Nr5 2018

What is the NR5 Form?

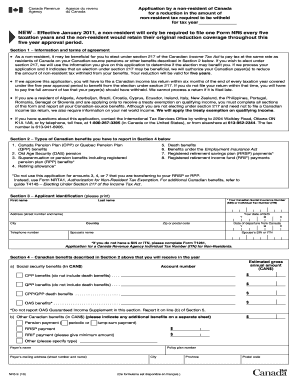

The NR5 form is a Canadian tax document specifically designed for non-residents of Canada who are applying for a reduction in withholding tax on certain types of income. This form is essential for individuals who earn income from Canadian sources, such as dividends, interest, or royalties, and wish to claim a lower tax rate based on their residency status and applicable tax treaties. By completing the NR5 form, non-residents can ensure that they are not overtaxed on their earnings in Canada.

How to Use the NR5 Form

To effectively use the NR5 form, non-residents must first determine their eligibility based on their residency status and the income types they receive. Once eligibility is confirmed, the individual should fill out the form accurately, providing all required personal information, including their name, address, and details about the income in question. After completing the form, it must be submitted to the Canada Revenue Agency (CRA) along with any necessary supporting documents to validate the claim for reduced withholding tax.

Steps to Complete the NR5 Form

Completing the NR5 form involves several key steps:

- Gather necessary documents, including proof of non-residency and any relevant tax treaty information.

- Fill out the NR5 form with accurate personal details and income information.

- Review the form for completeness and correctness to avoid delays in processing.

- Submit the completed form to the CRA, ensuring that all supporting documents are included.

Following these steps carefully can help streamline the process and reduce the risk of errors that could affect the outcome of the application.

Legal Use of the NR5 Form

The NR5 form is legally binding when filled out correctly and submitted according to the regulations set forth by the CRA. It is crucial for non-residents to understand that submitting false information or failing to comply with the requirements can lead to penalties or denial of the tax relief sought. The form must be used in accordance with Canadian tax laws and any applicable international tax treaties to ensure its validity.

Eligibility Criteria for the NR5 Form

To be eligible to submit the NR5 form, individuals must meet specific criteria:

- They must be considered a non-resident of Canada for tax purposes.

- The income for which they are claiming a reduction must be subject to withholding tax.

- They should have a valid tax identification number from their country of residence.

- They must provide documentation that supports their residency status and income type.

Meeting these criteria is essential for a successful application and to avoid complications with the CRA.

Required Documents for the NR5 Form

When submitting the NR5 form, non-residents must include several supporting documents to substantiate their claims:

- Proof of non-residency, such as a tax residency certificate from their home country.

- Details of the income being reported, including any relevant tax treaty provisions.

- Identification documents, such as a passport or national ID.

Providing these documents helps ensure that the CRA can process the NR5 form efficiently and accurately.

Quick guide on how to complete nr5

Complete Nr5 effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Handle Nr5 on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Nr5 with ease

- Obtain Nr5 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Revise and eSign Nr5 and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nr5

Create this form in 5 minutes!

How to create an eSignature for the nr5

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NR5 form and how can airSlate SignNow help with it?

The NR5 form is a document used by non-residents to request a waiver on certain Canadian taxes. airSlate SignNow streamlines the completion and electronic signing of the NR5 form, allowing users to fill out, send, and eSign the document quickly and securely.

-

Is there a cost associated with using airSlate SignNow for the NR5 form?

airSlate SignNow offers competitive pricing plans that cater to varying business needs. You can efficiently complete the NR5 form without breaking the bank, as our solutions are both cost-effective and packed with features to support document management.

-

What features does airSlate SignNow provide for the NR5 form?

airSlate SignNow offers an array of features including customizable templates, electronic signatures, and secure cloud storage. These features simplify the process of managing the NR5 form, ensuring that your documentation is handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software tools for the NR5 form?

Yes, airSlate SignNow supports integration with various software tools such as CRMs and project management platforms. This allows for seamless workflows when preparing your NR5 form alongside your existing business applications.

-

How does airSlate SignNow ensure the security of my NR5 form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect all documents, including your NR5 form, ensuring that your sensitive information remains confidential.

-

Is it easy to get started with airSlate SignNow for the NR5 form?

Absolutely! Getting started with airSlate SignNow is quick and user-friendly. Simply sign up, choose your plan, and begin creating or importing your NR5 form with ease.

-

What are the benefits of using airSlate SignNow for managing the NR5 form?

Using airSlate SignNow for the NR5 form offers numerous benefits, such as increased efficiency, reduced paperwork, and improved accuracy in submissions. Additionally, the ability to track document status ensures that you stay informed throughout the process.

Get more for Nr5

Find out other Nr5

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free