Iht416 Form

What is the Iht416

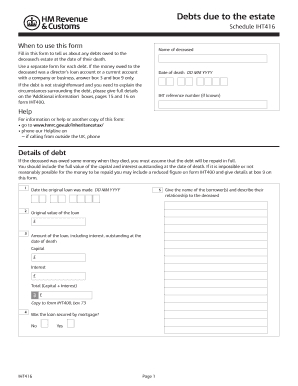

The Iht416 form, also known as the IHT 416, is a crucial document used in the United States for reporting the value of an estate for inheritance tax purposes. This form is typically required when an individual passes away, and their estate needs to be assessed for tax liabilities. The Iht416 form provides a comprehensive overview of the deceased's assets, liabilities, and overall estate valuation, ensuring that the appropriate taxes are calculated and reported accurately.

How to use the Iht416

Using the Iht416 form involves several key steps. First, gather all necessary information regarding the deceased's assets, including real estate, bank accounts, investments, and personal property. Next, accurately fill out the form, ensuring that all values are current and reflect the fair market value at the time of death. It is important to provide detailed descriptions of each asset and liability to avoid any discrepancies. Once completed, the form must be submitted to the appropriate tax authority, along with any required supporting documents.

Steps to complete the Iht416

Completing the Iht416 form involves a systematic approach:

- Collect all relevant financial documents, including bank statements, property deeds, and investment records.

- Determine the fair market value of each asset as of the date of death.

- List all liabilities, such as debts and mortgages, to accurately reflect the net estate value.

- Fill out the Iht416 form, ensuring all information is complete and accurate.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the relevant tax authority along with any required attachments.

Legal use of the Iht416

The Iht416 form is legally binding and must be completed in accordance with federal and state laws governing inheritance and estate taxes. To ensure its legal validity, the form must be filled out accurately and submitted within the specified deadlines. Compliance with the relevant tax regulations is essential to avoid penalties and ensure that the estate is settled according to the law.

Key elements of the Iht416

Several key elements must be included in the Iht416 form to ensure its effectiveness:

- Identification of the deceased, including full name and date of death.

- A detailed inventory of all assets and their respective values.

- A comprehensive list of liabilities associated with the estate.

- Signature of the executor or administrator of the estate, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Iht416 form can vary based on state regulations and the specific circumstances of the estate. Generally, the form must be submitted within a certain period following the date of death, often within nine months. It is crucial to check with local tax authorities for specific deadlines to avoid late fees or penalties.

Quick guide on how to complete iht416

Effortlessly Prepare Iht416 on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Iht416 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

Easily Edit and Electronically Sign Iht416

- Locate Iht416 and click on Get Form to begin.

- Use the provided tools to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Iht416 and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht416

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iht416 and how does it relate to airSlate SignNow?

The iht416 is a key feature of the airSlate SignNow platform that facilitates the efficient signing and management of documents. It enhances the document workflow experience, making it simpler for businesses to eSign and send documents securely.

-

What are the pricing options for airSlate SignNow's iht416 feature?

Pricing for the iht416 functionality within airSlate SignNow varies based on the selected plan. Users can choose from several plans that cater to individual, business, or enterprise needs, ensuring that there's a suitable option for all budget levels.

-

Can I integrate iht416 with other business applications?

Yes, the iht416 feature of airSlate SignNow allows seamless integration with various third-party applications. This ensures that businesses can streamline their workflows by connecting iht416 with tools they already use, enhancing productivity.

-

What benefits does iht416 offer for eSigning documents?

The iht416 feature offers numerous benefits, including increased efficiency and security in eSigning documents. It allows businesses to expedite the signing process while reducing the risk of fraud, providing peace of mind in document management.

-

Is the iht416 feature user-friendly for beginners?

Absolutely! The iht416 feature is designed with user-friendliness in mind. Even those new to electronic signatures will find it intuitive and easy to navigate, thanks to its straightforward interface.

-

How can iht416 improve my business's document management process?

Implementing the iht416 feature can signNowly streamline your document management process. It centralizes eSigning, reduces paper usage, and improves the overall speed and organization of acquiring signatures.

-

Are there any security measures associated with the iht416 feature?

Yes, airSlate SignNow prioritizes security with its iht416 feature. It includes advanced encryption and compliance with industry regulations, ensuring that all signatures and document exchanges are secure and protected.

Get more for Iht416

- Order for appraisal guardianship or conservatorship wisconsin form

- Order to authorize andor confirm salemortgagelease of real estate of individual under guardianship or conservatorship wisconsin form

- Mortgage real estate form

- Wisconsin rights additional form

- Notice removal form 497431024

- Notice removal form 497431025

- Petition termination guardianship form

- Wi modification form

Find out other Iht416

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document