSign and send documents securely.

-

How much does it cost to use the Delaware Claim For Revision Form with airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to meet different business needs. You can access the Delaware Claim For Revision Form without incurring hefty costs, as our plans are designed to be cost-effective while providing essential features for document management and eSigning.

-

What features does airSlate SignNow offer for the Delaware Claim For Revision Form?

With airSlate SignNow, you can easily fill out and eSign the Delaware Claim For Revision Form online. Key features include customizable templates, real-time tracking of document status, and secure cloud storage, ensuring that your revisions are handled efficiently and securely.

-

Can I integrate the Delaware Claim For Revision Form with other applications?

Yes, airSlate SignNow allows seamless integration with various applications, enhancing the functionality of the Delaware Claim For Revision Form. You can integrate with CRM systems, cloud storage services, and other business tools, streamlining your document workflow and improving overall efficiency.

-

Is the Delaware Claim For Revision Form compliant with legal standards?

Absolutely! The Delaware Claim For Revision Form prepared through airSlate SignNow adheres to all necessary legal standards for electronic signatures and document submissions. This ensures that your claims are processed efficiently and meet all regulatory requirements.

-

How can airSlate SignNow help me track the status of my Delaware Claim For Revision Form?

airSlate SignNow provides real-time tracking for all documents, including the Delaware Claim For Revision Form. You will receive notifications when your document is viewed, signed, or completed, allowing you to stay informed about the progress of your claim.

-

What are the benefits of using airSlate SignNow for the Delaware Claim For Revision Form?

Using airSlate SignNow for the Delaware Claim For Revision Form offers numerous benefits, such as increased efficiency, reduced paper usage, and enhanced security. Additionally, the user-friendly interface ensures that anyone can easily manage their claims without technical expertise.

Get more for Delaware Claim For Revision Form

- Request for traffic school after bail forfeiture or trial form

- Education financial statement form

- Notifiable condition report form queensland health health qld gov

- Renew blue badge swindon form

- Art institute transcript request form 29457196

- Income confirmation form icf government of newfoundland and

- Ptec program information packet mybrcc

- Referral contract form national association of realtors realtor

Find out other Delaware Claim For Revision Form

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure