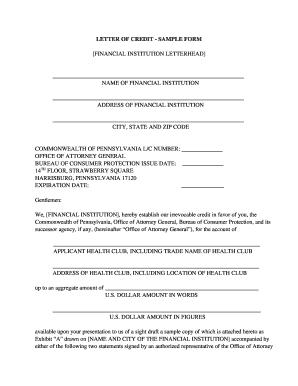

Letter of Credit PDF Form

What is the letter of credit PDF?

A letter of credit PDF is a financial document that guarantees payment from a buyer's bank to a seller, provided that the seller meets the specified terms and conditions outlined in the document. This instrument is commonly used in international trade to mitigate risks associated with non-payment. The letter of credit serves as a secure method of payment, ensuring that the seller receives their funds as long as they fulfill their obligations. The PDF format allows for easy distribution and storage of this important document, making it accessible for both parties involved in the transaction.

Key elements of the letter of credit PDF

Understanding the key elements of a letter of credit PDF is essential for both buyers and sellers. The main components typically include:

- Beneficiary: The party entitled to receive payment.

- Applicant: The buyer who requests the letter of credit.

- Issuing Bank: The bank that issues the letter of credit on behalf of the applicant.

- Amount: The total sum guaranteed by the letter of credit.

- Expiration Date: The date by which the conditions must be met for payment to be made.

- Terms and Conditions: Specific requirements that must be fulfilled by the beneficiary to receive payment.

Each of these elements plays a crucial role in ensuring that the transaction is conducted smoothly and securely.

Steps to complete the letter of credit PDF

Completing a letter of credit PDF involves several important steps to ensure accuracy and compliance with the terms agreed upon by both parties. Follow these steps:

- Obtain the letter of credit template: Download a letter of credit template in PDF format.

- Fill in the applicant's information: Provide the buyer's name, address, and banking details.

- Include beneficiary details: Enter the seller's name and address accurately.

- Specify the amount: Clearly state the total amount to be covered by the letter of credit.

- Outline terms and conditions: Detail the specific requirements that the seller must meet.

- Review and verify: Double-check all information for accuracy and completeness.

- Submit the document: Send the completed PDF to the issuing bank for processing.

Following these steps can help ensure that the letter of credit is executed correctly, facilitating a smoother transaction.

Legal use of the letter of credit PDF

The legal use of a letter of credit PDF is governed by various regulations and standards, including the Uniform Commercial Code (UCC) in the United States. This legal framework ensures that the rights and obligations of both the buyer and seller are protected. For a letter of credit to be considered legally binding, it must meet specific requirements, such as being issued by a recognized financial institution and containing clear terms and conditions. Additionally, compliance with electronic signature laws, such as the ESIGN Act, is essential when executing the document digitally.

Examples of using the letter of credit PDF

Understanding practical examples can clarify how a letter of credit PDF is utilized in real-world scenarios. Common situations include:

- International Trade: A U.S. importer uses a letter of credit to guarantee payment to a foreign supplier upon shipment of goods.

- Real Estate Transactions: A buyer may use a letter of credit to secure financing for a property purchase.

- Construction Projects: Contractors often require letters of credit to ensure payment for materials and labor.

These examples illustrate the versatility and importance of letters of credit in various business contexts.

How to obtain the letter of credit PDF

Obtaining a letter of credit PDF typically involves working with a bank or financial institution. The process generally includes:

- Contacting your bank: Reach out to your bank to inquire about their letter of credit services.

- Providing necessary documentation: Submit any required documents, such as purchase agreements or invoices.

- Completing an application: Fill out the bank's application form for a letter of credit.

- Reviewing terms: Discuss and agree on the terms and conditions with your bank.

- Receiving the PDF: Once approved, the bank will issue the letter of credit in PDF format.

This process ensures that both parties have the necessary documentation to proceed with their transaction securely.

Quick guide on how to complete letter of credit pdf

Effortlessly Prepare Letter Of Credit Pdf on Any Device

Digital document management has gained traction among companies and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents rapidly and without interruptions. Manage Letter Of Credit Pdf on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and Electronically Sign Letter Of Credit Pdf with Ease

- Find Letter Of Credit Pdf and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent parts of the documents or obscure confidential information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal significance as a standard handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Letter Of Credit Pdf and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the letter of credit pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a letter of credit and how does it work?

A letter of credit is a financial document issued by a bank or financial institution that guarantees payment to a seller on behalf of the buyer. It ensures that the seller receives payment upon fulfilling specific conditions outlined in the letter. airSlate SignNow can streamline the process of preparing and signing letters of credit, making it faster and more efficient.

-

How can I create a letter of credit using airSlate SignNow?

Creating a letter of credit with airSlate SignNow is simple. You can choose from pre-made templates or create a customized document from scratch. Our platform allows you to easily input necessary details and eSign for a secure and legally binding agreement.

-

What are the benefits of using airSlate SignNow for letters of credit?

Using airSlate SignNow for letters of credit offers numerous benefits including faster processing times, reduced paperwork, and enhanced security features. The eSigning process is user-friendly, allowing you to manage your documents efficiently while ensuring compliance with legal standards.

-

Is there a cost associated with creating a letter of credit on airSlate SignNow?

Yes, there is a cost to use airSlate SignNow’s features for creating a letter of credit. However, the pricing is competitive and reflects the value of our secure, easy-to-use platform. For detailed pricing plans, you can visit our pricing page or contact our sales team for personalized assistance.

-

Does airSlate SignNow support integrations with other financial systems for letters of credit?

Absolutely! airSlate SignNow provides integrations with various financial systems to facilitate the seamless management of letters of credit. This integration helps streamline workflows and enhances collaboration between your financial service providers and your business operations.

-

Can I track the status of my letter of credit in airSlate SignNow?

Yes, you can easily track the status of your letter of credit in airSlate SignNow. Our platform offers real-time updates and notifications, so you can monitor the progress of the document, ensuring that all parties stay informed at every step of the signing process.

-

What types of businesses benefit from using letters of credit?

Various businesses, especially those engaged in international trade or large transactions, can benefit from using letters of credit. The added security and assurance provided by a letter of credit can help build trust between buyers and sellers. airSlate SignNow offers an ideal solution for these businesses to efficiently prepare and manage letters of credit.

Get more for Letter Of Credit Pdf

- Alabama ground applicators certificate of insurance form

- Irs pub 550 form

- Case investigation form for dengue

- Application for icce examination colombo plan form

- Place value and expanded form matching worksheet

- Fcat seating chart browardk12flus broward k12 fl form

- Paramount theater donation request form

- Dcs ombudsman complaint form idoa public

Find out other Letter Of Credit Pdf

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document