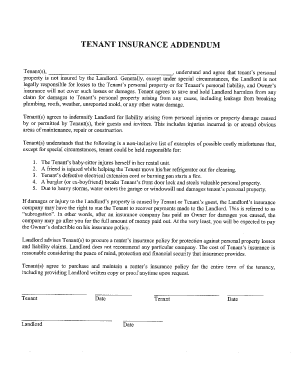

Tenant Insurance Addendum Form

What is the Tenant Insurance Addendum

The tenant insurance addendum is a legal document that supplements a rental agreement, specifying the requirement for renters to maintain insurance coverage. This addendum outlines the responsibilities of the tenant regarding their renters insurance policy, ensuring that both the landlord and tenant understand the necessary coverage. It typically includes details such as the minimum amount of coverage required, the types of incidents covered, and the obligations of the tenant to provide proof of insurance to the landlord.

How to use the Tenant Insurance Addendum

Using the tenant insurance addendum involves several steps to ensure compliance with the rental agreement. First, both the landlord and tenant should review the addendum carefully to understand the insurance requirements. The tenant must then acquire a renters insurance policy that meets the specified criteria. After obtaining the policy, the tenant should provide proof of insurance to the landlord, often in the form of a certificate of insurance. This documentation confirms that the tenant has the required coverage in place.

Key elements of the Tenant Insurance Addendum

The tenant insurance addendum includes several key elements that clarify the expectations for both parties. These elements typically encompass:

- Coverage Requirements: Specifies the minimum coverage limits for personal property and liability.

- Proof of Insurance: Outlines the obligation of the tenant to provide documentation of their insurance policy.

- Liability Clauses: Details the responsibilities of the tenant in case of damage or loss.

- Duration of Coverage: Indicates how long the insurance must remain active during the tenancy.

Steps to complete the Tenant Insurance Addendum

Completing the tenant insurance addendum involves a systematic approach to ensure all necessary information is accurately filled out. Here are the steps to follow:

- Review the rental agreement and the addendum to understand the requirements.

- Obtain a renters insurance policy that meets the outlined coverage requirements.

- Fill out the addendum with your personal information and insurance details.

- Sign and date the addendum to confirm your agreement.

- Submit the completed addendum along with proof of insurance to the landlord.

Legal use of the Tenant Insurance Addendum

The legal use of the tenant insurance addendum is crucial for both landlords and tenants. This document serves as a binding agreement that outlines the insurance obligations of the tenant, protecting both parties in the event of a claim. For the addendum to be legally enforceable, it must be signed by both the landlord and tenant, and it should comply with state laws regarding rental agreements and insurance requirements. Ensuring that the addendum is properly executed can help prevent disputes related to insurance coverage during the tenancy.

State-specific rules for the Tenant Insurance Addendum

State-specific rules regarding the tenant insurance addendum can vary significantly. Some states may require landlords to include specific language in the addendum or may have regulations governing the minimum insurance coverage amounts. It is essential for both landlords and tenants to familiarize themselves with their state's laws to ensure compliance. Consulting with a legal professional or a local housing authority can provide clarity on any state-specific requirements related to the tenant insurance addendum.

Quick guide on how to complete tenant insurance addendum

Effortlessly Prepare Tenant Insurance Addendum on Any Device

The digital management of documents has gained traction among businesses and individuals alike. It presents an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Tenant Insurance Addendum seamlessly on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to Edit and Electronically Sign Tenant Insurance Addendum with Ease

- Find Tenant Insurance Addendum and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools specifically available from airSlate SignNow for that purpose.

- Craft your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Tenant Insurance Addendum and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tenant insurance addendum

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tenant insurance addendum?

A tenant insurance addendum is a specific clause added to a lease agreement that requires tenants to maintain a renters insurance policy. This addendum protects both landlords and tenants by ensuring coverage for personal property and liability. Understanding this addendum is crucial for renters looking to comply with lease terms.

-

How does the tenant insurance addendum benefit me as a renter?

By including a tenant insurance addendum in your lease, you safeguard your personal belongings in case of theft, fire, or water damage. It also provides liability coverage, which can protect you against potential claims from accidents that occur in your rented space. This protection not only ensures peace of mind but can also save you money in unforeseen circumstances.

-

Is there a cost associated with implementing a tenant insurance addendum?

The cost for implementing a tenant insurance addendum generally stems from the renters insurance policy you choose, rather than fees for the addendum itself. Typically, renters insurance is affordable, often costing around $15 to $30 per month. It's a small price for signNow protection, making it a worthwhile investment for tenants.

-

Are there specific features I should look for in a renters insurance policy related to the tenant insurance addendum?

When considering a renters insurance policy with a tenant insurance addendum, ensure it covers personal property, liability, and additional living expenses. Some policies also offer coverage for specific valuable items, such as electronics or jewelry. Reviewing these features can help you select a policy that best suits your individual needs.

-

How can I easily manage my tenant insurance addendum paperwork?

Using airSlate SignNow, you can streamline the management of your tenant insurance addendum and associated documents. The platform allows for easy eSigning and secure storage of all important lease documents. Its user-friendly interface ensures that both landlords and tenants can efficiently handle their agreements.

-

Can I digitally sign my tenant insurance addendum?

Yes, you can digitally sign your tenant insurance addendum through airSlate SignNow. The platform provides a secure and efficient way to eSign documents without the need for printing or scanning. This feature simplifies the process for both renters and landlords, ensuring everyone has quick access to the signed agreement.

-

What happens if I don't agree to the tenant insurance addendum?

If you do not agree to the tenant insurance addendum, the landlord may refuse to rent to you, as many landlords require this policy for liability and property protection. It’s essential to communicate your concerns, as some landlords might negotiate or provide alternatives. Not having this addendum could leave you vulnerable to signNow financial risks.

Get more for Tenant Insurance Addendum

Find out other Tenant Insurance Addendum

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe