Liberia Revenue Authority Forms

What is the Liberia Revenue Authority Forms

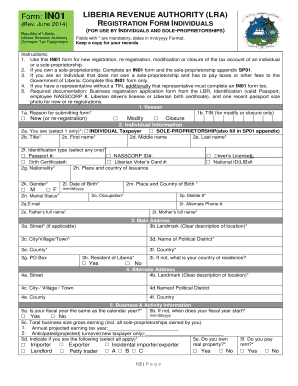

The Liberia Revenue Authority forms are official documents used for various tax-related purposes within Liberia. These forms are essential for individuals and businesses to report their income, claim deductions, and fulfill their tax obligations. The forms ensure compliance with local tax laws and regulations, which are crucial for maintaining good standing with the Liberia Revenue Authority. Each form serves a specific purpose, such as filing tax returns, applying for tax exemptions, or reporting changes in financial status.

How to use the Liberia Revenue Authority Forms

Using the Liberia Revenue Authority forms involves several straightforward steps. First, identify the specific form required for your tax situation, such as the LRA tax return forms. Next, gather all necessary information and documentation, which may include income statements, identification numbers, and previous tax returns. After completing the form, ensure that all information is accurate and complete. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, as specified by the Liberia Revenue Authority.

Steps to complete the Liberia Revenue Authority Forms

Completing the Liberia Revenue Authority forms requires careful attention to detail. Follow these steps for a smooth process:

- Identify the correct form based on your tax needs.

- Gather all required documentation, including income statements and identification.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the form according to the specified submission methods.

Legal use of the Liberia Revenue Authority Forms

The legal use of the Liberia Revenue Authority forms is governed by local tax laws and regulations. Properly completed forms are considered legally binding documents, provided they meet specific criteria set by the Liberia Revenue Authority. This includes accurate information, appropriate signatures, and adherence to submission deadlines. Electronic submissions are also recognized as valid, provided they comply with relevant eSignature laws.

Form Submission Methods

There are several methods for submitting the Liberia Revenue Authority forms. Taxpayers can choose from the following options:

- Online Submission: Many forms can be submitted electronically through the Liberia Revenue Authority website, allowing for quick processing.

- Mail: Forms can be printed and sent via postal service to the designated address provided by the Liberia Revenue Authority.

- In-Person: Taxpayers may also submit forms directly at local Liberia Revenue Authority offices.

Required Documents

To complete the Liberia Revenue Authority forms, certain documents are typically required. These may include:

- Proof of income, such as pay stubs or tax statements.

- Identification documents, including a government-issued ID or tax identification number.

- Previous tax returns for reference and accuracy.

Quick guide on how to complete liberia revenue authority forms

Effortlessly Prepare Liberia Revenue Authority Forms on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate template and securely save it online. airSlate SignNow offers you all the necessary tools to design, modify, and electronically sign your documents swiftly without delays. Handle Liberia Revenue Authority Forms on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

Steps to Edit and Electronically Sign Liberia Revenue Authority Forms with Ease

- Locate Liberia Revenue Authority Forms and then click Get Form to begin.

- Use the tools available to fill out your document.

- Select relevant sections of the documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal standing as a standard ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Liberia Revenue Authority Forms to ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the liberia revenue authority forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Liberia Revenue Authority forms available for eSigning?

The Liberia Revenue Authority forms include tax-related documents, registration forms, and compliance submissions that can be easily eSigned using airSlate SignNow. Our platform allows users to upload and manage these forms seamlessly. By leveraging airSlate SignNow, you ensure that all updates to these forms are compliant with the latest regulations.

-

How does airSlate SignNow simplify the process of handling Liberia Revenue Authority forms?

airSlate SignNow empowers users to complete Liberia Revenue Authority forms electronically, saving time and reducing errors associated with paper forms. Our intuitive interface makes it easy to fill out, sign, and share documents securely. This streamlining of workflow ensures that your tax filings and other submissions are processed quickly and correctly.

-

Is there a cost associated with using airSlate SignNow for Liberia Revenue Authority forms?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for handling Liberia Revenue Authority forms. Our cost-effective solution provides a range of features ensuring that you get value for your investment. You can explore our plans to find the one that best fits your usage requirements.

-

What benefits does airSlate SignNow offer for managing Liberia Revenue Authority forms?

Using airSlate SignNow to manage Liberia Revenue Authority forms brings several benefits, including faster processing times, enhanced security, and improved document tracking. Additionally, our solution helps reduce the likelihood of mistakes, ensuring compliance with local regulations. This efficiency translates to better workflow management and a signNow reduction in administrative burdens.

-

Can I integrate airSlate SignNow with other platforms for Liberia Revenue Authority forms?

Absolutely! airSlate SignNow allows integrations with various platforms to facilitate a smooth workflow when handling Liberia Revenue Authority forms. This includes popular tools like CRMs, document management systems, and cloud storage services. These integrations help centralize your processes and improve overall efficiency.

-

How secure is the signing process for Liberia Revenue Authority forms on airSlate SignNow?

Security is a top priority at airSlate SignNow when it comes to signing Liberia Revenue Authority forms. Our platform employs industry-standard encryption and robust authentication measures to ensure that your documents are safe from unauthorized access. You can confidently manage sensitive tax information knowing that it is well-protected.

-

Are there templates available for Liberia Revenue Authority forms in airSlate SignNow?

Yes, airSlate SignNow provides a variety of templates for Liberia Revenue Authority forms to simplify the document creation process. These templates are designed to meet local requirements and can be customized to fit specific business needs. Utilizing templates saves time and ensures that your forms are compliant and ready for submission.

Get more for Liberia Revenue Authority Forms

- Aadhar declaration idfc bank form

- Brat diet eating after an upset stomach or vomiting familydoctor org form

- Little league baseball game pitch log ll production uploads form

- Kmf application no form

- Trajectories conference a success indiana university indiana form

- Limited liability operating agreement template form

- Manager managed llc operating agreement template form

- Manager managed operating agreement template form

Find out other Liberia Revenue Authority Forms

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself