Form 2790 Self Employment Record

What is the Form 2790 Self Employment Record

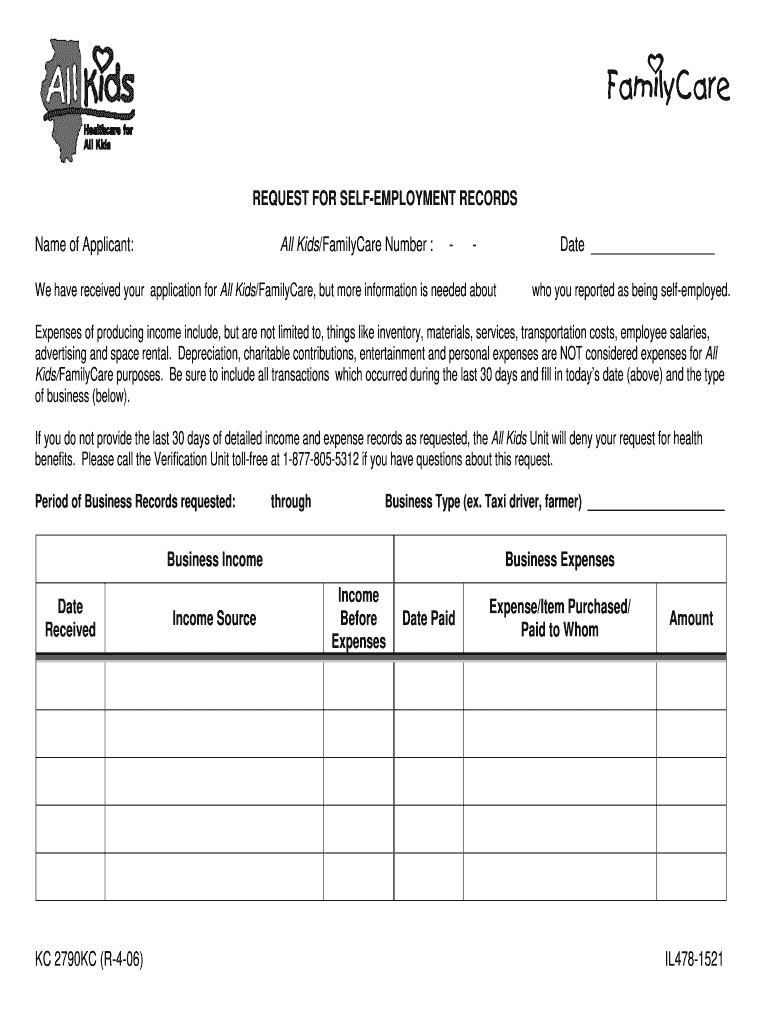

The Form 2790 Self Employment Record is a crucial document for individuals engaged in self-employment. This form serves as a record of income and expenses, helping self-employed individuals track their financial activities for tax purposes. It is particularly important for reporting income accurately when filing taxes, ensuring compliance with IRS regulations. The form captures essential details about the nature of the business, the income generated, and any deductible expenses, making it an indispensable tool for self-employed individuals.

How to use the Form 2790 Self Employment Record

Using the Form 2790 requires careful attention to detail. First, gather all relevant financial documents, such as invoices, receipts, and bank statements. Begin by filling out the form with accurate information regarding your business activities, including the type of services or products offered. Next, document your income and expenses clearly, ensuring that all amounts are correctly calculated. After completing the form, review it for accuracy before submission, as any errors could lead to complications during tax filing.

Steps to complete the Form 2790 Self Employment Record

Completing the Form 2790 involves several steps to ensure accuracy and compliance. Start by entering your personal information, including your name and Social Security number. Next, provide details about your business, such as its name and address. Then, list your income sources and corresponding amounts. Following this, itemize your business expenses, categorizing them appropriately. Finally, double-check all entries for correctness before signing and dating the form. This thorough approach helps prevent issues with the IRS and supports accurate tax reporting.

Legal use of the Form 2790 Self Employment Record

The legal use of the Form 2790 is essential for maintaining compliance with tax laws. This form must be filled out truthfully and submitted as part of your tax return to the IRS. Failing to provide accurate information can result in penalties, including fines and interest on unpaid taxes. Additionally, the form serves as a legal record of your self-employment activities, which can be referenced in case of an audit. Understanding the legal implications of this form is vital for all self-employed individuals.

Key elements of the Form 2790 Self Employment Record

Key elements of the Form 2790 include sections for personal identification, business details, income reporting, and expense documentation. Each section is designed to capture specific information that the IRS requires for accurate tax assessment. Important components include the total income earned, a breakdown of deductible expenses, and any relevant business identifiers. Ensuring that all key elements are completed accurately is critical for the form's validity and for meeting tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2790 are aligned with the overall tax filing schedule in the United States. Typically, self-employed individuals must submit their tax returns, including the Form 2790, by April 15 of each year. However, if you require an extension, the deadline may be extended to October 15. It is crucial to be aware of these dates to avoid late fees and penalties. Keeping a calendar of important tax dates can help ensure timely submissions and compliance.

Quick guide on how to complete form 2790 self employment record

Prepare Form 2790 Self Employment Record effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the right format and securely archive it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage Form 2790 Self Employment Record on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Form 2790 Self Employment Record without stress

- Find Form 2790 Self Employment Record and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes only moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to secure your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 2790 Self Employment Record and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2790 self employment record

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 2790 self employment record used for?

The form 2790 self employment record is primarily used to document and verify self-employment income for tax purposes. It helps individuals maintain accurate financial records, which is essential for filing taxes and applying for loans or benefits. Using this form can streamline many administrative processes for self-employed individuals.

-

How can airSlate SignNow help with the form 2790 self employment record?

airSlate SignNow allows users to easily create, send, and electronically sign the form 2790 self employment record. With its intuitive interface, you can quickly fill out all necessary fields and ensure compliance with tax regulations. The ability to eSign documents on any device enhances your efficiency and secures crucial financial documentation.

-

What are the pricing options for airSlate SignNow when managing documents like the form 2790 self employment record?

airSlate SignNow offers various pricing plans suitable for different needs, including plans tailored for individual users or businesses. Pricing starts competitively, providing a cost-effective solution for managing documents like the form 2790 self employment record. Explore our plans to find the one that best fits your self-employment documentation needs.

-

Are there any integrations available with airSlate SignNow for the form 2790 self employment record?

Yes, airSlate SignNow integrates with various productivity tools and applications, allowing seamless management of the form 2790 self employment record. These integrations facilitate a smooth workflow, letting you connect with your favorite apps like Google Drive, Slack, and CRM systems. This makes it easy to store and retrieve your self-employment records as needed.

-

Is airSlate SignNow secure for handling sensitive information like the form 2790 self employment record?

Absolutely! airSlate SignNow prioritizes the security and privacy of your documents, including the form 2790 self employment record. Our platform uses advanced encryption methods and secure servers to protect your sensitive information, ensuring that your self-employment records are safe from unauthorized access.

-

What features does airSlate SignNow offer for the form 2790 self employment record?

airSlate SignNow provides a variety of features to enhance your experience with the form 2790 self employment record. Users can create templates, set signing workflows, and track document status in real-time. These functionalities help streamline the process of managing self-employment records efficiently.

-

Can I customize the form 2790 self employment record using airSlate SignNow?

Yes, you can customize the form 2790 self employment record according to your specific requirements using airSlate SignNow’s robust editing tools. This flexibility allows you to add branding, fields, and notes tailored to your business or personal needs. Customizing your forms ensures they meet organizational standards and user preferences.

Get more for Form 2790 Self Employment Record

- Self certification form liberty university liberty

- Tmhp form 6700

- Ssa further action notice english ssa tentative nonconfirmation uscis form

- Printable complaint form washington state office of the insurance insurance wa

- City of grand rapids income taxresident form

- 4582 michigan business tax penalty and interest computation for underpaid estimated tax form

- City treasurer amp form

- Unknown article translation michigan form 4884

Find out other Form 2790 Self Employment Record

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy