Form 100X Amended Corporation 2020

What is the Form 100X Amended Corporation

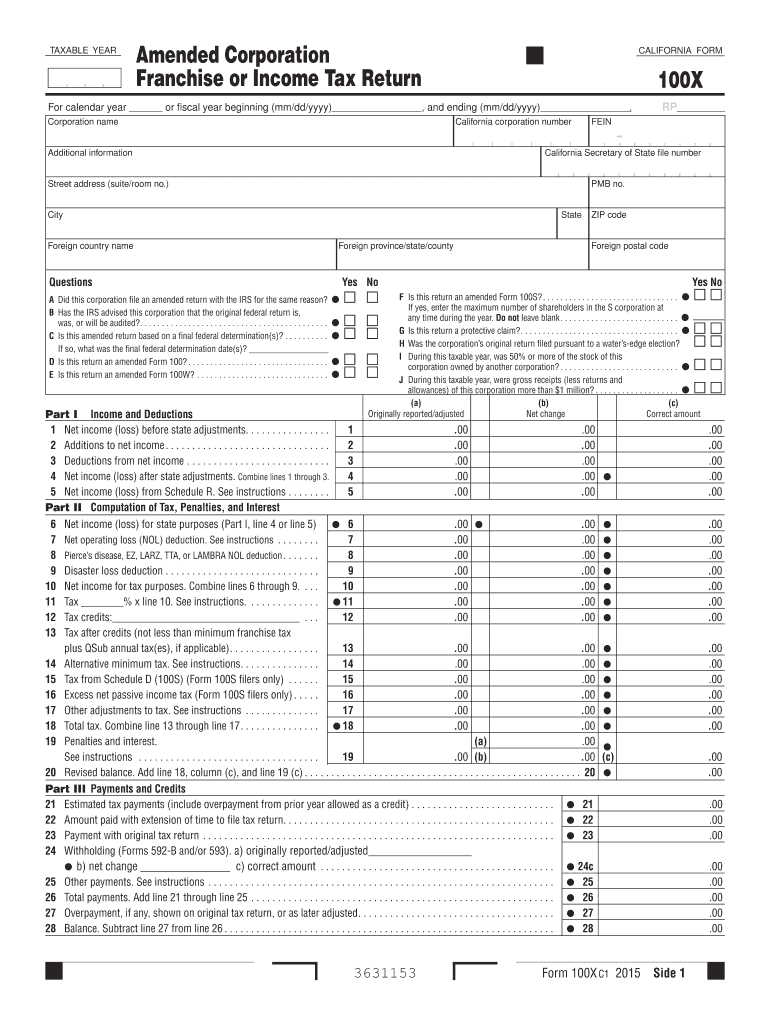

The Form 100X Amended Corporation is a tax form used by corporations in the United States to amend previously filed corporate tax returns. This form allows corporations to correct errors, update information, or make changes to their tax liability. It is essential for ensuring that the corporation's tax records are accurate and compliant with IRS regulations. Filing this form can help avoid penalties and ensure proper reporting of income and deductions.

How to use the Form 100X Amended Corporation

Using the Form 100X Amended Corporation involves several steps to ensure proper completion and submission. First, gather all necessary financial documents and previous tax returns related to the original filing. Next, accurately fill out the form, providing updated information where required. Be sure to explain the reasons for the amendments in the designated section. Once completed, review the form for accuracy before submission.

Steps to complete the Form 100X Amended Corporation

Completing the Form 100X Amended Corporation requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Form 100X from the IRS website or authorized sources.

- Fill in the corporation’s name, address, and Employer Identification Number (EIN).

- Indicate the tax year for which you are amending the return.

- Provide details of the changes being made, including any corrections to income, deductions, or credits.

- Attach any supporting documentation that justifies the amendments.

- Sign and date the form before submitting it to the appropriate IRS address.

Legal use of the Form 100X Amended Corporation

The legal use of the Form 100X Amended Corporation is governed by IRS regulations. This form must be filed to ensure compliance with tax laws when changes are made to previously submitted returns. Failure to file this form correctly may result in penalties or additional taxes owed. It is crucial for corporations to understand their obligations under U.S. tax law and to use this form to maintain accurate records.

Filing Deadlines / Important Dates

Filing deadlines for the Form 100X Amended Corporation typically align with the IRS guidelines for corporate tax returns. Generally, corporations must file the amended return within three years of the original due date. However, specific circumstances may affect these deadlines, such as changes in tax law or extensions granted by the IRS. It is important for corporations to stay informed about any updates to filing requirements.

Form Submission Methods (Online / Mail / In-Person)

The Form 100X Amended Corporation can be submitted through various methods. Corporations may choose to file electronically using IRS-approved e-filing software, which can streamline the process and reduce errors. Alternatively, the form can be mailed to the appropriate IRS address, ensuring that it is sent via a traceable method. In-person submissions are generally not recommended for this form, as the IRS primarily processes forms through mail or electronic means.

Quick guide on how to complete 2015 form 100x amended corporation

Complete Form 100X Amended Corporation with ease on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow supplies you with all the resources needed to create, modify, and electronically sign your documents swiftly and efficiently. Manage Form 100X Amended Corporation on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Form 100X Amended Corporation effortlessly

- Locate Form 100X Amended Corporation and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specially designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 100X Amended Corporation and guarantee seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 100x amended corporation

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 100x amended corporation

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the Form 100X Amended Corporation?

The Form 100X Amended Corporation is a tax form used by corporations to amend previously filed California corporate tax returns. This form allows businesses to report changes in income, deductions, or other relevant information. By using the Form 100X Amended Corporation, corporations ensure compliance with state regulations and avoid potential penalties.

-

How can airSlate SignNow assist with the Form 100X Amended Corporation?

airSlate SignNow streamlines the process of submitting the Form 100X Amended Corporation by allowing users to electronically sign and send documents securely. Our platform facilitates quick access to templates, guided filling, and management of paperwork, making your amendment process hassle-free. With airSlate SignNow, ensuring compliance and efficiency in document handling has never been easier.

-

What are the pricing options for airSlate SignNow when filing the Form 100X Amended Corporation?

airSlate SignNow offers flexible pricing plans catering to various business needs, starting with a free trial for new users. Depending on the plan, businesses can access advanced features, including document templates tailored for the Form 100X Amended Corporation. Compare our pricing options to choose a plan that best suits your corporate needs and budget.

-

Are there any specific features of airSlate SignNow for the Form 100X Amended Corporation?

Yes, airSlate SignNow offers essential features for the Form 100X Amended Corporation, including customizable templates, workflow automation, and secure signing options. These features enhance document management and help ensure that all necessary amendments are completed accurately and efficiently. Our intuitive interface simplifies the entire process, making it accessible for all users.

-

What are the benefits of using airSlate SignNow for Form 100X Amended Corporation filings?

Using airSlate SignNow for your Form 100X Amended Corporation filings provides numerous benefits, such as increased efficiency, reduced processing times, and enhanced document security. The ease of eSigning allows you to expedite your amendments and maintain compliance without delays. Additionally, our platform minimizes errors through automated workflows and reminders.

-

Can airSlate SignNow integrate with other software for managing the Form 100X Amended Corporation?

Yes, airSlate SignNow integrates seamlessly with many popular software applications, allowing users to manage their Form 100X Amended Corporation filings alongside other essential business tools. Integrations with accounting software, CRMs, and document management systems enhance workflow efficiency. This connectivity ensures a smoother process for tracking amendments and managing corporate documents.

-

Is airSlate SignNow compliant with legal regulations for the Form 100X Amended Corporation?

Absolutely, airSlate SignNow is fully compliant with relevant legal and regulatory standards for electronic signatures, including the requirements for the Form 100X Amended Corporation. Our platform adheres to industry best practices to ensure that electronically signed documents are legally binding and secure. This compliance gives users peace of mind when submitting their amended tax filings.

Get more for Form 100X Amended Corporation

Find out other Form 100X Amended Corporation

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer