Form 8332 Fillable

What is the Form 8332 Fillable

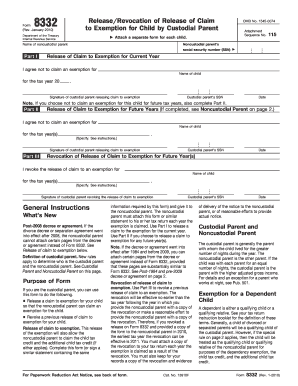

The Form 8332 is a crucial document used by custodial parents to release their claim to the child tax credit and dependency exemption for a child. This form allows the non-custodial parent to claim these benefits on their tax return. The fillable version of the form simplifies the process, enabling users to complete it electronically, ensuring accuracy and efficiency. It is essential for parents who share custody arrangements and want to navigate tax benefits correctly.

How to use the Form 8332 Fillable

Using the Form 8332 fillable is straightforward. First, access the form through a reliable platform that allows for electronic completion. Fill in the required fields, including the names of the parents and the child, as well as the tax year for which the exemption is being claimed. After completing the form, both parents must sign it to validate the agreement. Once signed, the non-custodial parent can submit it with their tax return to claim the benefits.

Steps to complete the Form 8332 Fillable

Completing the Form 8332 fillable involves several key steps:

- Download the fillable form from a trusted source.

- Enter the custodial parent's information, including their name and Social Security number.

- Provide the child's details, such as their name and Social Security number.

- Specify the tax year for which the exemption is being transferred.

- Both parents must sign and date the form to confirm the agreement.

- Save the completed form for your records and submit it with the non-custodial parent's tax return.

Legal use of the Form 8332 Fillable

The legal use of the Form 8332 fillable is governed by IRS regulations. It must be accurately completed and signed by both parents to be considered valid. The form serves as a legal agreement that the custodial parent is relinquishing their right to claim the child as a dependent for the specified tax year. Failure to comply with the requirements may lead to penalties or denial of the tax benefits for the non-custodial parent.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 8332. It is important to follow these guidelines to ensure compliance. The form must be submitted with the non-custodial parent's tax return, and it is advisable to retain a copy for personal records. The IRS also recommends that both parents keep a record of any agreements regarding the dependency exemption to avoid disputes in the future.

Eligibility Criteria

To be eligible to use the Form 8332 fillable, certain criteria must be met. The custodial parent must have the right to claim the child as a dependent in the tax year in question. Additionally, the non-custodial parent must have provided at least half of the child's support during the year. Both parents must agree on the transfer of the exemption, which is formalized through the completion of the form.

Quick guide on how to complete form 8332 fillable

Complete Form 8332 Fillable effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without interruptions. Handle Form 8332 Fillable on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to edit and eSign Form 8332 Fillable with ease

- Obtain Form 8332 Fillable and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8332 Fillable and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8332 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the simplicity 8332 feature offered by airSlate SignNow?

The simplicity 8332 feature in airSlate SignNow allows users to effortlessly manage document workflows with ease. It streamlines the signing process, ensuring that all parties can sign documents quickly and without hassle. This feature is designed to enhance productivity while reducing administrative burdens.

-

How does airSlate SignNow's simplicity 8332 compare in terms of pricing?

The simplicity 8332 pricing model of airSlate SignNow offers exceptional value for businesses of all sizes. Customers can choose from various plans that include advanced features at competitive rates, making it a cost-effective solution. This pricing flexibility ensures you only pay for what you need.

-

What are the primary benefits of using simplicity 8332 with airSlate SignNow?

Using simplicity 8332 with airSlate SignNow provides several key benefits, such as enhanced efficiency and reduced turnaround times for document signing. Additionally, it offers a user-friendly experience that simplifies the entire eSigning process. Overall, it helps businesses save both time and resources.

-

Can I integrate the simplicity 8332 feature into existing software?

Absolutely! The simplicity 8332 feature in airSlate SignNow seamlessly integrates with popular business software and applications. This allows you to enhance your existing workflows without signNow changes to your current systems, ensuring a smooth transition and continued efficiency.

-

Is training required to use simplicity 8332 effectively?

No extensive training is required to use the simplicity 8332 feature in airSlate SignNow. The platform is designed to be intuitive, allowing users to quickly learn and adopt the eSigning process. However, resources and support are available if you need further assistance.

-

What types of documents can I manage with simplicity 8332?

With the simplicity 8332 feature in airSlate SignNow, you can manage a wide range of documents, including contracts, agreements, and forms. This versatility makes it suitable for various industries and use cases. The platform supports multiple file formats for added convenience.

-

How secure is the simplicity 8332 feature?

The simplicity 8332 feature prioritizes security, with robust encryption protocols to protect your documents and sensitive information. airSlate SignNow complies with industry standards and regulations, ensuring that your data remains safe throughout the signing process. You can trust in the security of your transactions.

Get more for Form 8332 Fillable

- City of lake worth building department form

- Shippers domestic truck bill of lading non negotiable freightagents form

- Esl phonics world name nursery 1 phonics class date short vowels o word search circle the short vowel o form

- 8710 form

- Opra open public records act form

- Vacantabandoned property registration form

- Dhs 2402 eng change report form

- Bbq cater contract template form

Find out other Form 8332 Fillable

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free

- How To Sign Kentucky Affidavit of Heirship

- Can I Sign Louisiana Affidavit of Heirship

- How To Sign New Jersey Affidavit of Heirship

- Sign Oklahoma Affidavit of Heirship Myself

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe