LOUISIANA ESTIMATED TAX DECLARATION VOUCHER Form

What is the Louisiana Estimated Tax Declaration Voucher

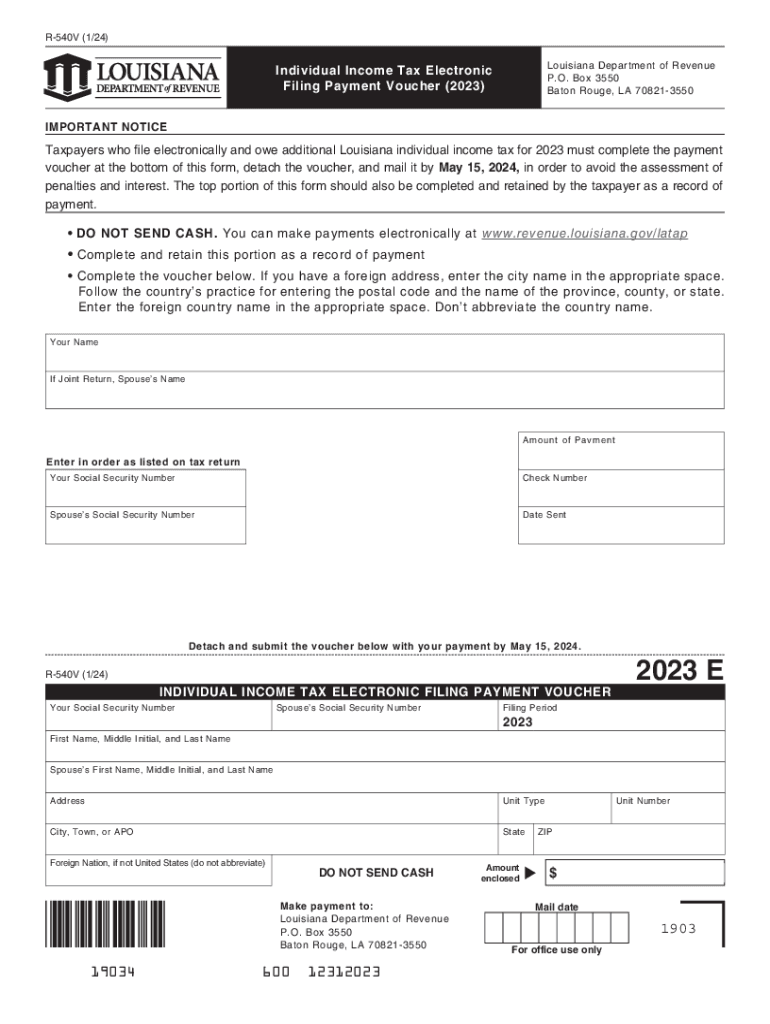

The Louisiana Estimated Tax Declaration Voucher is a crucial document for taxpayers in Louisiana who need to report and pay estimated taxes on income that is not subject to withholding. This form is particularly relevant for individuals who are self-employed, have significant income from sources such as rental properties, or receive dividends and interest. By using this voucher, taxpayers can ensure they meet their tax obligations throughout the year, rather than waiting until the annual tax return is filed.

How to use the Louisiana Estimated Tax Declaration Voucher

To use the Louisiana Estimated Tax Declaration Voucher effectively, taxpayers should first determine their estimated tax liability for the year. This involves calculating expected income and deductions. Once the estimated tax amount is known, the voucher can be filled out with the necessary details, including the taxpayer's name, address, and Social Security number. The completed voucher should then be submitted along with the estimated payment to the Louisiana Department of Revenue by the specified deadlines.

Steps to complete the Louisiana Estimated Tax Declaration Voucher

Completing the Louisiana Estimated Tax Declaration Voucher involves several key steps:

- Gather financial information, including income sources and potential deductions.

- Calculate the estimated tax liability based on current tax rates.

- Fill out the voucher, ensuring all required fields are completed accurately.

- Double-check the calculations for accuracy.

- Submit the voucher along with the payment to the appropriate tax authority.

Key elements of the Louisiana Estimated Tax Declaration Voucher

The Louisiana Estimated Tax Declaration Voucher includes several important elements that taxpayers must complete:

- Taxpayer identification information, such as name and Social Security number.

- Estimated tax payment amount for the current period.

- Payment method selection, whether by check or electronic payment.

- Signature and date to validate the submission.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Louisiana Estimated Tax Declaration Voucher. Generally, estimated tax payments are due quarterly, with deadlines typically falling on April 15, June 15, September 15, and January 15 of the following year. It is essential to adhere to these dates to avoid penalties and interest on late payments.

Penalties for Non-Compliance

Failure to file the Louisiana Estimated Tax Declaration Voucher or to make the required estimated tax payments can result in significant penalties. Taxpayers may incur interest charges on unpaid amounts and face additional penalties for underpayment. Understanding these consequences can help motivate timely compliance with tax obligations.

Quick guide on how to complete louisiana estimated tax declaration voucher

Effortlessly Prepare LOUISIANA ESTIMATED TAX DECLARATION VOUCHER on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the necessary instruments to create, edit, and electronically sign your documents swiftly and without delays. Handle LOUISIANA ESTIMATED TAX DECLARATION VOUCHER on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Simple Steps to Edit and Electronically Sign LOUISIANA ESTIMATED TAX DECLARATION VOUCHER with Ease

- Obtain LOUISIANA ESTIMATED TAX DECLARATION VOUCHER and click Get Form to begin.

- Utilize the tools available to complete your document.

- Mark important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form searches, or mistakes that require reprinting documents. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign LOUISIANA ESTIMATED TAX DECLARATION VOUCHER and guarantee excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct louisiana estimated tax declaration voucher

Create this form in 5 minutes!

How to create an eSignature for the louisiana estimated tax declaration voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a LOUISIANA ESTIMATED TAX DECLARATION VOUCHER?

The LOUISIANA ESTIMATED TAX DECLARATION VOUCHER is a form used by individuals and businesses in Louisiana to report and pay estimated taxes to the state. It helps taxpayers manage their tax liabilities throughout the year rather than making a single payment at tax time.

-

How can airSlate SignNow help with LOUISIANA ESTIMATED TAX DECLARATION VOUCHER?

airSlate SignNow simplifies the process of completing and eSigning the LOUISIANA ESTIMATED TAX DECLARATION VOUCHER by providing an easy-to-use platform. You can seamlessly fill out the required information, sign it electronically, and send it directly to the tax authorities.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your LOUISIANA ESTIMATED TAX DECLARATION VOUCHER provides several benefits, including enhanced efficiency, reduced paperwork, and faster processing times. The platform also offers security features to ensure the confidentiality of your sensitive information.

-

Is the LOUISIANA ESTIMATED TAX DECLARATION VOUCHER available for electronic submission?

Yes, the LOUISIANA ESTIMATED TAX DECLARATION VOUCHER can be submitted electronically. airSlate SignNow allows you to complete your voucher online and submit it directly to the applicable tax authority, simplifying the process and saving you time.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a range of features for managing the LOUISIANA ESTIMATED TAX DECLARATION VOUCHER, including templates, custom branding, and reminders for important deadlines. These features help you stay organized and ensure compliance with tax regulations.

-

How much does airSlate SignNow cost?

airSlate SignNow offers various pricing plans that can accommodate different business needs. Depending on your requirements for handling documents like the LOUISIANA ESTIMATED TAX DECLARATION VOUCHER, you can choose a plan that fits your budget and needs.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow can be integrated with various software applications to enhance your workflow. This capability allows you to streamline the process of completing the LOUISIANA ESTIMATED TAX DECLARATION VOUCHER by connecting it with your existing systems.

Get more for LOUISIANA ESTIMATED TAX DECLARATION VOUCHER

- Application to be consecrated to the office of bishop aabc form

- Ems application form

- Alagappa university accredited with a grade by naac cgpa364 in form

- Cda application form rnli 2018 reliance life insurance

- Photo with plain background customer service point msp msd form

- United kingdom motor vehicle form

- First time buyers declaration form

- Sdlt46 notice of appeal against a penalty stamp duty land tax form

Find out other LOUISIANA ESTIMATED TAX DECLARATION VOUCHER

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship