Tax Tables Arkansas Gov 2019

What is the Tax Tables Arkansas gov

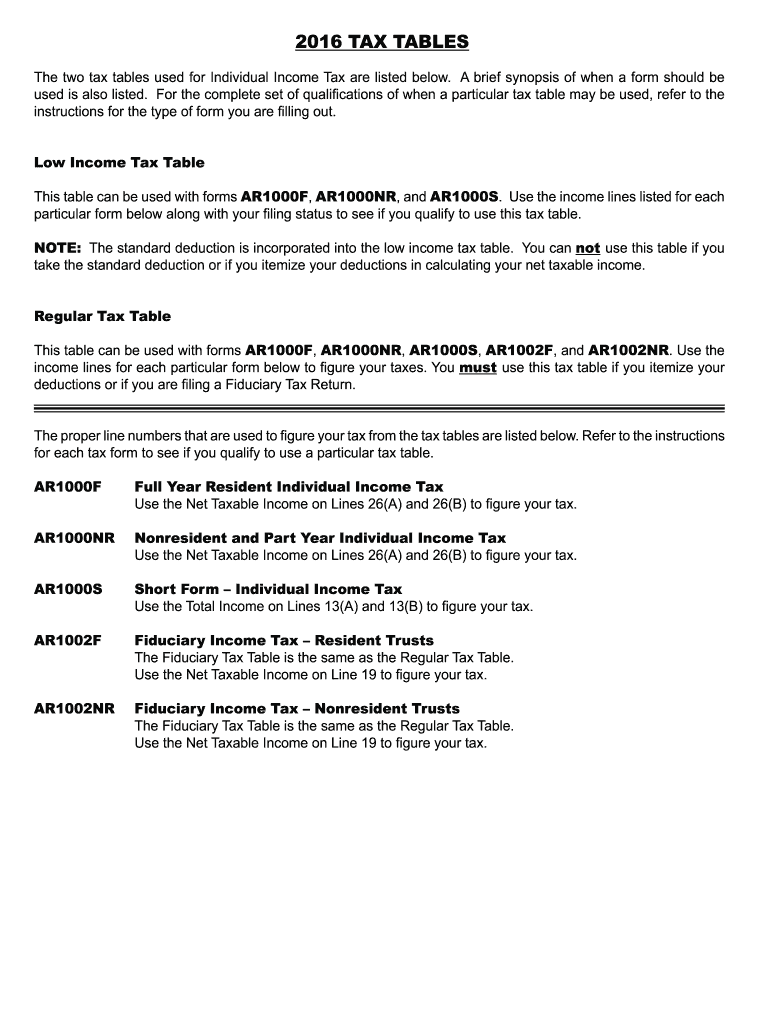

The Tax Tables Arkansas gov refers to the official tax rate tables published by the Arkansas Department of Finance and Administration. These tables provide essential information regarding state income tax rates applicable to individuals and businesses. They are crucial for taxpayers to determine their tax obligations based on their income levels. The tables are updated regularly to reflect changes in tax law and are designed to help residents of Arkansas accurately calculate their state income tax liabilities.

How to use the Tax Tables Arkansas gov

Using the Tax Tables Arkansas gov involves several straightforward steps. First, identify your filing status, which can be single, married filing jointly, married filing separately, or head of household. Next, locate the appropriate tax table that corresponds to your filing status and income level. By finding your taxable income in the table, you can determine the amount of state income tax owed. It is important to ensure that you are referencing the correct year’s tables, as tax rates may change annually.

Key elements of the Tax Tables Arkansas gov

The key elements of the Tax Tables Arkansas gov include the income brackets, corresponding tax rates, and any applicable deductions or credits. Each table typically lists a range of income levels alongside the tax rate that applies to each bracket. Understanding these elements is vital for taxpayers to accurately assess their tax liabilities. Additionally, the tables may include information on standard deductions and personal exemptions, which can further influence the final tax calculation.

Steps to complete the Tax Tables Arkansas gov

Completing the Tax Tables Arkansas gov requires careful attention to detail. Begin by gathering all necessary financial documents, such as W-2 forms and any other income statements. Next, determine your total taxable income by subtracting any eligible deductions from your gross income. Once you have your taxable income, refer to the tax tables to find the applicable tax rate. Finally, calculate your total tax liability by applying the tax rate to your taxable income, ensuring to account for any additional credits or adjustments.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Tables Arkansas gov typically align with the federal tax filing schedule. For individual taxpayers, the deadline to file state income tax returns is generally April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to stay informed about any changes to these deadlines, as timely filing helps avoid penalties and interest on unpaid taxes.

Legal use of the Tax Tables Arkansas gov

The legal use of the Tax Tables Arkansas gov is essential for compliance with state tax laws. Taxpayers must utilize these tables to ensure accurate reporting of their income and corresponding tax obligations. Failure to use the correct tax tables can lead to underreporting or overreporting of income, potentially resulting in legal penalties. It is important for individuals and businesses to understand that these tables are an official resource and should be used in accordance with Arkansas tax regulations.

Examples of using the Tax Tables Arkansas gov

Examples of using the Tax Tables Arkansas gov can illustrate how taxpayers navigate their tax obligations. For instance, if a single filer has a taxable income of $50,000, they would locate this amount in the tax table for single filers. The table will indicate the tax rate applicable to that income level, allowing the taxpayer to calculate their state income tax owed. Similarly, a married couple filing jointly with a combined income of $100,000 would follow the same process using the appropriate table for their filing status. These examples highlight the practical application of the tax tables in everyday tax preparation.

Quick guide on how to complete 2016 tax tables arkansasgov

Complete Tax Tables Arkansas gov effortlessly on any device

Online document organization has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Tax Tables Arkansas gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Tax Tables Arkansas gov with ease

- Find Tax Tables Arkansas gov and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you prefer to submit your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Edit and electronically sign Tax Tables Arkansas gov to guarantee excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 tax tables arkansasgov

Create this form in 5 minutes!

How to create an eSignature for the 2016 tax tables arkansasgov

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What are Tax Tables Arkansas gov and how can they benefit my business?

Tax Tables Arkansas gov provide essential information for businesses to comply with state tax regulations. By utilizing these tables, you can ensure accurate tax calculations, ultimately aiding in financial planning and budgeting. Accessing updated tax tables helps in staying compliant with Arkansas state laws.

-

How can airSlate SignNow assist with processing Tax Tables Arkansas gov?

airSlate SignNow streamlines document workflows related to tax management, including processing Tax Tables Arkansas gov. With our eSigning feature, you can securely sign and send tax documents without hassle. This helps in ensuring timely submissions of tax-related filings.

-

Is airSlate SignNow affordable for managing Tax Tables Arkansas gov documentation?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to manage documentation related to Tax Tables Arkansas gov. We offer competitive pricing plans that can fit various business sizes and needs. This allows you to optimize your budget while ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for handling Tax Tables Arkansas gov?

airSlate SignNow includes features like customizable templates, automated reminders, and secure cloud storage for managing Tax Tables Arkansas gov documents. You can easily create, send, and track documents to ensure that all tax-related tasks are handled promptly and efficiently. These tools are designed to simplify the process.

-

Can I integrate airSlate SignNow with other tools for Tax Tables Arkansas gov management?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and tax software to enhance your handling of Tax Tables Arkansas gov. This integration ensures that all your tax data is synchronized and easily accessible, streamlining your overall workflow. You can improve productivity and efficiency through these integrations.

-

How does airSlate SignNow help ensure compliance with Tax Tables Arkansas gov?

With airSlate SignNow, you can stay updated with the latest versions of Tax Tables Arkansas gov, helping your business comply with state tax regulations. Our platform provides easy access to create and manage necessary documents, ensuring that all information is accurate. Timely updates minimize the risk of non-compliance.

-

What types of businesses can benefit from using airSlate SignNow for Tax Tables Arkansas gov?

AirSlate SignNow is designed to benefit a wide range of businesses, from small startups to large enterprises, that need to manage Tax Tables Arkansas gov documentation. Regardless of the size or industry, having an efficient eSignature solution helps in simplifying compliance and enhancing document management. All businesses aiming for efficiency and accuracy will find value.

Get more for Tax Tables Arkansas gov

Find out other Tax Tables Arkansas gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors