Ky Estimated Tax Payments Form

What is the Ky Estimated Tax Payments Form

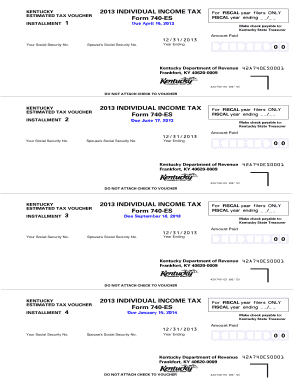

The Ky Estimated Tax Payments Form is a crucial document for individuals and businesses in Kentucky who anticipate owing tax of $500 or more when they file their return. This form allows taxpayers to estimate their tax liability for the year and make payments throughout the year to avoid penalties and interest. It is particularly relevant for self-employed individuals, freelancers, and those with significant non-wage income. Understanding this form helps ensure compliance with state tax regulations and provides a clear overview of expected tax obligations.

How to use the Ky Estimated Tax Payments Form

Using the Ky Estimated Tax Payments Form involves a few straightforward steps. First, gather all necessary financial information, including income sources and deductions. Next, calculate your expected annual income and applicable deductions to determine your estimated tax liability. Once you have this information, fill out the form accurately, ensuring all figures are correct. Finally, submit the form along with your estimated payment to the appropriate state tax authority by the designated deadlines to maintain compliance and avoid penalties.

Steps to complete the Ky Estimated Tax Payments Form

Completing the Ky Estimated Tax Payments Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather financial documents, including previous tax returns, income statements, and deduction records.

- Estimate your total income for the year, factoring in all sources of revenue.

- Calculate your expected deductions to arrive at your taxable income.

- Use the Kentucky tax tables to determine your estimated tax liability based on your taxable income.

- Fill out the form with your estimated tax figures, ensuring accuracy.

- Submit the completed form and your payment by the specified deadlines.

Legal use of the Ky Estimated Tax Payments Form

The Ky Estimated Tax Payments Form is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is accurate and truthful to avoid legal repercussions. The form must be filed on time to prevent penalties for underpayment or late payment of taxes. Additionally, using a reliable eSignature solution can enhance the legal validity of the form, ensuring that all signatures are authenticated and compliant with state eSignature laws.

Filing Deadlines / Important Dates

Timely filing of the Ky Estimated Tax Payments Form is critical to avoid penalties. The state typically requires estimated tax payments to be made quarterly. Key deadlines include:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

It is advisable to mark these dates on your calendar to ensure compliance and avoid additional charges.

Who Issues the Form

The Ky Estimated Tax Payments Form is issued by the Kentucky Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with tax laws in Kentucky. Taxpayers can obtain the form directly from the department's website or through authorized tax professionals. Staying informed about updates or changes to the form is essential for accurate filing.

Quick guide on how to complete ky estimated tax payments form

Complete Ky Estimated Tax Payments Form effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documentation, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Ky Estimated Tax Payments Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Ky Estimated Tax Payments Form with ease

- Obtain Ky Estimated Tax Payments Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent parts of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign utility, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from a device of your choice. Modify and eSign Ky Estimated Tax Payments Form and ensure outstanding communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ky estimated tax payments form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iia ky gov pay ky collection case jsp?

The iia ky gov pay ky collection case jsp is a platform that enables users to manage their collection cases effectively. By utilizing airSlate SignNow, businesses can streamline their document processes associated with this system, making it easier to handle payments and communications.

-

How can airSlate SignNow assist with iia ky gov pay ky collection case jsp?

AirSlate SignNow integrates seamlessly with the iia ky gov pay ky collection case jsp, allowing users to send and eSign necessary documents quickly. This integration helps improve efficiency and reduces turnaround time for managing collection cases.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers various pricing plans to cater to different business needs, making it a cost-effective solution for managing processes like those in the iia ky gov pay ky collection case jsp. Each plan is designed to provide essential features, ensuring you only pay for what you need.

-

What features does airSlate SignNow include for collection case management?

AirSlate SignNow includes features such as eSignature capabilities, document tracking, and templates tailored for collection case management, including those related to iia ky gov pay ky collection case jsp. These features enable businesses to manage their documentation efficiently and securely.

-

Is airSlate SignNow user-friendly for those working with iia ky gov pay ky collection case jsp?

Yes, airSlate SignNow is designed with user experience in mind, making it accessible for anyone who needs to work with iia ky gov pay ky collection case jsp. The platform provides intuitive navigation and easy-to-follow instructions, ensuring a smooth experience.

-

Can airSlate SignNow help reduce time spent on document management?

Absolutely! By automating document workflows associated with iia ky gov pay ky collection case jsp, airSlate SignNow signNowly reduces the time spent on document management. This efficiency allows teams to focus on their core business activities instead.

-

What integrations does airSlate SignNow offer for handling collection cases?

AirSlate SignNow offers a variety of integrations that complement the iia ky gov pay ky collection case jsp, including popular CRM and ERP systems. These integrations enable users to streamline their workflows, ensuring that data flows seamlessly between platforms.

Get more for Ky Estimated Tax Payments Form

Find out other Ky Estimated Tax Payments Form

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online