Nonresident Decedent Affidavit of Domicile REV 1737 1 FormsPublications 2015

What is the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications

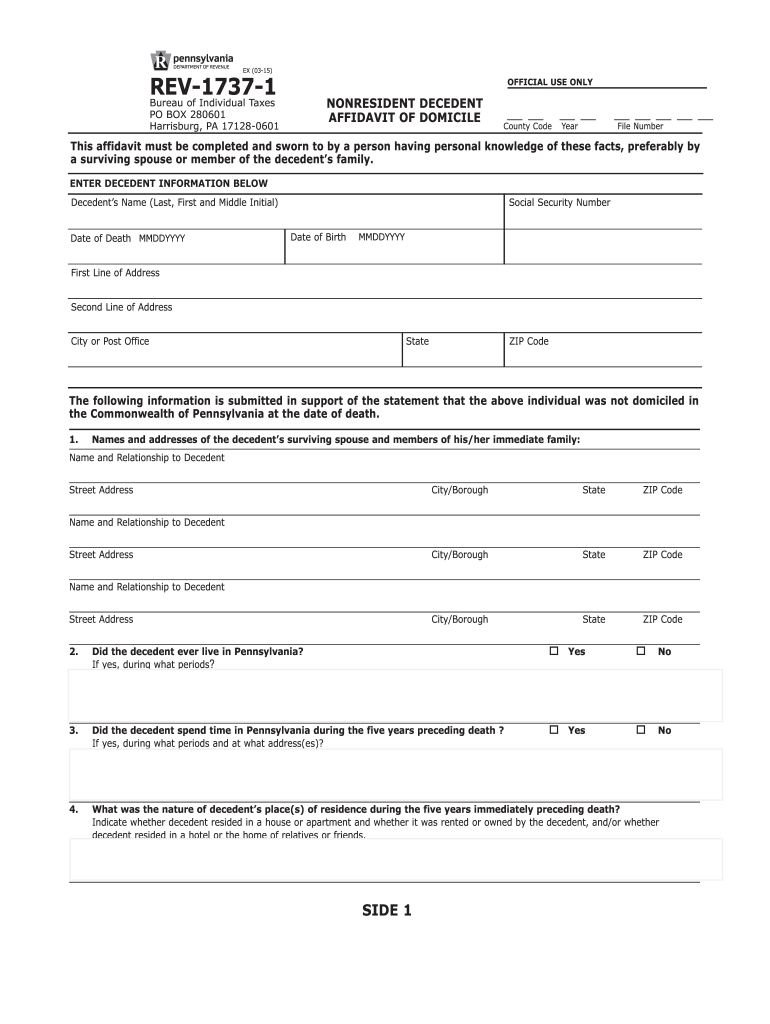

The Nonresident Decedent Affidavit of Domicile REV 1737 1 is a legal document used in the United States to establish the domicile of a deceased individual who was not a resident of the state where the affidavit is filed. This form is crucial for determining tax obligations and the distribution of the decedent's assets. It is typically required by state authorities to clarify the legal residence of the deceased for estate tax purposes and to ensure compliance with local laws. The affidavit serves as a formal declaration, providing necessary information about the decedent's last known address and other relevant details.

How to use the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications

To use the Nonresident Decedent Affidavit of Domicile REV 1737 1, individuals must first obtain the form, which can typically be downloaded from state revenue department websites or obtained in person. After securing the form, the user should carefully fill in the required fields, including the decedent's name, date of death, and last known address. It is essential to provide accurate and complete information to avoid delays or complications. Once completed, the affidavit must be signed by the appropriate parties, often including the executor of the estate or a legal representative. After signing, the form can be submitted to the relevant state authority, either online or via mail, depending on state regulations.

Steps to complete the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications

Completing the Nonresident Decedent Affidavit of Domicile REV 1737 1 involves several key steps:

- Obtain the form from the appropriate state revenue department.

- Read the instructions carefully to understand the requirements.

- Fill in the decedent's personal information, including full name, date of birth, and date of death.

- Provide the last known address of the decedent, ensuring accuracy.

- Include any additional information required by state regulations.

- Sign the affidavit, ensuring that all required signatures are present.

- Submit the completed form to the relevant state authority, following their submission guidelines.

Legal use of the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications

The legal use of the Nonresident Decedent Affidavit of Domicile REV 1737 1 is primarily to establish the domicile of a deceased individual for estate tax purposes. This affidavit is recognized by state authorities as a valid declaration of the decedent's last residence, which is critical in determining tax liabilities and the distribution of assets. It is important to note that the affidavit must be completed accurately and submitted in accordance with state laws to ensure its legal validity. Failure to comply with these requirements may result in penalties or complications in the estate settlement process.

Required Documents

When preparing to file the Nonresident Decedent Affidavit of Domicile REV 1737 1, certain documents are typically required. These may include:

- A copy of the decedent's death certificate.

- Proof of the decedent's last known address, such as utility bills or tax returns.

- Identification of the individual completing the affidavit, such as a driver's license or passport.

- Any additional documentation required by the state, which may vary.

Filing Deadlines / Important Dates

Filing deadlines for the Nonresident Decedent Affidavit of Domicile REV 1737 1 can vary by state. It is crucial to be aware of these deadlines to avoid potential penalties. Generally, the affidavit should be filed within a specific timeframe following the decedent's death, often within six months to one year. Checking with the state revenue department for precise deadlines is essential to ensure compliance and timely processing of the estate.

Quick guide on how to complete nonresident decedent affidavit of domicile rev 1737 1 formspublications

Your assistance manual for preparing your Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications

If you wish to learn how to finalize and submit your Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications, here are some brief instructions on how to streamline tax filing signNowly.

First, you simply need to create your airSlate SignNow account to transform your approach to managing documents online. airSlate SignNow is a highly user-friendly and robust document management solution that enables you to modify, draft, and finalize your tax documents with ease. Utilizing its editor, you can alternate between text, checkboxes, and electronic signatures and revert to adjust responses as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and seamless sharing.

Follow these steps to finalize your Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications in just a few minutes:

- Set up your account and start working on PDFs in no time.

- Browse our catalog to find any IRS tax document; navigate through variations and schedules.

- Click Get document to access your Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your submission and amend any inaccuracies.

- Save adjustments, print your copy, dispatch it to your addressee, and download it to your device.

Refer to this guide to submit your taxes electronically with airSlate SignNow. Be aware that filing on paper can lead to return mistakes and postpone refunds. Furthermore, before electronically filing your taxes, verify the IRS website for submission guidelines applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct nonresident decedent affidavit of domicile rev 1737 1 formspublications

Create this form in 5 minutes!

How to create an eSignature for the nonresident decedent affidavit of domicile rev 1737 1 formspublications

How to make an electronic signature for the Nonresident Decedent Affidavit Of Domicile Rev 1737 1 Formspublications in the online mode

How to create an electronic signature for your Nonresident Decedent Affidavit Of Domicile Rev 1737 1 Formspublications in Chrome

How to create an electronic signature for putting it on the Nonresident Decedent Affidavit Of Domicile Rev 1737 1 Formspublications in Gmail

How to create an electronic signature for the Nonresident Decedent Affidavit Of Domicile Rev 1737 1 Formspublications right from your mobile device

How to generate an electronic signature for the Nonresident Decedent Affidavit Of Domicile Rev 1737 1 Formspublications on iOS devices

How to create an eSignature for the Nonresident Decedent Affidavit Of Domicile Rev 1737 1 Formspublications on Android devices

People also ask

-

What is the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications used for?

The Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications is primarily used to establish the domicile of a deceased nonresident for tax purposes. This form helps clarify the residency status of the decedent and aids in the proper filing of taxes related to their estate.

-

How can I access the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications?

You can easily access the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications through the airSlate SignNow platform. Once you sign up, you'll find a library of forms including this affidavit, allowing for quick downloads and eSigning.

-

Is there a cost associated with using the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications?

While accessing the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications may vary depending on your subscription plan, airSlate SignNow offers competitive pricing for all its services. Many users find that the investment conveniently pays off with the ease of use and efficiency of managing documents.

-

Can I eSign the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications?

Yes, you can eSign the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications using airSlate SignNow. Our platform provides a simple, secure way to sign documents electronically, ensuring that all signatures are valid and legally recognized.

-

What features does airSlate SignNow offer for the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications?

airSlate SignNow offers a variety of features for the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications, including cloud storage, customizable templates, and robust security measures. Additionally, you can track document status and receive notifications for completed actions.

-

Are there integrations available for the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications?

Yes, airSlate SignNow provides integrations with numerous applications that enhance the efficiency of handling the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications. You can integrate with CRM systems, accounting software, and various cloud storage options to streamline your document workflow.

-

How does using the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications benefit my business?

Using the Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications can signNowly streamline your estate management process. By utilizing airSlate SignNow's eSigning solutions, you can expedite document turnaround time and reduce the risk of errors, ultimately enhancing your business efficiency.

Get more for Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications

- Wa judgment form

- Letter tenant notice 497429573 form

- Wa supplemental statement form

- Washington landlord notice form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497429576 form

- Defendant criminal form

- Washington repair form

- Washington interlock form

Find out other Nonresident Decedent Affidavit Of Domicile REV 1737 1 FormsPublications

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online