Form 9061

What is the Form 9061

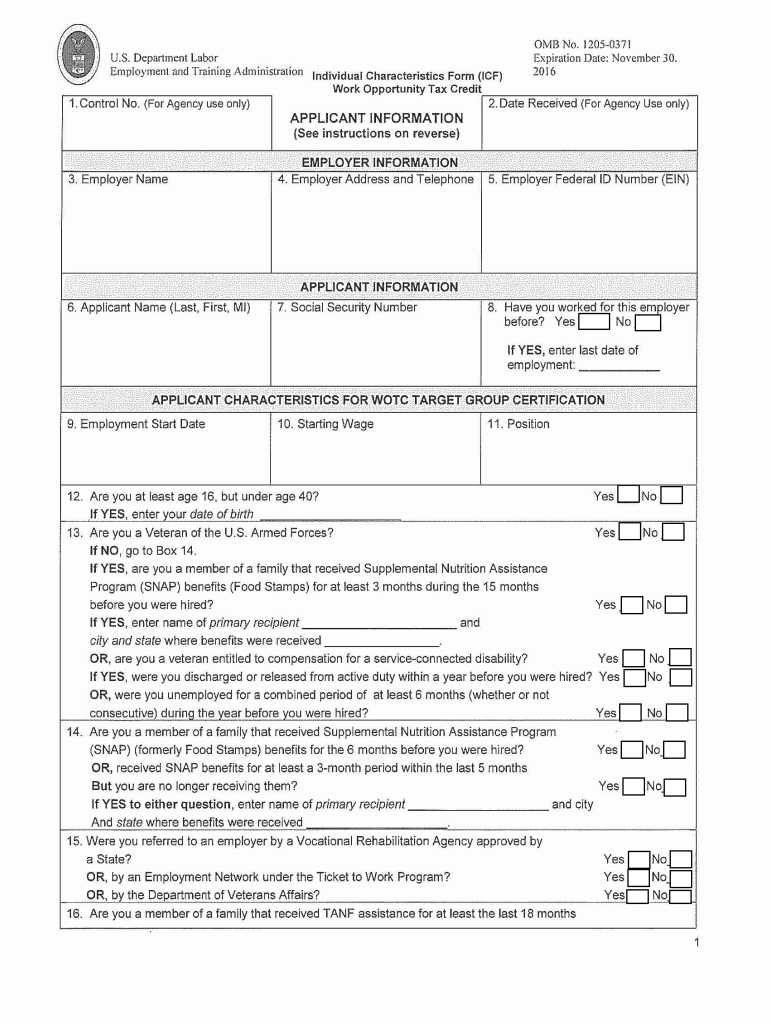

The Form 9061, also known as the "Qualified Information Return," is a tax form used primarily by employers to report information about their employees. This form is essential for compliance with federal tax regulations and is often required for various employment-related filings. It helps the Internal Revenue Service (IRS) track employment and income data, ensuring that individuals are accurately reporting their earnings and tax obligations.

How to use the Form 9061

Using the Form 9061 involves several steps to ensure accurate completion and submission. First, gather all necessary information about the employee, including their name, Social Security number, and employment details. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once completed, the form can be submitted electronically or via mail, depending on the employer's preference and IRS guidelines. Utilizing digital tools can streamline this process, making it easier to manage and store the form securely.

Steps to complete the Form 9061

Completing the Form 9061 requires attention to detail. Follow these steps for successful completion:

- Gather employee information, including name, Social Security number, and address.

- Fill in the employer's information, including name, address, and Employer Identification Number (EIN).

- Complete the sections regarding employment status and any applicable tax withholding information.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 9061

The legal use of the Form 9061 is governed by IRS regulations. It is crucial for employers to ensure that the form is filled out correctly and submitted on time to avoid potential penalties. The form serves as a record of employment and income, which can be referenced in case of audits or disputes. Compliance with all applicable laws and regulations is essential to maintain the legal validity of the form.

