F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas 2019

What is the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas

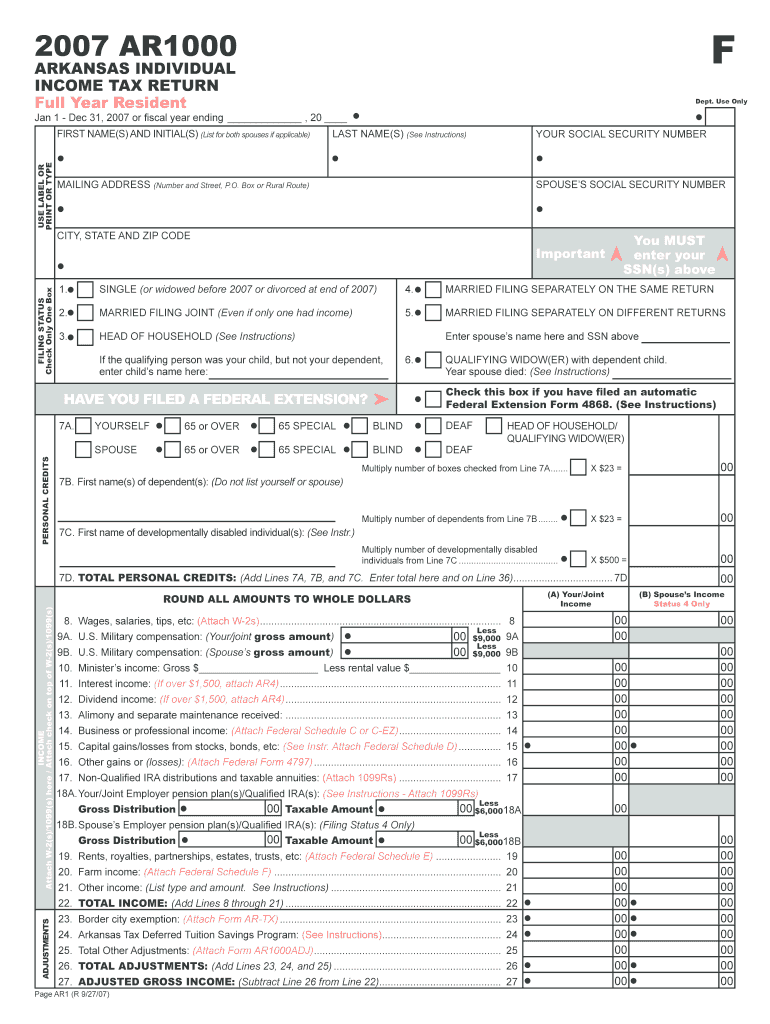

The F AR1000 Arkansas Individual Income Tax Return is a form used by full-year residents of Arkansas to report their income and calculate their state income tax liability. This form is essential for individuals who have earned income within the state and are required to file taxes annually. It includes various sections to detail income sources, deductions, and credits applicable to the taxpayer's situation. Understanding this form is crucial for compliance with state tax laws and ensuring accurate reporting.

Steps to complete the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas

Completing the F AR1000 Arkansas Individual Income Tax Return involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Review the instructions specific to the F AR1000 to understand the required information and sections.

- Fill in personal information, such as your name, address, and Social Security number.

- Report all sources of income accurately, including wages, interest, and dividends.

- Claim any deductions or credits for which you qualify to reduce your taxable income.

- Double-check all entries for accuracy before submitting the form.

How to obtain the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas

The F AR1000 Arkansas Individual Income Tax Return can be obtained through several channels. It is available on the Arkansas Department of Finance and Administration's website, where you can download a PDF version. Additionally, physical copies may be available at local tax offices or libraries. For those who prefer digital solutions, e-filing options through approved tax software can streamline the process of obtaining and submitting the form.

Legal use of the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas

The F AR1000 is legally binding when completed and submitted according to Arkansas tax laws. To ensure its legal validity, taxpayers must provide accurate information and sign the form. Electronic signatures are acceptable if they comply with the state's eSignature regulations. It is important to maintain copies of the submitted form and any supporting documentation for future reference or in case of an audit.

Required Documents

When preparing to complete the F AR1000 Arkansas Individual Income Tax Return, several documents are necessary:

- W-2 forms from employers detailing annual wages.

- 1099 forms for any freelance or contract work.

- Documentation of other income sources, such as interest or dividends.

- Receipts or records for deductions, including medical expenses and charitable contributions.

- Any previous year’s tax returns for reference.

Filing Deadlines / Important Dates

Filing deadlines for the F AR1000 Arkansas Individual Income Tax Return typically align with federal tax deadlines. Generally, the form must be submitted by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions available and the specific dates associated with them to avoid penalties.

State-specific rules for the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas

Arkansas has specific rules that govern the completion and submission of the F AR1000. These include guidelines on what constitutes taxable income, allowable deductions, and credits unique to the state. Taxpayers should familiarize themselves with Arkansas tax laws to ensure compliance and maximize potential refunds. Additionally, certain local taxes may apply depending on the taxpayer's residence, which should also be considered when filing.

Quick guide on how to complete f 2007 ar1000 arkansas individual income tax return full year resident dept arkansas

Easily Prepare F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly and without any hold-ups. Handle F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas on any device using the airSlate SignNow apps for Android or iOS and enhance your document-based tasks today.

How to Edit and eSign F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas with Ease

- Find F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your adjustments.

- Select your preferred method for delivering your form via email, SMS, invitation link, or download it to your PC.

Put an end to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f 2007 ar1000 arkansas individual income tax return full year resident dept arkansas

Create this form in 5 minutes!

How to create an eSignature for the f 2007 ar1000 arkansas individual income tax return full year resident dept arkansas

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas?

The F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas is the official tax form for Arkansas residents to report their income and determine their tax liability. It is essential for fulfilling your annual tax obligations and is used to calculate any refunds or amounts owed.

-

How do I complete the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas?

Completing the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas involves gathering your income information, potential deductions, and credits. You can fill out the form manually or use online tools available through various platforms for ease of use and accuracy.

-

What are the deadlines for submitting the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas?

Generally, the deadline for submitting the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas is April 15th each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It's crucial to check for any updates from the Arkansas Department of Finance and Administration.

-

Are there any fees associated with filing the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas?

Filing the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas can be done without any direct fees if you file it directly through the state website. However, third-party services may charge fees for processing and e-filing your return, which can provide additional convenience and support.

-

What features does airSlate SignNow offer when filing the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas?

airSlate SignNow provides features such as electronic signature capabilities, document sharing, and secure storage, making it easier for businesses to handle the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas. These tools are essential for managing documents efficiently during tax season.

-

How can I ensure my F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas form is accurate?

To ensure accuracy when filling out the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas, consider using software that provides guidance on deductions and credits. Additionally, reviewing your information and checking against IRS guidelines can help reduce errors before submission.

-

What are the benefits of e-filing the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas?

E-filing the F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas offers many benefits, including faster processing times, quicker refunds, and confirmation of receipt. It also enhances security and minimizes the risk of data loss compared to paper filing.

Get more for F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas

- Co 17 form probate court

- Wilcac life insurance forms

- Sworn accountability statement for cmr form

- Relay for life luminaria form

- Student accident report sample form

- Calgary cambridge guides fillable pdf form

- Enrollment format

- Diploma in immediate medical care royal college of surgeons of edinburgh form

Find out other F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online