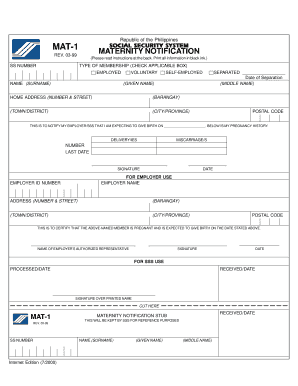

Mat 1 Form

What is the Mat 1 Form

The Mat 1 Form is a specific document used primarily for tax purposes in the United States. It serves as a declaration of certain tax-related information that may be required by state or federal authorities. This form is essential for individuals and businesses to ensure compliance with tax regulations and to accurately report income or deductions. Understanding the purpose and requirements of the Mat 1 Form is crucial for effective tax management.

How to Use the Mat 1 Form

Using the Mat 1 Form involves several key steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and financial records relevant to the reporting period. Next, fill out the form carefully, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submitting it to the appropriate tax authority. Utilizing electronic tools, such as eSignature solutions, can streamline this process and enhance security.

Steps to Complete the Mat 1 Form

Completing the Mat 1 Form requires attention to detail. Follow these steps for effective completion:

- Gather necessary documents, such as W-2s, 1099s, or other income statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all relevant income, deductions, and credits accurately.

- Double-check all entries for accuracy and completeness.

- Sign and date the form, ensuring compliance with eSignature regulations if submitting electronically.

Legal Use of the Mat 1 Form

The Mat 1 Form holds legal significance when completed and submitted correctly. It is recognized by tax authorities as a valid document for reporting income and fulfilling tax obligations. To ensure its legal standing, it is essential to comply with all relevant regulations, including those pertaining to electronic signatures. Utilizing a trusted eSignature platform can enhance the legal validity of your submission by providing an electronic certificate and maintaining compliance with laws such as ESIGN and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the Mat 1 Form can vary based on the specific tax year and the individual's circumstances. Generally, it is advisable to submit the form by the federal tax filing deadline, which typically falls on April fifteenth. However, individuals may also need to be aware of state-specific deadlines that could differ. Keeping track of these dates is crucial to avoid penalties and ensure timely compliance with tax obligations.

Examples of Using the Mat 1 Form

The Mat 1 Form can be utilized in various scenarios, such as:

- Individuals reporting freelance income or side business earnings.

- Small business owners declaring revenue and expenses for tax purposes.

- Taxpayers applying for specific credits or deductions that require detailed income reporting.

Each of these examples highlights the form's importance in maintaining accurate records and fulfilling tax responsibilities.

Quick guide on how to complete mat 1 form

Complete Mat 1 Form effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without unnecessary delays. Handle Mat 1 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign Mat 1 Form with ease

- Obtain Mat 1 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Craft your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Mat 1 Form to maintain excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mat 1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MAT 1 form 2019, and why is it important?

The MAT 1 form 2019 is a crucial document for businesses in the UK, providing details about your tax liabilities. Completing this form helps ensure compliance with tax regulations, avoiding potential fines and penalties. By using airSlate SignNow, you can efficiently eSign and send your MAT 1 form 2019, streamlining your submission process.

-

How can I complete the MAT 1 form 2019 using airSlate SignNow?

Using airSlate SignNow, you can easily complete the MAT 1 form 2019 by uploading the document and filling in the required fields. Our platform offers intuitive editing tools, making it user-friendly for all business types. Additionally, you can securely eSign the document directly within the platform, speeding up the submission.

-

Is there a cost associated with using airSlate SignNow for the MAT 1 form 2019?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs when utilizing the service for the MAT 1 form 2019. Our pricing is competitive and designed to be cost-effective for businesses of all sizes. You can choose a plan that fits your volume of document signing and management needs.

-

What features does airSlate SignNow offer for the MAT 1 form 2019?

AirSlate SignNow provides multiple features to assist with the MAT 1 form 2019, including customizable templates, secure eSigning, and real-time tracking of document status. Our platform also supports cloud storage, making it easy to access your completed forms whenever you need them. These features enhance efficiency and compliance in document management.

-

How does airSlate SignNow ensure the security of my MAT 1 form 2019?

airSlate SignNow employs advanced security measures to protect your MAT 1 form 2019 and other sensitive documents. These measures include encryption, secure access controls, and compliance with industry regulations. You can trust that your data is safe while using our platform to eSign and send important documents.

-

Can I integrate airSlate SignNow with other software for managing the MAT 1 form 2019?

Absolutely! airSlate SignNow offers integration capabilities with various business applications that can help streamline the management of your MAT 1 form 2019. Integrating with platforms like CRM tools or accounting software can help centralize your document workflows and enhance overall productivity.

-

What benefits can I expect from using airSlate SignNow for the MAT 1 form 2019?

Utilizing airSlate SignNow for your MAT 1 form 2019 allows for quicker processing times and improved compliance with tax regulations. The ability to eSign documents electronically reduces paper usage and enhances efficiency. Additionally, the platform simplifies collaboration with team members and clients during the document review process.

Get more for Mat 1 Form

- Dyno liability release form

- Student non vocational enrolment contract liaison college form

- Patients pathsinc org form

- Supplier diversity application alaska airlines form

- Key findings from maryland pro bono reporting courts state md form

- Vafax form

- Wholesale agreement template form

- Wholesale pricing agreement template form

Find out other Mat 1 Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document