Key elements of the Form 9061

Understanding the key elements of the Form 9061 is vital for accurate reporting. Important components include:

- Employee's personal information: This includes their full name, Social Security number, and address.

- Employer's details: The employer must provide their name, address, and EIN.

- Employment status: Indicating whether the employee is full-time, part-time, or seasonal.

- Tax withholding information: This section details any federal tax withholdings applicable to the employee.

Form Submission Methods

The Form 9061 can be submitted through various methods, depending on the employer's preference and IRS requirements. Options include:

- Online submission: Many employers choose to submit the form electronically through IRS-approved platforms, which can enhance efficiency and tracking.

- Mail submission: Employers can also print the completed form and send it via postal service to the appropriate IRS address.

- In-person submission: In certain cases, forms may be submitted directly at designated IRS offices, although this method is less common.

Quick guide on how to complete form 9061

Effortlessly Prepare Form 9061 on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Handle Form 9061 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Form 9061 with Ease

- Locate Form 9061 and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with specialized tools offered by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate concerns of lost or disorganized files, tedious form navigation, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and eSign Form 9061 to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 9061

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 9061 and why do I need it?

Form 9061, also known as the 'Supplemental Employment Certification', is essential for businesses participating in the Work Opportunity Tax Credit (WOTC) program. This form helps determine the eligibility of employees and allows companies to claim tax credits. Using airSlate SignNow to manage Form 9061 streamlines the process, making it easy to eSign and submit the document electronically.

-

How can airSlate SignNow help with filling out Form 9061?

airSlate SignNow provides an intuitive platform that simplifies the completion of Form 9061. With its user-friendly interface, you can easily fill out and customize the form according to your business needs. Additionally, you can collect electronic signatures seamlessly, ensuring a quick and efficient submission process.

-

Is there a cost associated with using airSlate SignNow for Form 9061?

Yes, airSlate SignNow offers affordable pricing plans that cater to various business sizes and needs. The cost includes access to features that streamline the eSigning process for Form 9061 and other important documents. You can choose a plan that best fits your budget while still enjoying all the benefits of electronic document management.

-

What are the key features of airSlate SignNow for managing Form 9061?

Key features of airSlate SignNow for handling Form 9061 include customizable templates, electronic signatures, and secure document storage. These tools greatly enhance the user experience by providing an efficient way to prepare, send, and manage Form 9061. Furthermore, the platform supports real-time tracking of document status, allowing users to stay updated on their submissions.

-

Can I integrate airSlate SignNow with other applications for managing Form 9061?

Yes, airSlate SignNow offers numerous integrations with popular applications such as CRM systems, project management tools, and cloud storage services. This capability allows for seamless data transfer and better management of Form 9061 across different platforms. By integrating these tools, you can enhance your workflow and make the documentation process more efficient.

-

What benefits does airSlate SignNow provide for eSigning Form 9061?

Using airSlate SignNow for eSigning Form 9061 offers multiple benefits, including time savings, reduced paper usage, and improved workflow efficiency. The platform enables instant signatures, which speeds up the processing time for your forms. Additionally, it enhances document security and compliance, ensuring your Form 9061 is handled accurately.

-

Is it easy to get started with airSlate SignNow for Form 9061?

Absolutely! Getting started with airSlate SignNow to manage Form 9061 is simple and user-friendly. You can easily create an account, access pre-built templates, and start filling out the form right away. The platform also offers tutorials to help you navigate through the process seamlessly.

Get more for Form 9061

- Cpy document wisconsin state legislature legis wisconsin form

- Www irs govretirement plansverifying rolloververifying rollover contributions to plansinternal revenue form

- California pre kindergarten and school immunization record form

- Forms 440237545

- Fas business servicesthe university of texas at austin form

- Termination of email contract template form

- Termination of service contract template form

- Termination of real estate by buyer contract template form

Find out other Form 9061

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online