DSS EA 320 0402 SELF EMPLOYMENT LEDGER State Sd Us Form

What is the Nebraska Self Employment Ledger?

The Nebraska self employment ledger is a crucial document for individuals who operate their own businesses in Nebraska. This ledger serves as a record of income and expenses, helping self-employed individuals track their financial activities throughout the year. It is particularly useful for tax purposes, as it allows users to accurately report their earnings and deductions when filing taxes. Maintaining an organized ledger can simplify the process of preparing for tax season and ensure compliance with state regulations.

Key Elements of the Nebraska Self Employment Ledger

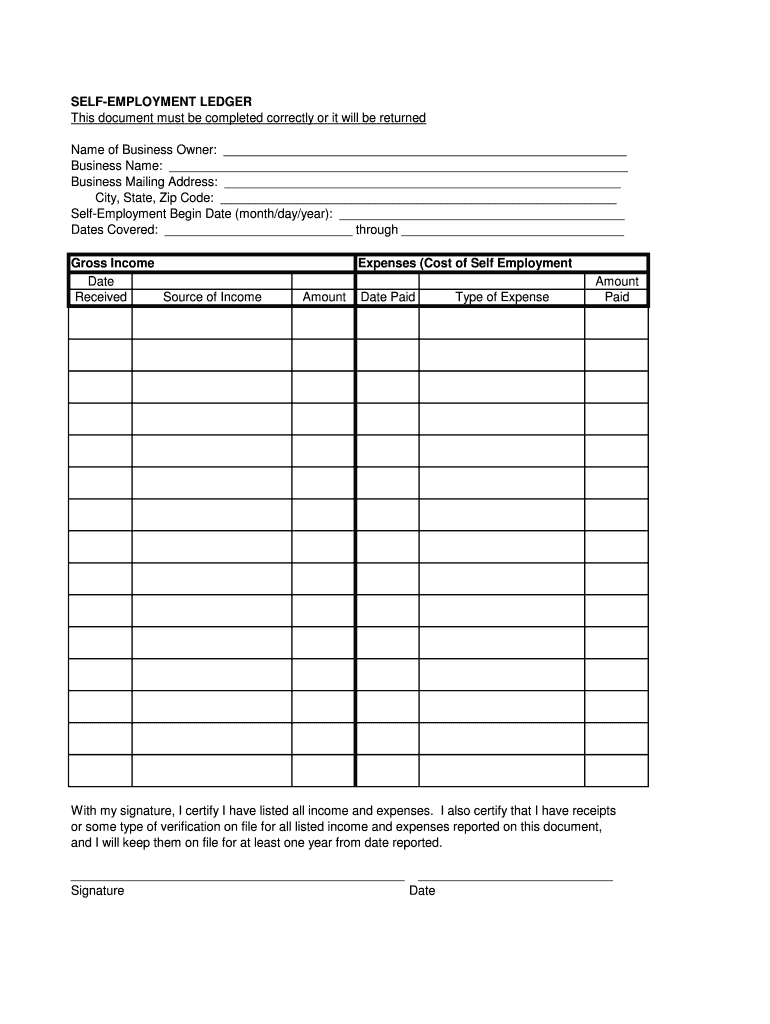

When filling out the Nebraska self employment ledger, there are several key elements to include:

- Date: Record the date of each transaction to maintain a chronological order.

- Description: Provide a brief description of the income or expense to clarify its nature.

- Income Amount: Document the amount earned from each source of income.

- Expense Amount: Note all business-related expenses, including receipts where applicable.

- Net Profit/Loss: Calculate the difference between total income and total expenses to determine your net profit or loss for the period.

Steps to Complete the Nebraska Self Employment Ledger

Completing the Nebraska self employment ledger involves several straightforward steps:

- Gather all financial documents, including invoices, receipts, and bank statements.

- Start with the first transaction of the reporting period and enter the date, description, and amounts in the appropriate columns.

- Continue to record each transaction as it occurs, ensuring all entries are accurate and up to date.

- At the end of the reporting period, total the income and expenses to calculate your net profit or loss.

- Review the completed ledger for accuracy before using it for tax reporting.

Legal Use of the Nebraska Self Employment Ledger

The Nebraska self employment ledger is not only a useful tool for personal organization but also serves a legal purpose. It can be used to substantiate income claims during audits or disputes with the IRS or state tax authorities. Keeping detailed and accurate records is essential for compliance with tax laws and can protect self-employed individuals from potential penalties. It is advisable to retain copies of the ledger and any supporting documents for at least three years, as this is the typical period for tax audits.

Examples of Using the Nebraska Self Employment Ledger

Self-employed individuals can use the Nebraska self employment ledger in various scenarios:

- A freelance graphic designer can track income from different clients and expenses related to software subscriptions and marketing materials.

- A small business owner may document sales revenue and operational costs, such as rent and utilities, to assess profitability.

- A consultant can record fees earned for services rendered and associated travel expenses to ensure accurate tax reporting.

IRS Guidelines for Self Employment Record Keeping

The IRS provides specific guidelines for self-employed individuals regarding record keeping. According to IRS regulations, it is essential to maintain accurate records of all income and expenses. This includes keeping receipts, invoices, and any other documentation that supports the entries in the Nebraska self employment ledger. The IRS recommends using a consistent method for recording transactions, whether through a digital ledger or a paper format, to ensure clarity and reliability during tax filing.

Quick guide on how to complete dss ea 320 0402 self employment ledger state sd us

Effortlessly prepare DSS EA 320 0402 SELF EMPLOYMENT LEDGER State sd us on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents swiftly without delays. Handle DSS EA 320 0402 SELF EMPLOYMENT LEDGER State sd us on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and electronically sign DSS EA 320 0402 SELF EMPLOYMENT LEDGER State sd us with ease

- Locate DSS EA 320 0402 SELF EMPLOYMENT LEDGER State sd us and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your changes.

- Choose your delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management requirements with just a few clicks from any device you prefer. Edit and electronically sign DSS EA 320 0402 SELF EMPLOYMENT LEDGER State sd us and ensure outstanding communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dss ea 320 0402 self employment ledger state sd us

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Nebraska self employment ledger?

A Nebraska self employment ledger is a tool designed to help self-employed individuals in Nebraska track their income and expenses efficiently. This ledger simplifies financial management, allowing users to maintain clear records for tax purposes or business analysis.

-

How can airSlate SignNow assist with managing a Nebraska self employment ledger?

airSlate SignNow provides a user-friendly platform for creating, signing, and managing your Nebraska self employment ledger. With its electronic signatures and document management features, you can ensure your financial records are secure and accessible anytime.

-

What benefits does a Nebraska self employment ledger offer?

Using a Nebraska self employment ledger helps you keep track of all your business-related finances, making tax preparation much simpler and more accurate. It enhances your ability to identify potential deductions and manage cash flow effectively.

-

Is airSlate SignNow suitable for small businesses in Nebraska using a self employment ledger?

Yes, airSlate SignNow is a cost-effective solution for small businesses in Nebraska that need to manage their self employment ledger. Its features cater to the specific needs of small business owners by streamlining document signing and storage.

-

What features does airSlate SignNow offer for a Nebraska self employment ledger?

airSlate SignNow includes features such as secure document storage, electronic signatures, easy access from any device, and customizable templates for your Nebraska self employment ledger. These features enhance productivity and simplify the document workflow.

-

Can I integrate airSlate SignNow with other software for my Nebraska self employment ledger?

Absolutely! airSlate SignNow offers various integrations with popular accounting and project management software, making it easy to maintain your Nebraska self employment ledger alongside other business tools. This ensures seamless data flow between applications.

-

What is the pricing structure for airSlate SignNow when creating a Nebraska self employment ledger?

airSlate SignNow provides flexible pricing plans, allowing users to choose a plan that best suits their needs for managing a Nebraska self employment ledger. You can find affordable options whether you're a solo entrepreneur or a larger small business.

Get more for DSS EA 320 0402 SELF EMPLOYMENT LEDGER State sd us

- Credit card pay form gov uk

- Kyops form

- Ese teacher input form

- Chapter 7 proteins and fats worksheet answer key form

- Texas death certificate form

- Bf1us application form ny i danmark nyidanmark

- Mississippi agreement or contract for deed for sale and purchase of real estate aka land or executory contract form

- Academic records college withdrawal form bhcc mass

Find out other DSS EA 320 0402 SELF EMPLOYMENT LEDGER State sd us

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy