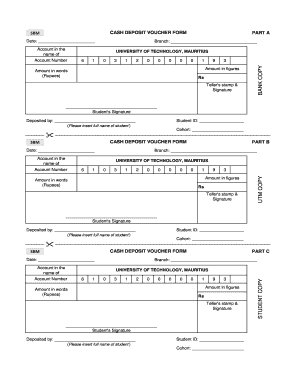

Cash Deposit Voucher Form

What is the Cash Deposit Voucher

A cash deposit voucher is a financial document used to facilitate the deposit of cash into a bank account. It serves as a record of the transaction between the depositor and the bank, ensuring that both parties have a clear understanding of the amount deposited and the account credited. This voucher typically includes details such as the depositor's name, account number, date of the transaction, and the amount being deposited. Understanding what a cash deposit voucher entails is essential for individuals and businesses alike, as it streamlines the process of handling cash transactions securely and efficiently.

How to Use the Cash Deposit Voucher

Using a cash deposit voucher involves several straightforward steps. First, gather the necessary information, including your bank account details and the amount you intend to deposit. Next, fill out the cash deposit voucher accurately, ensuring all required fields are completed. After filling out the voucher, present it along with the cash to the bank teller or use the bank's designated drop-off point. Retain a copy of the voucher for your records, as it serves as proof of the transaction. This process helps maintain accurate financial records and can be crucial for both personal and business accounting.

Steps to Complete the Cash Deposit Voucher

Completing a cash deposit voucher requires attention to detail. Follow these steps for accurate completion:

- Begin by entering the date of the transaction at the top of the voucher.

- Fill in your name and contact information as the depositor.

- Provide your bank account number where the funds will be deposited.

- Indicate the amount of cash being deposited clearly.

- Sign the voucher to validate the transaction.

- Double-check all entries for accuracy before submission.

By following these steps, you ensure that your cash deposit is processed smoothly and that you have a reliable record of the transaction.

Legal Use of the Cash Deposit Voucher

The cash deposit voucher is legally recognized as a binding document when completed correctly. It serves as evidence of the cash transaction and can be used in financial audits or disputes. To ensure its legal validity, it is essential to comply with any specific banking regulations and requirements. Properly filled out vouchers that include the necessary signatures and details are crucial for maintaining compliance with financial laws. Understanding the legal implications of this document can help individuals and businesses protect their financial interests.

Key Elements of the Cash Deposit Voucher

Several key elements make up a cash deposit voucher. These include:

- Depositor Information: Name, address, and contact details of the person making the deposit.

- Account Details: The account number into which the cash is being deposited.

- Date: The date on which the deposit is made.

- Amount: The total cash amount being deposited.

- Signature: The depositor's signature to authorize the transaction.

Each of these elements plays a vital role in ensuring the voucher's accuracy and legality.

Examples of Using the Cash Deposit Voucher

Cash deposit vouchers are commonly used in various scenarios, including:

- Individuals depositing cash from personal savings into their bank accounts.

- Businesses making cash deposits from daily sales to maintain liquidity.

- Non-profit organizations depositing cash donations received during fundraising events.

These examples illustrate the versatility of the cash deposit voucher in different financial contexts, highlighting its importance in maintaining accurate records and facilitating cash transactions.

Quick guide on how to complete cash deposit voucher

Manage Cash Deposit Voucher effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Cash Deposit Voucher on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Cash Deposit Voucher without hassle

- Locate Cash Deposit Voucher and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Cash Deposit Voucher and ensure outstanding communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cash deposit voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a cash deposit slip and how is it used?

A cash deposit slip is a document used by account holders to deposit cash into their bank accounts. It includes details such as account number, amount, and date. With airSlate SignNow, you can easily create, send, and eSign your cash deposit slip, streamlining the deposit process.

-

How does airSlate SignNow enhance the cash deposit slip process?

airSlate SignNow simplifies the cash deposit slip process by allowing users to create and modify slips digitally. This reduces the need for physical paperwork, saves time, and minimizes errors. With our eSignature feature, you can securely sign and send your cash deposit slip in minutes.

-

Is there a cost associated with using airSlate SignNow for a cash deposit slip?

airSlate SignNow offers competitive pricing options tailored to fit various business needs. There are no hidden fees when using our platform to manage your cash deposit slip. We provide cost-effective solutions that enhance efficiency and productivity.

-

Can I customize my cash deposit slip using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your cash deposit slip to meet your specific requirements. You can add your company logo, change the layout, and include any necessary fields. This customization helps maintain your brand identity while ensuring all critical information is captured.

-

What features does airSlate SignNow offer for cash deposit slips?

AirSlate SignNow offers several features for managing cash deposit slips, including templates, eSignatures, and document tracking. These features help ensure that your cash deposit slip process is efficient and secure. Additionally, you can access stored documents anytime to facilitate easy future deposits.

-

Are there integrations available for cash deposit slips with airSlate SignNow?

Absolutely! airSlate SignNow integrates with numerous third-party applications, enhancing the functionality of your cash deposit slip. Integrations with CRMs and accounting tools streamline your financial processes, allowing for smoother document management and data synchronization.

-

How secure is my cash deposit slip with airSlate SignNow?

Security is a top priority at airSlate SignNow. Your cash deposit slip is protected with bank-level encryption and stored securely to prevent unauthorized access. Our commitment to data protection ensures that your sensitive information remains safe during the signing and sending processes.

Get more for Cash Deposit Voucher

Find out other Cash Deposit Voucher

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure