940 Form

What is the 940 form?

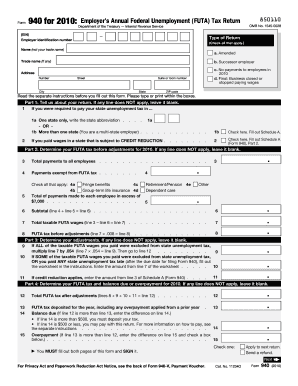

The 940 form, also known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a tax document used by employers in the United States. It is filed annually to report and pay federal unemployment taxes. Employers are responsible for paying this tax, which funds unemployment benefits for workers who have lost their jobs. The form provides the IRS with essential information regarding the total wages paid to employees and the amount of FUTA tax owed. Understanding the 940 form is crucial for businesses to ensure compliance with federal tax regulations.

Steps to complete the 940 form

Completing the 940 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including total wages paid to employees and any applicable deductions. Next, fill out the form by providing your business details, including the employer identification number (EIN) and the reporting period. Calculate the FUTA tax owed based on the wages reported. Ensure that all calculations are accurate to avoid penalties. Finally, review the completed form for any errors before submitting it to the IRS by the designated deadline.

IRS Guidelines for the 940 form

The IRS provides specific guidelines for completing and filing the 940 form. Employers must adhere to these guidelines to ensure compliance. Key points include understanding the eligibility criteria for filing, knowing the tax rates applicable for the reporting year, and being aware of any changes in regulations. Additionally, the IRS outlines the necessary documentation that should accompany the form, such as records of wages paid and any adjustments made throughout the year. Familiarizing yourself with these guidelines helps prevent errors and ensures timely submission.

Filing Deadlines / Important Dates

Filing the 940 form requires adherence to specific deadlines to avoid penalties. Generally, the form must be filed by January 31 of the year following the reporting period. If you are making a payment, ensure it is submitted by the same date. Employers who file electronically may have different deadlines, so it is essential to check the IRS website for the most current information. Keeping track of these important dates helps businesses maintain compliance with federal tax obligations.

Legal use of the 940 form

The legal use of the 940 form is governed by federal tax laws. Employers must file the form annually to report their FUTA tax liability accurately. Failure to file or inaccuracies in reporting can lead to penalties and interest charges. The form serves as a legal document that confirms an employer's compliance with federal unemployment tax obligations. It is important to ensure that all information provided is truthful and complete, as discrepancies may result in audits or further legal action.

Digital vs. Paper Version of the 940 form

Employers have the option to file the 940 form either digitally or on paper. The digital version allows for quicker processing and may reduce the likelihood of errors. Filing electronically can streamline the submission process and provide immediate confirmation of receipt. Conversely, the paper version requires mailing to the appropriate IRS address, which may result in longer processing times. Both methods are legally valid, but choosing the digital route often enhances efficiency and compliance.

Quick guide on how to complete 940

Complete 940 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage 940 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign 940 with ease

- Obtain 940 and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choosing. Modify and eSign 940 and facilitate seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 940

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 940 form 2015, and why is it important?

The 940 form 2015 is an annual report used by employers to report their Federal Unemployment Tax Act (FUTA) tax liabilities. It is important for businesses to complete this form accurately to remain compliant with tax regulations and avoid penalties.

-

How can airSlate SignNow help with completing the 940 form 2015?

airSlate SignNow streamlines the process of filling out and submitting the 940 form 2015 by offering easy-to-use eSignature features and document management tools. This ensures that your forms are completed accurately and submitted on time, reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 940 form 2015?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those who need to manage the 940 form 2015 and other tax documents. The cost is competitive and reflects the range of features provided, making it an affordable solution for businesses.

-

What features does airSlate SignNow offer for handling the 940 form 2015?

airSlate SignNow provides features such as customizable templates, secure document sharing, and electronic signatures, all essential for efficiently managing the 940 form 2015. These features help businesses ensure compliance and streamline their filing process.

-

Can I integrate airSlate SignNow with other software for handling the 940 form 2015?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and HR software, making it easy to import or export data related to the 940 form 2015. This integration ensures that your workflow is smooth and efficient.

-

What are the benefits of using airSlate SignNow for the 940 form 2015?

Using airSlate SignNow for the 940 form 2015 offers increased productivity through automated workflows and remote signing capabilities. Additionally, it enhances document security and reduces turnaround times, allowing businesses to focus on their core operations.

-

Is airSlate SignNow user-friendly for handling the 940 form 2015?

Yes, airSlate SignNow is designed with user experience in mind, offering an intuitive interface that's easy to navigate. This makes it simple for users to manage the 940 form 2015, regardless of their tech-savvy level.

Get more for 940

- Lcsw renewal form oregon gov oregon

- South carolina building permit form

- Planning ampamp development formerly building ampamp zoning jo daviess county

- Sc moncks corner business form

- Sc business license renewal form

- Sc city columbia business license form

- Business personal property return aiken county aikencountysc form

- Pursuant to section 33 42 45 of the 1976 s form

Find out other 940

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document