Disclaimer of Inheritance Form PDF

What is the Disclaimer of Inheritance Form PDF

The Disclaimer of Inheritance Form PDF is a legal document that allows an individual to refuse or disclaim their right to inherit property or assets from a deceased person's estate. This form is often used when the inheritor does not wish to accept the inheritance due to various reasons, such as tax implications or personal circumstances. By completing this form, the individual formally indicates their decision to renounce their claim to the inheritance, which can have significant legal implications for the distribution of the deceased's assets.

How to Use the Disclaimer of Inheritance Form PDF

To effectively use the Disclaimer of Inheritance Form PDF, follow these steps:

- Download the form from a reliable source or create a custom template that meets your state's legal requirements.

- Fill in the necessary details, including your name, the name of the deceased, and a description of the inheritance being disclaimed.

- Sign and date the form in the presence of a notary public if required by your state.

- Submit the completed form to the executor of the estate or the appropriate court, ensuring that it is filed within the stipulated timeframe.

Steps to Complete the Disclaimer of Inheritance Form PDF

Completing the Disclaimer of Inheritance Form PDF involves several key steps:

- Review the form to understand all sections and requirements.

- Provide your personal information accurately, including your address and contact details.

- Clearly state your intention to disclaim the inheritance and specify the assets involved.

- Sign the form, ensuring that your signature matches the name provided.

- Have the form notarized if required, as this adds an extra layer of authenticity.

- Keep a copy of the completed form for your records before submission.

Legal Use of the Disclaimer of Inheritance Form PDF

The legal use of the Disclaimer of Inheritance Form PDF is governed by state laws, which may vary. Generally, the form must be executed in accordance with the laws of the state where the deceased resided. It is crucial to ensure that the disclaimer is filed within a specific timeframe, often within nine months of the decedent's death, to be legally effective. Failure to comply with these legal requirements may result in the disclaimer being invalidated, allowing the inheritance to pass to the disclaimant.

Key Elements of the Disclaimer of Inheritance Form PDF

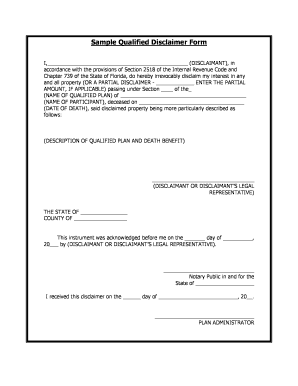

When preparing the Disclaimer of Inheritance Form PDF, certain key elements must be included:

- Your full legal name and contact information.

- The name of the deceased and details of the estate.

- A clear statement of your intention to disclaim the inheritance.

- A description of the specific assets being disclaimed.

- Your signature and date of completion.

- Notary acknowledgment if required by law.

State-Specific Rules for the Disclaimer of Inheritance Form PDF

Each state has its own rules regarding the Disclaimer of Inheritance Form PDF. It is important to familiarize yourself with the specific requirements in your state, including:

- The timeframe for filing the disclaimer.

- Whether notarization is necessary.

- Any additional documentation that may be required.

- How the disclaimer affects the distribution of the estate.

Quick guide on how to complete disclaimer of inheritance form pdf

Complete Disclaimer Of Inheritance Form Pdf effortlessly on any device

Online document management has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without complications. Manage Disclaimer Of Inheritance Form Pdf on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to edit and eSign Disclaimer Of Inheritance Form Pdf with ease

- Obtain Disclaimer Of Inheritance Form Pdf and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information carefully and click on the Done button to preserve your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or shareable link, or download it directly to your computer.

Put an end to lost or misplaced files, painstaking form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign Disclaimer Of Inheritance Form Pdf and ensure clear communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the disclaimer of inheritance form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a disclaimer of inheritance form PDF, and why is it important?

A disclaimer of inheritance form PDF is a legal document that allows an heir to refuse their inheritance rights. This form is crucial for preventing any future claims against one's assets and ensuring that the inheritance is passed down according to the deceased's wishes. Understanding how to use this form can help simplify estate management.

-

How can I create a disclaimer of inheritance form PDF using airSlate SignNow?

Creating a disclaimer of inheritance form PDF with airSlate SignNow is easy. You can start by selecting a template from our library or uploading your document directly. Our intuitive interface allows for quick editing and customization, ensuring your form meets legal standards effortlessly.

-

Is there a cost associated with using airSlate SignNow for a disclaimer of inheritance form PDF?

Yes, airSlate SignNow offers affordable pricing plans that cater to various needs. Depending on the features you choose, you can access essential tools for eSigning and document management, making it a cost-effective solution for handling a disclaimer of inheritance form PDF and other legal documents.

-

What features does airSlate SignNow offer for managing a disclaimer of inheritance form PDF?

AirSlate SignNow provides a range of features, including electronic signatures, document sharing, and secure cloud storage for your disclaimer of inheritance form PDF. The platform also allows real-time tracking and audit trails to ensure that your documents are managed with maximum efficiency and security.

-

Can I integrate airSlate SignNow with other applications for managing a disclaimer of inheritance form PDF?

Yes, airSlate SignNow supports integrations with numerous applications, including CRM and document management systems. This allows users to seamlessly incorporate the disclaimer of inheritance form PDF into their existing workflows, enhancing productivity and collaboration across teams.

-

What are the benefits of using an electronic disclaimer of inheritance form PDF?

Using an electronic disclaimer of inheritance form PDF with airSlate SignNow offers numerous benefits, including speed, efficiency, and reduced errors. Electronic forms streamline the signing process, eliminate paperwork, and provide easy access to essential documents from anywhere. This enhances the overall user experience signNowly.

-

Is it legally binding to sign a disclaimer of inheritance form PDF electronically?

Yes, a disclaimer of inheritance form PDF signed electronically through airSlate SignNow is legally binding. The platform complies with e-signature laws, ensuring that your electronic signature holds the same validity as a handwritten one. This makes it a reliable choice for legal and estate planning purposes.

Get more for Disclaimer Of Inheritance Form Pdf

- City of cincinnati annual reconciliation form

- Pwpds form

- Asthma medication administration formoffice of school

- Reportable incidents and notable occurrences bissnybborgb form

- Fhcda consent form 2

- Staff action plan opwdd form

- To prevent delays in processing your prior authorization request fill out this form in its entirety

- Superimposed major medical claim form osaunion osaunion

Find out other Disclaimer Of Inheritance Form Pdf

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online