T4ap Form

What is the T4ap?

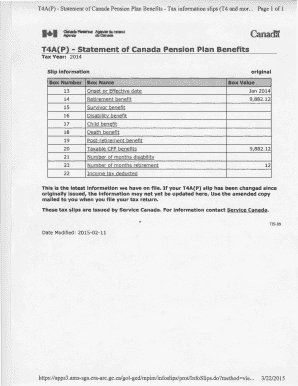

The T4ap is a specific form used in Canada to report income received from the Canada Pension Plan (CPP) benefits. This form is essential for individuals who have received payments from the CPP and need to declare this income for tax purposes. The T4ap provides a summary of the total benefits received during the tax year, ensuring that recipients can accurately report their income to the Internal Revenue Service (IRS) in the United States, if applicable.

How to Use the T4ap

Using the T4ap involves understanding its purpose and accurately filling it out. Recipients of CPP benefits should keep track of the payments they receive throughout the year. When tax season arrives, they can use the information on the T4ap to complete their tax returns. This form helps ensure compliance with tax regulations and assists in determining the correct tax owed or refund due.

Steps to Complete the T4ap

Completing the T4ap requires careful attention to detail. Follow these steps for accurate completion:

- Gather all relevant documents, including any notices of assessment and previous tax returns.

- Fill in personal information, such as your name, address, and social security number.

- Report the total amount of CPP benefits received as indicated on the T4ap.

- Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the completed form with your tax return by the designated deadline.

Legal Use of the T4ap

The T4ap is legally recognized as a valid document for reporting income from the Canada Pension Plan. It is crucial for recipients to understand that this form must be used in compliance with both Canadian and U.S. tax laws. Proper use of the T4ap ensures that individuals fulfill their tax obligations and avoid potential legal issues related to income reporting.

Key Elements of the T4ap

Several key elements are essential to understand when working with the T4ap:

- Recipient Information: This includes the individual's name, address, and social security number.

- Income Amount: The total amount of CPP benefits received during the tax year.

- Tax Year: The specific year for which the income is being reported.

- Issuer Information: Details about the organization or entity that issued the T4ap.

Filing Deadlines / Important Dates

Filing deadlines for the T4ap are critical to ensure compliance. Typically, individuals must submit their tax returns, including the T4ap, by April 15 of the following year. It is important to stay informed about any changes in deadlines that may arise due to specific circumstances or legislation.

Quick guide on how to complete t4ap

Prepare T4ap seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can obtain the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without holdups. Handle T4ap on any device with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and eSign T4ap effortlessly

- Locate T4ap and then click Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about misplaced or lost documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Edit and eSign T4ap and ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t4ap

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is t4ap and how does it relate to airSlate SignNow?

T4ap is a key factor in streamlining document management processes. With airSlate SignNow, t4ap allows businesses to efficiently send and eSign documents, enhancing overall productivity and ensuring secure transactions.

-

How much does airSlate SignNow cost with the t4ap feature?

Pricing for airSlate SignNow varies based on the plan you select, but incorporating t4ap capabilities is included in all tiers. This cost-effective solution ensures that users get the best value while enhancing their document signing processes.

-

What are the main features of airSlate SignNow that utilize t4ap?

AirSlate SignNow offers numerous features that leverage t4ap, including customizable templates, advanced eSignature options, and real-time tracking of documents. These features simplify workflows and improve collaboration across teams.

-

How can businesses benefit from using airSlate SignNow with t4ap?

Businesses benefit from airSlate SignNow with t4ap by reducing turnaround times for document signing and improving efficiency. The ability to securely send and manage contracts digitally enhances overall productivity and client satisfaction.

-

Can I integrate airSlate SignNow with other tools while using t4ap?

Yes, airSlate SignNow supports integrations with a variety of popular tools while utilizing t4ap functionality. This ensures seamless workflows across your business applications, enhancing your overall operational efficiency.

-

Is the t4ap feature suitable for small businesses?

Absolutely! The t4ap functionality in airSlate SignNow is designed to meet the needs of businesses of all sizes, including small businesses. It offers an affordable way to manage documents while ensuring compliance and security.

-

How secure is my data when using airSlate SignNow and t4ap?

Security is a top priority for airSlate SignNow, especially when utilizing t4ap. The platform employs robust encryption methods and complies with industry standards to ensure that your data remains safe and secure throughout the document signing process.

Get more for T4ap

Find out other T4ap

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy