Uniform Residential Loan Form pdfFiller

What is the Uniform Residential Loan Application?

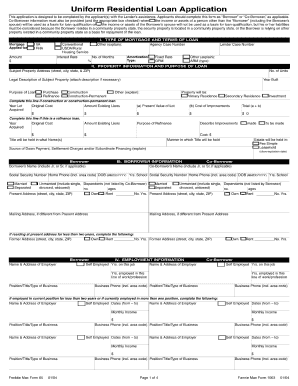

The Uniform Residential Loan Application, often referred to as Form 1003, is a standardized document used by lenders in the United States to collect information from borrowers applying for a residential mortgage. This form captures essential details about the borrower, including personal information, employment history, financial status, and property details. It serves as a foundational tool for lenders to evaluate a borrower's creditworthiness and ability to repay the loan. The uniformity of this application helps streamline the mortgage process across different lenders and ensures that all necessary information is gathered consistently.

Steps to Complete the Uniform Residential Loan Application

Completing the Uniform Residential Loan Application involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather Personal Information: Collect your full name, Social Security number, and contact details.

- Employment History: Provide details about your current and previous employment, including job titles, employer names, and dates of employment.

- Financial Information: List your assets, liabilities, and income sources. This includes bank statements, investment accounts, and any outstanding debts.

- Property Information: Describe the property you intend to purchase or refinance, including its address, type, and estimated value.

- Review and Sign: Carefully review all entered information for accuracy before signing the application. Ensure that all required fields are completed.

Legal Use of the Uniform Residential Loan Application

The Uniform Residential Loan Application is legally recognized in the United States, provided it is completed accurately and submitted in accordance with federal and state regulations. When filled out digitally, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures and documents are legally binding, similar to their paper counterparts. Using a reliable eSignature solution can enhance the legal validity of your application by providing a digital certificate and audit trail.

Key Elements of the Uniform Residential Loan Application

Several key elements are essential to the Uniform Residential Loan Application, which include:

- Borrower Information: Personal details of the borrower, including name, address, and Social Security number.

- Employment and Income: Comprehensive information about the borrower's employment status and income sources.

- Assets and Liabilities: A detailed account of the borrower's financial situation, including assets such as bank accounts and liabilities like loans.

- Property Details: Information about the property being financed, including its type, location, and value.

- Declarations: Statements regarding the borrower's financial history, including any bankruptcies or foreclosures.

How to Obtain the Uniform Residential Loan Application

The Uniform Residential Loan Application can be obtained through various channels. Most lenders provide this form on their websites, often in a downloadable PDF format. Additionally, it can be accessed through financial institutions that offer mortgage services. For those preferring a digital approach, many online platforms offer the ability to fill out and eSign the application directly. This method not only simplifies the process but also ensures that the application is submitted securely and efficiently.

Form Submission Methods

Submitting the Uniform Residential Loan Application can be done through several methods, depending on the lender's requirements:

- Online Submission: Many lenders allow applicants to complete and submit the application electronically through their websites.

- Mail: Applicants can print the completed form and send it via postal mail to the lender's designated address.

- In-Person: Some borrowers may choose to submit the application in person at their lender's office, where they can also ask questions and receive immediate assistance.

Quick guide on how to complete uniform residential loan form pdffiller

Complete Uniform Residential Loan Form Pdffiller effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the instruments necessary to create, modify, and eSign your documents swiftly without delays. Handle Uniform Residential Loan Form Pdffiller on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to adjust and eSign Uniform Residential Loan Form Pdffiller with ease

- Locate Uniform Residential Loan Form Pdffiller and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and eSign Uniform Residential Loan Form Pdffiller to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uniform residential loan form pdffiller

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the uniform residential loan application?

The uniform residential loan application is a standard form used by lenders to gather information from borrowers seeking home loans. It simplifies the application process by providing a uniform format that covers personal, financial, and property details, ensuring a comprehensive review of the application for approval.

-

How does airSlate SignNow facilitate the uniform residential loan application process?

airSlate SignNow streamlines the uniform residential loan application by allowing users to fill out and eSign documents electronically. This process enhances efficiency, reduces paperwork, and accelerates the overall timeline for loan approval, making it easier for borrowers and lenders alike.

-

What are the key features of airSlate SignNow for handling loan applications?

Key features of airSlate SignNow for loan applications include secure eSigning, customizable templates for the uniform residential loan application, automated reminders, and cloud storage for easy access to documents. These features collectively improve collaboration and ensure every step is properly documented.

-

Is airSlate SignNow cost-effective for processing uniform residential loan applications?

Yes, airSlate SignNow offers a cost-effective solution for processing uniform residential loan applications. With competitive pricing plans, businesses can efficiently manage document workflows without incurring hefty costs, making it a practical choice for any lending institution.

-

Can airSlate SignNow integrate with other software for loan processing?

Absolutely! airSlate SignNow can seamlessly integrate with various CRM systems, loan origination software, and other business tools. This integration capability allows users to manage the uniform residential loan application process alongside their existing workflows, enhancing overall productivity.

-

What benefits can lenders expect from using airSlate SignNow for loan applications?

Lenders using airSlate SignNow for the uniform residential loan application can expect faster closing times, reduced administrative burdens, and improved client satisfaction. The platform's user-friendly interface makes it simple for both lenders and borrowers to navigate the application process, leading to a better overall experience.

-

Is it secure to eSign the uniform residential loan application through airSlate SignNow?

Yes, eSigning the uniform residential loan application through airSlate SignNow is highly secure. The platform employs industry-standard encryption and compliance measures, ensuring that all documents are protected and that user data remains confidential throughout the signing process.

Get more for Uniform Residential Loan Form Pdffiller

- Test form 3a answer key

- Drill team permission slip and expectation sheet form

- Cancellation of security interest marion county iowa form

- Form 1192

- Online nm rpd 41109 rev 062010 form

- Lease to own business agreement template form

- Lease to own car agreement template form

- Lease to own equipment agreement template form

Find out other Uniform Residential Loan Form Pdffiller

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free