8995 Form 2020

What is the 8995 Form

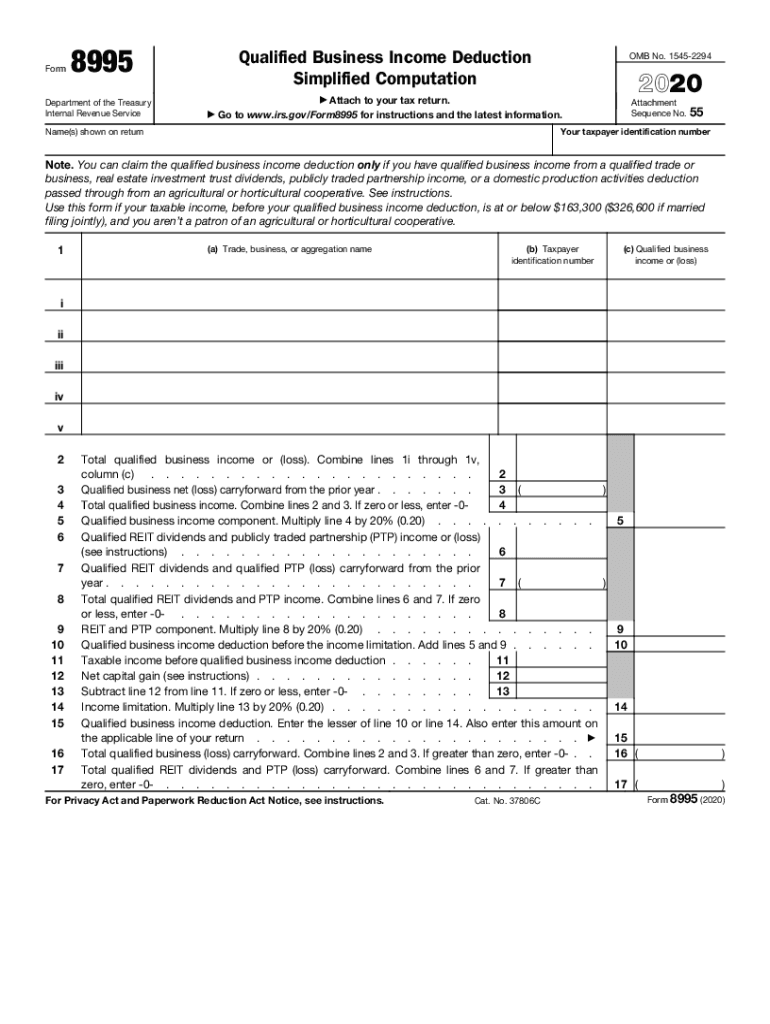

The 2 form, officially known as the Qualified Business Income Deduction Simplified, is a tax form used by eligible taxpayers to calculate their qualified business income (QBI) deduction. This form is particularly relevant for individuals, partnerships, S corporations, and some estates and trusts that have income from a qualified trade or business. The purpose of the 8995 form is to simplify the process of claiming the QBI deduction, which can significantly reduce taxable income for eligible taxpayers.

How to use the 8995 Form

Using the 2 form involves several key steps. First, gather all necessary financial information related to your business income. This includes gross income, deductions, and any relevant tax documents. Next, accurately fill out the form, ensuring that all calculations for the qualified business income deduction are correct. The form guides users through the process, providing clear instructions on how to report income and deductions. Once completed, the form must be included with your tax return when filing with the IRS.

Steps to complete the 8995 Form

Completing the 2 form requires careful attention to detail. Follow these steps:

- Begin by entering your name and taxpayer identification number at the top of the form.

- Report your qualified business income in the designated section, ensuring all figures are accurate.

- Calculate your QBI deduction using the instructions provided, which may involve applying specific percentages based on your income level.

- Double-check all entries for accuracy, as errors can lead to delays or issues with your tax return.

- Attach the completed form to your tax return before submission.

Key elements of the 8995 Form

The 2 form includes several key elements that are essential for accurately calculating the QBI deduction. These elements include:

- Qualified Business Income: This is the net income from a qualified trade or business, excluding investment income.

- W-2 Wages: If applicable, report any W-2 wages paid by the business, as this can affect the deduction amount.

- Qualified Property: Any property used in the business that can contribute to the QBI deduction must be reported.

- Calculation of the Deduction: The form provides a structured method for calculating the deduction based on the reported income and expenses.

IRS Guidelines

The IRS provides specific guidelines for completing the 2 form, which are essential for compliance and accuracy. Taxpayers should refer to the IRS instructions for the form, which outline eligibility criteria, necessary documentation, and detailed steps for completing the form. These guidelines ensure that taxpayers understand the requirements for claiming the QBI deduction and help prevent common errors that could lead to audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the 2 form align with the standard tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. However, if you file for an extension, the deadline may be extended to October 15. It is crucial to adhere to these deadlines to avoid late fees or penalties. Additionally, staying informed about any changes to tax laws or filing requirements can help ensure compliance.

Quick guide on how to complete 8995 form

Complete 8995 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed files, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without interruptions. Manage 8995 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign 8995 Form effortlessly

- Locate 8995 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you prefer. Modify and eSign 8995 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8995 form

Create this form in 5 minutes!

How to create an eSignature for the 8995 form

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the 2020 8995 and how does it relate to airSlate SignNow?

The 2020 8995 is a form used for tax reporting purposes, and airSlate SignNow can simplify the process by allowing users to easily eSign and send tax documents, including the 2020 8995. This feature ensures that your documents are secured and processed efficiently.

-

How does airSlate SignNow enhance the eSigning process for documents like the 2020 8995?

airSlate SignNow offers an intuitive interface that streamlines the eSigning process for the 2020 8995. With features like templates and reminders, users can ensure timely and accurate signatures without hassle.

-

Is airSlate SignNow a cost-effective solution for signing the 2020 8995?

Yes, airSlate SignNow is known for being a cost-effective solution for document management, including the 2020 8995. Offering competitive pricing plans, it allows businesses to save money while efficiently managing their eSignature needs.

-

What integrations are available with airSlate SignNow for managing the 2020 8995?

airSlate SignNow integrates with various leading applications, enabling seamless management of the 2020 8995 and other documents. Whether you're using CRMs or cloud storage services, these integrations enhance productivity and accessibility.

-

Can I customize the signing workflow for the 2020 8995 in airSlate SignNow?

Absolutely! airSlate SignNow provides customizable workflows that allow you to tailor the signing process for the 2020 8995 according to your specific needs. This feature helps streamline approvals and expedites document flow.

-

What security measures does airSlate SignNow have for documents like the 2020 8995?

Security is a top priority at airSlate SignNow. For documents like the 2020 8995, it employs advanced encryption and compliance standards to protect sensitive information, ensuring that your documents remain secure throughout the signing process.

-

How can I access the 2020 8995 form within airSlate SignNow?

You can easily upload and manage the 2020 8995 form directly within airSlate SignNow's platform. Once uploaded, you can send it for eSignature promptly, all within a user-friendly interface that ensures ease of use.

Get more for 8995 Form

Find out other 8995 Form

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking