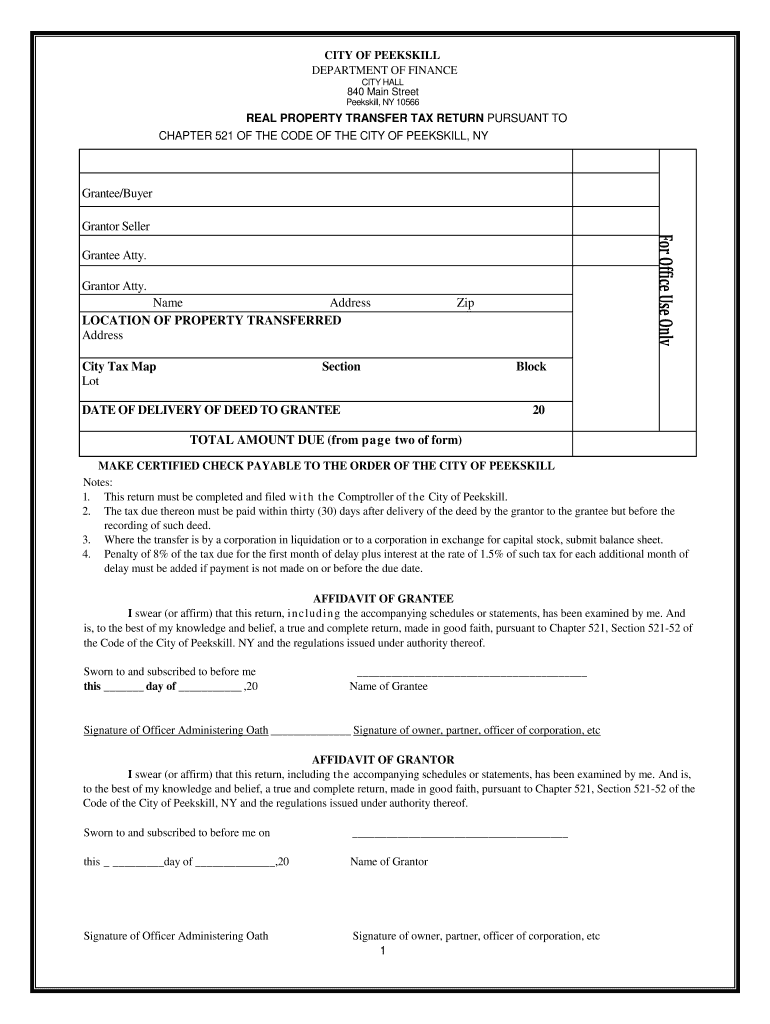

Peekskill Transfer Tax Form

What is the Peekskill Transfer Tax Form

The Peekskill Transfer Tax Form is a document required for the transfer of real property within the city of Peekskill, New York. This form is used to report the sale or transfer of real estate and to calculate the associated local transfer tax. The tax is typically based on the sale price of the property, and the form ensures compliance with local regulations. Proper completion of this form is essential for both buyers and sellers to avoid potential legal issues and to ensure that the transaction is processed smoothly.

How to use the Peekskill Transfer Tax Form

Using the Peekskill Transfer Tax Form involves several steps to ensure accurate completion. First, gather all necessary information regarding the property, including the sale price, property description, and the names of the buyer and seller. Next, fill out the form with this information, ensuring that all fields are completed accurately. After filling out the form, it must be signed by the appropriate parties. Finally, submit the completed form to the relevant city department, along with any required payment for the transfer tax.

Steps to complete the Peekskill Transfer Tax Form

Completing the Peekskill Transfer Tax Form requires careful attention to detail. Follow these steps:

- Obtain the form from the city’s official website or local government office.

- Provide accurate information about the property, including its address and sale price.

- Include the names and contact information of both the buyer and seller.

- Sign and date the form where indicated.

- Submit the form to the city of Peekskill along with any required fees.

Legal use of the Peekskill Transfer Tax Form

The legal use of the Peekskill Transfer Tax Form is crucial for ensuring that real estate transactions comply with local laws. This form serves as an official record of the property transfer and is necessary for the city to collect the appropriate transfer tax. Failure to properly complete and submit this form can result in penalties, including fines or delays in the property transfer process. It is important to understand the legal implications of the form and to ensure that it is filled out correctly.

Required Documents

When completing the Peekskill Transfer Tax Form, several documents may be required to support the transaction. These typically include:

- Proof of identity for both the buyer and seller.

- A copy of the purchase agreement or contract.

- Any prior deeds or titles related to the property.

- Documentation of any exemptions or deductions that may apply.

Form Submission Methods

The Peekskill Transfer Tax Form can be submitted through various methods to accommodate different preferences. These include:

- Online submission through the city’s official website, if available.

- Mailing the completed form to the appropriate city department.

- In-person submission at the local government office during business hours.

Quick guide on how to complete peekskill transfer tax form

Complete Peekskill Transfer Tax Form effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Peekskill Transfer Tax Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest method to modify and eSign Peekskill Transfer Tax Form effortlessly

- Obtain Peekskill Transfer Tax Form and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal authority as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in a few clicks from your preferred device. Alter and eSign Peekskill Transfer Tax Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the peekskill transfer tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Peekskill transfer tax form?

The city of Peekskill transfer tax form is a document required for recording the transfer of property ownership within the city. This form provides details about the transaction, such as the property address and the sale price. Completing this form accurately is vital to ensure compliance with local tax laws.

-

How can airSlate SignNow help with the city of Peekskill transfer tax form?

airSlate SignNow provides a streamlined process for filling out and signing the city of Peekskill transfer tax form. Our easy-to-use platform allows users to electronically sign documents, making it a convenient solution for property transactions. You can save time and reduce errors by utilizing our digital signature capabilities.

-

What are the costs associated with using airSlate SignNow for the city of Peekskill transfer tax form?

airSlate SignNow offers competitive pricing plans that cater to various needs, including a free trial for new users. The costs for utilizing our platform to handle the city of Peekskill transfer tax form depend on the plan you choose, ensuring that you find a solution that fits your budget.

-

Are there any integrations available for the city of Peekskill transfer tax form with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your experience when handling the city of Peekskill transfer tax form. You can connect with popular tools like Google Drive, Salesforce, and others, enabling efficient document management and sharing. This integration streamlines your workflow and enhances productivity.

-

What features does airSlate SignNow offer for managing the city of Peekskill transfer tax form?

airSlate SignNow offers an array of features to simplify managing the city of Peekskill transfer tax form. These include customizable templates, document tracking, and secure cloud storage for easy access. Additionally, our platform supports multiple signing options, ensuring flexibility for all users involved in the transfer.

-

Is airSlate SignNow user-friendly for completing the city of Peekskill transfer tax form?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the city of Peekskill transfer tax form without hassle. The intuitive interface guides you through each step of the signing process, ensuring that even those with minimal technical experience can successfully use it.

-

Can I track the status of my city of Peekskill transfer tax form using airSlate SignNow?

Yes, you can track the status of your city of Peekskill transfer tax form through airSlate SignNow’s document tracking feature. This allows you to monitor when the form is opened, viewed, or signed, providing peace of mind during the transfer process. You’ll always stay informed about the progress of your documentation.

Get more for Peekskill Transfer Tax Form

- Aw8 11a form

- Download evs question paper class 1 cbse cbseedurite com form

- 05 158 a 100295746 form

- Medical estimate template form

- Vanguard trustee certification form 14616452

- Certification of serious health condition form

- Employment application la sdo 02 26 14 acumen fiscal agent form

- Model agency contract template form

Find out other Peekskill Transfer Tax Form

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free