Form 3809 Targeted Tax Area Deduction and Credit Summary Form 3809 Targeted Tax Area Deduction and Credit Summary 2019

What is the Form 3809 Targeted Tax Area Deduction and Credit Summary?

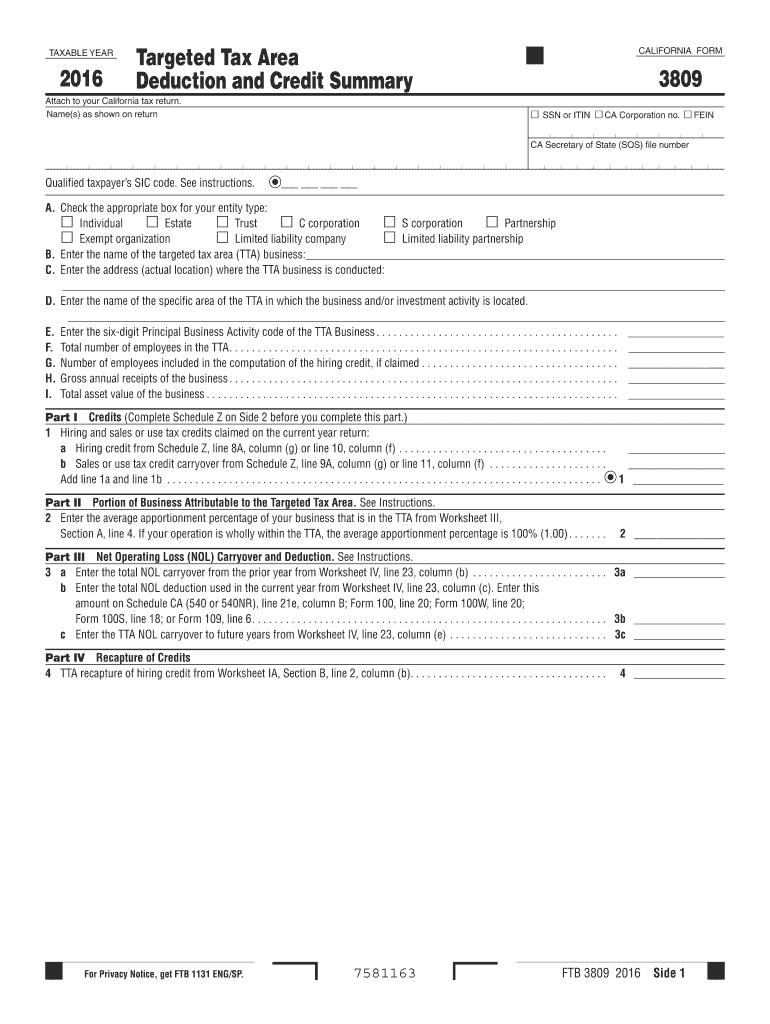

The Form 3809 Targeted Tax Area Deduction and Credit Summary is a tax form used by businesses and individuals to claim deductions and credits for activities conducted in designated targeted tax areas. These areas are typically identified by the IRS as regions that may benefit from economic incentives to encourage investment and job creation. The form provides a structured way to report eligible expenses and calculate the corresponding tax benefits, helping taxpayers maximize their deductions while complying with federal tax regulations.

Steps to Complete the Form 3809 Targeted Tax Area Deduction and Credit Summary

Completing the Form 3809 requires careful attention to detail to ensure accuracy and compliance. Here are the essential steps:

- Gather all necessary documentation, including receipts and records of expenses related to the targeted tax area.

- Fill out the identification section, providing your name, address, and taxpayer identification number.

- Detail the specific deductions and credits you are claiming, ensuring that each entry is supported by appropriate documentation.

- Calculate the total deductions and credits, ensuring that all figures are accurate and reflect the current tax year's guidelines.

- Review the completed form for any errors or omissions before submission.

How to Obtain the Form 3809 Targeted Tax Area Deduction and Credit Summary

The Form 3809 can be obtained directly from the IRS website or through authorized tax preparation software. It is important to ensure that you are using the most current version of the form, as tax regulations and requirements may change annually. Additionally, some tax professionals may provide access to the form as part of their services.

Legal Use of the Form 3809 Targeted Tax Area Deduction and Credit Summary

To ensure that the Form 3809 is legally valid, it must be filled out accurately and submitted in accordance with IRS guidelines. This includes adhering to deadlines and maintaining proper records to support the claims made on the form. Electronic signatures are permissible, provided they comply with the relevant eSignature laws, such as ESIGN and UETA, which help establish the legal validity of electronically signed documents.

Key Elements of the Form 3809 Targeted Tax Area Deduction and Credit Summary

Understanding the key elements of the Form 3809 is crucial for effective completion. Important components include:

- Identification Information: This section requires basic taxpayer information.

- Deduction and Credit Details: Specific lines for entering the amounts being claimed.

- Supporting Documentation: A reminder to attach any necessary documentation that substantiates the claims.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3809 align with the overall tax filing schedule set by the IRS. Generally, the form must be submitted by the tax return due date, which is typically April 15 for individual taxpayers. Businesses may have different deadlines based on their entity type and fiscal year. It is advisable to check the IRS website for any updates or changes to these dates each tax year.

Quick guide on how to complete 2016 form 3809 targeted tax area deduction and credit summary 2016 form 3809 targeted tax area deduction and credit summary

Effortlessly Prepare Form 3809 Targeted Tax Area Deduction And Credit Summary Form 3809 Targeted Tax Area Deduction And Credit Summary on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to find the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Form 3809 Targeted Tax Area Deduction And Credit Summary Form 3809 Targeted Tax Area Deduction And Credit Summary on any device via airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Form 3809 Targeted Tax Area Deduction And Credit Summary Form 3809 Targeted Tax Area Deduction And Credit Summary with Ease

- Find Form 3809 Targeted Tax Area Deduction And Credit Summary Form 3809 Targeted Tax Area Deduction And Credit Summary and click Get Form to initiate the process.

- Use the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which requires just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or disorganized documents, cumbersome form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 3809 Targeted Tax Area Deduction And Credit Summary Form 3809 Targeted Tax Area Deduction And Credit Summary and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 3809 targeted tax area deduction and credit summary 2016 form 3809 targeted tax area deduction and credit summary

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 3809 targeted tax area deduction and credit summary 2016 form 3809 targeted tax area deduction and credit summary

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is the Form 3809 Targeted Tax Area Deduction and Credit Summary?

The Form 3809 Targeted Tax Area Deduction and Credit Summary is a document used to summarize tax deductions and credits available for businesses operating in designated targeted tax areas. This form helps businesses claim specific credits aimed at boosting economic development in these areas.

-

How can airSlate SignNow help with the completion of Form 3809?

airSlate SignNow offers an intuitive platform that simplifies the process of completing the Form 3809 Targeted Tax Area Deduction and Credit Summary. You can easily create, sign, and send documents securely, ensuring compliance and accuracy in your tax submissions.

-

What are the benefits of using airSlate SignNow for the Form 3809?

Using airSlate SignNow for the Form 3809 Targeted Tax Area Deduction and Credit Summary provides several benefits, including enhanced efficiency and reduced processing time. The platform allows for easy collaboration and quick electronic signatures, streamlining the entire documentation process.

-

Is there a cost associated with using airSlate SignNow for the Form 3809?

Yes, airSlate SignNow offers various pricing plans depending on your needs, including options for businesses that require assistance with the Form 3809 Targeted Tax Area Deduction and Credit Summary. These plans provide access to advanced features and ensure your team can manage documents effectively.

-

Can I integrate airSlate SignNow with other software while handling Form 3809?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, making it easy to handle all your document needs related to the Form 3809 Targeted Tax Area Deduction and Credit Summary. This integration allows for improved workflow efficiency and keeps your data organized.

-

What security measures does airSlate SignNow provide for the Form 3809?

airSlate SignNow prioritizes security and employs robust measures to protect your documents, including those related to the Form 3809 Targeted Tax Area Deduction and Credit Summary. The platform uses encryption and secure servers to safeguard sensitive information from unauthorized access.

-

How can I ensure compliance while using airSlate SignNow for Form 3809?

To ensure compliance when using airSlate SignNow for the Form 3809 Targeted Tax Area Deduction and Credit Summary, it is essential to follow IRS guidelines. The platform includes features that aid in compliance, such as reminders for deadlines and document tracking, to keep your submissions on point.

Get more for Form 3809 Targeted Tax Area Deduction And Credit Summary Form 3809 Targeted Tax Area Deduction And Credit Summary

- Driver training program sample form

- Ct tenant checklist form

- Irp schedule c form

- Spray diary template nz form

- Pr application form 4a sample

- Word format for hamad bin khalifa reccomendation letter

- Completion of community involvement activities form

- Rt workplace investigation workshops registration form vancouver p 1

Find out other Form 3809 Targeted Tax Area Deduction And Credit Summary Form 3809 Targeted Tax Area Deduction And Credit Summary

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself