Mi 1040v Form

What is the Mi 1040v Form

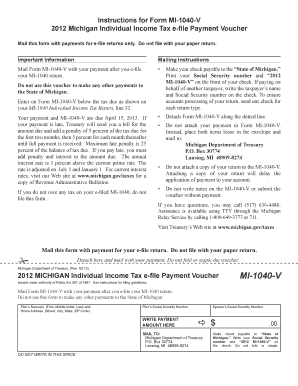

The Mi 1040v Form is a payment voucher used by taxpayers in Michigan when submitting their state income tax returns. This form is essential for individuals who owe taxes and prefer to make a payment along with their tax return. By including the Mi 1040v Form, taxpayers can ensure that their payment is properly credited to their account. It is specifically designed to facilitate the processing of tax payments and to streamline the overall filing process for Michigan residents.

How to use the Mi 1040v Form

Using the Mi 1040v Form involves a few straightforward steps. First, ensure that you have completed your Mi 1040 tax return. Once your return is ready, fill out the Mi 1040v Form with the required payment information. This includes the amount you owe and your personal details, such as your name and address. After completing the form, attach it to your tax return and submit it either by mail or electronically, depending on your filing method. This ensures that your payment is processed correctly and efficiently.

Steps to complete the Mi 1040v Form

Completing the Mi 1040v Form requires careful attention to detail. Follow these steps:

- Obtain the Mi 1040v Form from the Michigan Department of Treasury website or through tax preparation software.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount of tax you are paying with this voucher.

- Review the form for accuracy to avoid any delays in processing.

- Submit the form along with your Mi 1040 tax return.

Legal use of the Mi 1040v Form

The Mi 1040v Form is legally binding when filled out and submitted according to the guidelines set forth by the Michigan Department of Treasury. It serves as an official record of your tax payment and must be completed accurately to ensure compliance with state tax laws. When filed correctly, this form helps prevent penalties and interest on unpaid taxes, making it an important component of the tax filing process.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Mi 1040v Form. Typically, the deadline for submitting your state income tax return, along with the Mi 1040v Form, is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes in deadlines due to specific circumstances, such as extensions or state-specific regulations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Mi 1040v Form. The form can be filed online through various tax preparation software that supports Michigan state taxes. Alternatively, taxpayers can print the completed form and mail it to the appropriate address provided by the Michigan Department of Treasury. In-person submission is also an option at designated tax offices, ensuring that your payment is processed securely and efficiently.

Quick guide on how to complete mi 1040v form

Complete Mi 1040v Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Mi 1040v Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Mi 1040v Form with ease

- Locate Mi 1040v Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device of your choice. Modify and eSign Mi 1040v Form to ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi 1040v form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mi 1040v Form and why is it important?

The Mi 1040v Form is a payment voucher that individuals use when submitting their Michigan income tax returns. It is important as it helps ensure that payments are correctly applied to your tax account, preventing any potential delays or errors in processing your tax return.

-

How can airSlate SignNow help with the Mi 1040v Form?

airSlate SignNow simplifies the process of signing and sending the Mi 1040v Form. With our easy-to-use platform, you can quickly eSign this essential document, ensuring it is sent efficiently and securely to the Michigan Department of Treasury.

-

What features does airSlate SignNow offer for handling forms like the Mi 1040v Form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking of document status. These features help expedite the completion and submission of the Mi 1040v Form while maintaining compliance with legal standards.

-

Is airSlate SignNow a cost-effective solution for managing the Mi 1040v Form?

Yes, airSlate SignNow provides a cost-effective solution for managing documents like the Mi 1040v Form. Our pricing plans are designed to fit various business needs, ensuring you can manage your tax documents without overspending.

-

Can I integrate airSlate SignNow with other applications to manage the Mi 1040v Form?

Absolutely! airSlate SignNow integrates seamlessly with multiple applications like Google Drive, Dropbox, and more. This allows you to streamline your workflow when dealing with the Mi 1040v Form and other important documents.

-

What are the benefits of using airSlate SignNow for the Mi 1040v Form?

Using airSlate SignNow for the Mi 1040v Form offers numerous benefits, including enhanced security, faster processing times, and the ability to track document activity. These advantages signNowly improve your overall experience when handling tax-related documents.

-

How secure is airSlate SignNow when working with the Mi 1040v Form?

airSlate SignNow takes security seriously, utilizing advanced encryption methods to protect your data, including the Mi 1040v Form. This ensures that your sensitive financial information remains confidential and secure throughout the signing process.

Get more for Mi 1040v Form

- Www homeszz comcounty of fairfax taxescounty of fairfax taxes real estate homeszz com form

- Www esd whs milportals54retiree change of address requeststate tax withholding form

- Business registration application for income tax edpnc com form

- Otc 921 tax year 2024 revised 11 name form

- Alt w 9 form

- Tax year personal income tax formsdepartment of taxes

- Gdc application form

- Request for mutual exchange form bdc non bdc tenant

Find out other Mi 1040v Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document