Car Loan Application FY06 113006 Form

What is the Car Loan Application FY06 113006

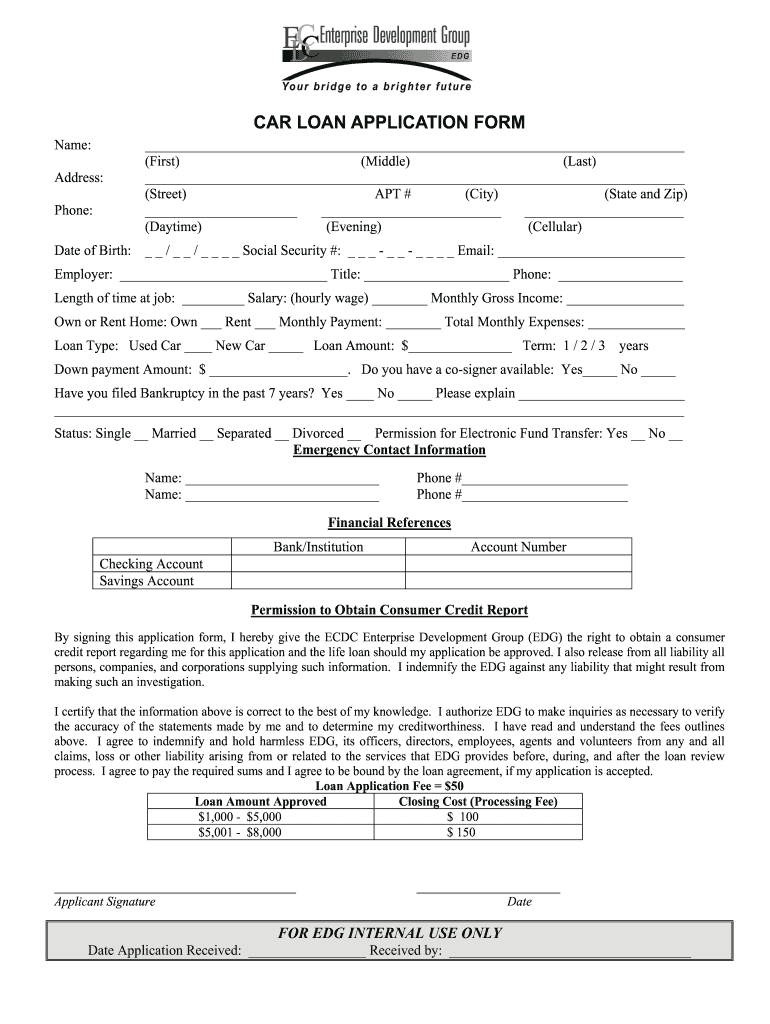

The Car Loan Application FY06 113006 is a standardized form used by financial institutions in the United States to assess an individual's eligibility for a car loan. This form collects essential information about the applicant’s financial status, employment history, and the vehicle being financed. It serves as a formal request for credit, enabling lenders to evaluate the risk associated with granting a loan. Understanding the specifics of this form is crucial for applicants to ensure they provide accurate information that aligns with lending requirements.

Key elements of the Car Loan Application FY06 113006

When filling out the Car Loan Application FY06 113006, several key elements must be addressed to facilitate the approval process. These elements typically include:

- Personal Information: Full name, address, and contact details.

- Employment Details: Current employer, job title, and length of employment.

- Financial Information: Income, monthly expenses, and existing debts.

- Vehicle Information: Make, model, year, and VIN of the car being financed.

- Loan Details: Desired loan amount, term, and purpose of the loan.

Providing complete and accurate information in these sections can significantly impact the loan approval process.

Steps to complete the Car Loan Application FY06 113006

Completing the Car Loan Application FY06 113006 involves several steps to ensure all necessary information is accurately provided. Here’s a straightforward guide to help you through the process:

- Gather Required Documents: Collect your identification, proof of income, and any other financial documents.

- Fill Out Personal Information: Enter your name, address, and contact information accurately.

- Provide Employment and Financial Details: Include your current employment status and financial obligations.

- Input Vehicle Information: Specify the details of the vehicle you wish to purchase.

- Review and Submit: Carefully review all information for accuracy before submitting the application.

Following these steps can help streamline the application process and improve your chances of approval.

Legal use of the Car Loan Application FY06 113006

The Car Loan Application FY06 113006 is legally binding when completed and submitted according to the regulations set forth by lending institutions. To ensure its legal validity, applicants must provide truthful and complete information. Misrepresentation or omission of critical details can lead to legal consequences, including denial of the application or potential fraud charges. Additionally, electronic submissions of this form must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act to be considered legally enforceable.

Form Submission Methods

The Car Loan Application FY06 113006 can typically be submitted through various methods, making it accessible for applicants. Common submission methods include:

- Online Submission: Many lenders offer secure online platforms for applicants to fill out and submit the form electronically.

- Mail Submission: Applicants can print the completed form and send it via postal mail to the lender's address.

- In-Person Submission: Some applicants may prefer to visit a branch office to submit the application directly.

Choosing the right submission method can depend on personal preference and the specific requirements of the lending institution.

Eligibility Criteria

To qualify for a car loan using the Car Loan Application FY06 113006, applicants must meet certain eligibility criteria set by lenders. Common requirements include:

- Age: Applicants must be at least eighteen years old.

- Income: Proof of stable income is necessary to demonstrate the ability to repay the loan.

- Credit History: A satisfactory credit score may be required, reflecting the applicant's creditworthiness.

- Residency: Applicants should be legal residents of the United States.

Meeting these criteria is essential for a successful application and loan approval.

Quick guide on how to complete car loan application fy06 113006

Prepare Car Loan Application FY06 113006 effortlessly on any gadget

Web-based document handling has gained traction among companies and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Car Loan Application FY06 113006 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Car Loan Application FY06 113006 with ease

- Locate Car Loan Application FY06 113006 and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Car Loan Application FY06 113006 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the car loan application fy06 113006

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Car Loan Application FY06 113006?

The Car Loan Application FY06 113006 is a customizable digital document that simplifies the process of applying for car loans. By using this form, applicants can easily provide the necessary information to lenders in a streamlined way, increasing their chances of loan approval.

-

How does airSlate SignNow enhance the Car Loan Application FY06 113006 process?

airSlate SignNow enhances the Car Loan Application FY06 113006 by allowing users to fill out, sign, and send the application electronically. This minimizes paperwork, speeds up the submission process, and provides a secure way to handle sensitive financial information.

-

What are the benefits of using the Car Loan Application FY06 113006?

Using the Car Loan Application FY06 113006 offers several benefits, including reduced processing times and improved accuracy in applications. This digital solution eliminates the need for physical documents, making it environmentally friendly and user-friendly.

-

Is there a cost associated with the Car Loan Application FY06 113006 through airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to the Car Loan Application FY06 113006. These plans are designed to cater to different business needs, ensuring that you get cost-effective solutions for electronic signatures and document management.

-

What features does the Car Loan Application FY06 113006 include?

The Car Loan Application FY06 113006 includes customizable fields for personal and financial information, electronic signature capabilities, and integration with CRM systems. These features streamline the application process and enhance overall user experience.

-

Can I integrate the Car Loan Application FY06 113006 with other software?

Absolutely! The Car Loan Application FY06 113006 can be integrated with various software solutions, such as CRM and LMS platforms, through airSlate SignNow’s API. This allows for seamless data transfer and improves workflow efficiency.

-

How secure is the Car Loan Application FY06 113006?

The Car Loan Application FY06 113006 is secure, featuring encryption and compliance with industry standards to protect user data. AirSlate SignNow is committed to providing a safe platform for handling sensitive financial documents.

Get more for Car Loan Application FY06 113006

- Derivatives and risk management by rajiv srivastava pdf 410181971 form

- Certificate of conformity coc for enabling work

- Bill of sale for boat amp trailer form

- In the event i am seriously ill or disabled or upon my form

- Request for special agreement check sac form

- For ptsd form

- Third party service agreement template form

- Third party vendor agreement template form

Find out other Car Loan Application FY06 113006

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online